If you’re passionate about finance and dream of a career in investment management or financial analysis, the Chartered Financial Analyst (CFA) program stands as a beacon of excellence. This prestigious certification, offered by the CFA Institute, is recognized globally for its rigorous curriculum and high standards. Let’s delve into what each level entails and how you can navigate through them successfully.

Also, Watch our video to learn all the MAJOR UPDATES in CFA Qualification :

Understanding the CFA Program Structure

The CFA program consists of three levels, each building upon the knowledge and skills acquired in the previous level. Here’s an overview of what you can expect at each stage:

Level 1: Foundation of Financial Knowledge

Subjects Covered:

Level 1 covers ten core subjects, including Ethics and Professional Standards, Quantitative Methods, Economics, Financial Reporting and Analysis (FRA), Corporate Finance, Equity Investments, Fixed Income, Derivatives, Alternative Investments, and Portfolio Management.

Exam Format:

Level 1 is a multiple-choice exam divided into morning and afternoon sessions, covering fundamental concepts across finance. It tests your understanding of basic principles and serves as a gateway to the subsequent levels.

Level 2: Deepening Analytical Skills

Subjects Covered:

Building upon Level 1, Level 2 dives deeper into financial analysis and valuation techniques. It includes more complex topics within FRA, Equity Investments, Fixed Income, Derivatives, Alternative Investments, Corporate Finance, and Portfolio Management.

Exam Format:

Level 2 introduces a mix of multiple-choice questions and item sets (also known as vignettes), which require a higher level of analysis and application of knowledge. This exam format assesses your ability to apply concepts rather than just recall them.

Level 3: Specialized Pathways

Subjects Covered:

Candidates can choose one of three specialized pathways: Private Wealth, Private Markets, or Portfolio Management. They will have the opportunity to select the path most directly related to their interests and aspirations.

Exam Format:

Level 3 is a culmination of the CFA journey, combining multiple-choice questions with constructed response (essay) questions. This level emphasizes integration and application of knowledge across various domains of finance, preparing candidates for real-world investment scenarios.

Key Considerations for Success

Navigating through the CFA levels requires dedication, strategic preparation, and a thorough understanding of the exam structure:

Ethics Emphasis:

Ethics is a cornerstone across all three levels, reflecting the importance of integrity and professional conduct in finance.

Progressive Difficulty:

Each level increases in complexity, with Level 1 focusing on foundational knowledge, Level 2 requiring deeper analysis and application, and Level 3 emphasizing integration and strategic decision-making.

Exam Preparation:

Utilize official CFA Institute materials, mock exams, and practice questions to familiarize yourself with the exam format and timing. Develop strong time management skills, especially for the item sets and constructed response questions in Levels 2 and 3.

Professional Relevance:

The CFA designation is highly respected in the finance industry, opening doors to career opportunities in investment banking, asset management, hedge funds, and more. It demonstrates your commitment to excellence and proficiency in financial analysis.

Exam Logistics and Timeline

Exam Frequency:

Level 1 exams are held four times a year (February, May, August, November), while Level 2 exams are held three times a year (May, August, November) and Level 3 are held two times a year (February & August).

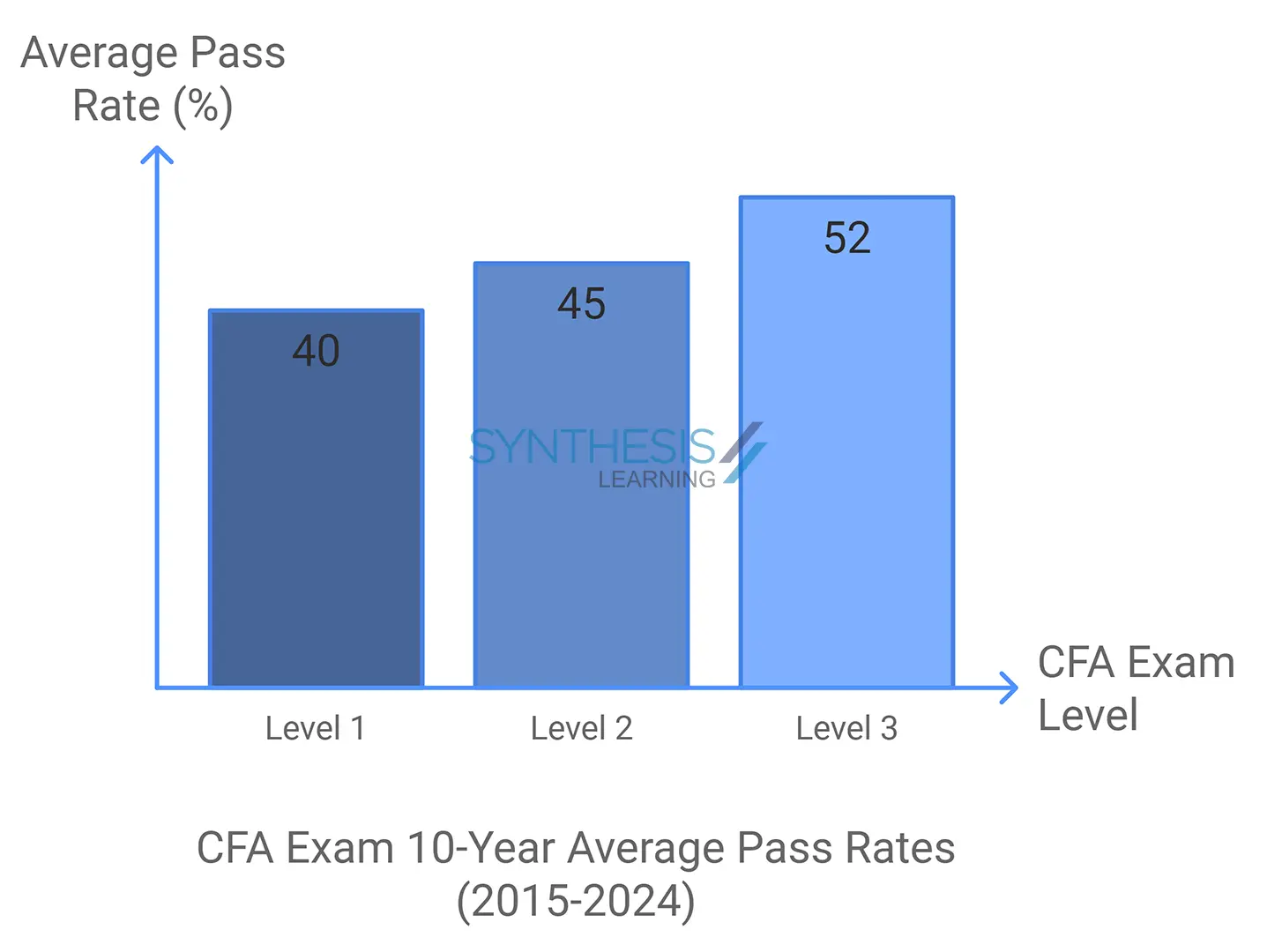

Pass Rates:

Historically, Level 1 has the lowest pass rate, with Levels 2 and 3 showing higher rates due to fewer candidates and more experienced test-takers.

- Scoring: CFA exams are scored based on a percentile system, emphasizing relative performance compared to other candidates rather than a fixed passing score.

Career Impact and Opportunities

Earning the CFA charter signifies not only academic achievement but also a commitment to continuous learning and ethical practices in finance. It enhances your credibility as a financial professional and increases your marketability in a competitive job market.

Conclusion

Embarking on the CFA journey is a significant commitment, but one that promises rich rewards in terms of knowledge, career advancement, and professional recognition. Whether you’re just starting with Level 1 or progressing through Levels 2 and 3, thorough preparation and dedication will pave the way for success.

Prepare diligently, stay focused on your goals, and leverage the resources available to you to excel in the CFA exams. Each level brings you closer to becoming a Chartered Financial Analyst—a distinction that opens doors to limitless opportunities in the world of finance.

Synthesis Learning Can Help You Achieve Your CFA Dream

Earning the CFA charter is a challenging but rewarding endeavor. Here at Synthesis Learning, we provide comprehensive coaching programs designed to help you conquer each CFA exam level. Our experienced instructors and industry-relevant curriculum will equip you with the knowledge and skills you need to succeed. Whether you’re just starting or aiming to tackle a specific level, our personalized approach ensures you receive the support you need to excel.

Ready to take the first step towards a flourishing career in finance? Contact Synthesis Learning today at 8291703707 and let us help you unlock your full potential!