India’s Most Trusted

CFA Coaching Provider

Achieve your goals with our 4-step CFA preparation:

- Counselling

- Coaching

- Mentoring

- Job Placements

CFA made simple, ping us!

What is CFA Course?

Become a stalwart in Investment Analysis and Portfolio Management

The Chartered Financial Analyst (CFA) Institute, a global association founded in 1963, administers the CFA Program, considered the gold standard for Investment Management professionals. This program sets ethical and professional standards within the industry.

Earning the CFA designation signifies a strong understanding of advanced investment analysis and real-world portfolio management skills. It requires passing a rigorous three-level exam program offered globally.

The CFA program is ideal for individuals who want to work in investment management as risk managers, portfolio managers, investment analysts, or financial advisers. It’s also valuable for those in related fields such as corporate finance, investment banking, and wealth management.

India has emerged as the largest market for Level 1 CFA candidates across the world. Checkout CFA Levels ->

CFA Paper Pattern

The CFA Program consists of three levels, each with a computer-based exam. The exams cover the following:

Level 1

Attempts: Feb, May, Aug, Nov

Pass Rate: 35-44%

Exam Topic Area Weight

Ethical & Professional Standards : 15-20%

Quantitative Methods : 6-9%

Economics : 6-9%

Financial Statement Analysis : 11-14%

Corporate Issuers : 6-9%

Equity investments : 11-14%

Fixed Income : 11-14%

Derivatives : 5-8%

Alternative Investments : 7-10%

Portfolio Management and Wealth Planning : 12-18%

Level 2

Attempts: May, Aug, Nov

Pass Rate: 44-47%

Exam Topic Area Weight

Ethical & Professional Standards : 10-15%

Quantitative Methods : 5-10%

Economics : 5-10%

Financial Statement Analysis : 10-15%

Corporate Issuers : 5-10%

Equity investments : 10-15%

Fixed Income : 10-15%

Derivatives : 5-10%

Alternative Investments : 5-10%

Portfolio Management and Wealth Planning : 10-15%

Level 3

Attempts: Feb, Aug

Pass Rate: 47-49%

Exam Topic Area Weight

Ethical & Professional Standards : 10-15%

Quantitative Methods : 0%

Economics : 5-10%

Financial Statement Analysis : 0%

Corporate Issuers : 0%

Equity investments : 10-15%

Fixed Income : 15-20%

Derivatives : 5-10%

Alternative Investments : 5-10%

Portfolio Management and Wealth Planning : 35-40%

Specialised Pathways: (Any one)

- Portfolio Management : 25-35%

- Private Markets : 25-35%

- Private Wealth : 25-35%

Exam Policy: Candidates can take each exam a maximum of twice per calendar year, with a minimum of six months between attempts.

Eligibility for the CFA Course

Here’s what drives thousands of Indian students to invest in their future!

- CFA Eligibility Criteria (earliest possible attempt for a 3 year graduate program)

- Level I: Register in Year 1 & Appear in Year 2

- Level II: Register in Year 2 & Appear in Year 3.

- Level III: Appear after Graduation.

Start your journey as a Business Analyst Equity Analyst Investment Banker Portfolio Manager Equity Researcher Consultant Risk Manager Credit Analyst Investment Officer Data Scientist Financial Planner

Know why CFA is on a rise!

Modes of Learning

CFA Classroom Coaching. Redefined.

- World Class Infrastructure

- Expert Tutors

- Hands on Learning

- Rigorous Assessments

- One on One Mentoring

- Revision & Doubt Solving Bootcamps

- Synthesis eCampus

- Systematic Student Progression

- 100% Placement Assistance

CFA Live Online Courses. Redefined.

- Live Study Lectures

- Expert Tutors

- Rigorous Assessments

- Regular Mentoring

- Revision & Doubt Solving Bootcamps

- Synthesis eCampus

- Revision Video Lectures

- 100% Placement Assistance

ACCA Self-paced Online Courses. Redefined.

- Video Lectures

- Progress Tests

- Energisers

- Practice Tutorials

- Personalised Study Plan

- Kaplan Content

- Full Pass Guarantee

- Study Anytime, Anywhere

- PC, Tablet, & Phone Compatible

- ACCA Approved

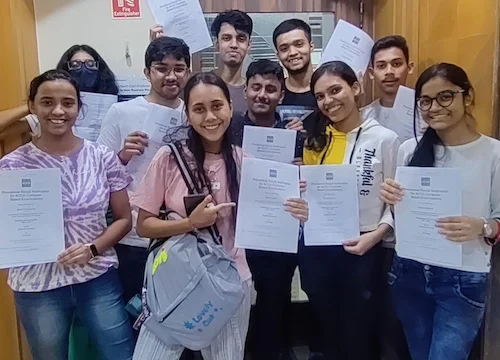

CFA Student Experiences

Students who have completed their journeys with us

Kunal Bhardhwa

I was hesitant to join CFA online classes, but Synthesis Learning has made the coaching very comfortable. The teachers teach in a way that students easily understand the concepts and clearly address all their doubts. I would recommend students to join them and have a better career path for their future.

Akshay Parab

I want to thank the team for all that I have learnt about CFA at Synthesis Learning. I really feel time spent over here is very useful and now my fundamentals about all the subjects which are strongly anchored. As because of this pandemic situation, I was hesitant to join any online classes for CFA, but Synthesis Learning made it very easy and comfortable, I strongly feel, I made a right choice by joining Synthesis Learning because main focus over here is on conceptual clarity and making fundamentals right, rather than increasing the batch size!

Anisha Vora

The teachers teach in a way that students can grasp and understand better. The teaching methodology is focused on knowledge and conceptual clarity as the CFA exam is very application-based. I would strongly recommend students to start their professional journey with Synthesis Learning!

Sameer Mehta

I was one of those who were very apprehensive about preparing for the CFA. After joining Synthesis Learning, my entire perspective changed. The teachers’ teaching style is fantastic, making even difficult subjects easy to understand. They addressed all my doubts very patiently. I strongly recommend anyone preparing for the CFA to join Synthesis Learning.

Riya Sharma

I was a working professional struggling to find the time to study for the CFA exams. Synthesis Learning’s flexible online classes and dedicated support team were a lifesaver! The instructors are incredibly knowledgeable and passionate, and they made the complex concepts of Level II easy to understand.

We're generally having Fun (while Learning)

Checkout some quick glimpses of all the memories we're creating at our offices and learning centres

CFA Jobs and Global Employers

Many leading financial institutions actively recruit CFA charter holders. These typically include Commercial Banks, NBFCs, Investment Banks, Private Equity Firms, Insurance Companies, Hedge Funds, Consulting Firms, Financial Advisory Firms, Corporate Finance Departments, Regulatory Agencies, Asset Management Companies, Wealth Management Firms and so on.

These companies trust CFAs with their future, do you?

Read More

Mastering the CFA Course with Synthesis Learning

The CFA (Chartered Financial Analyst) course is pivotal for aspiring finance professionals. The CFA course equips you with the analytical skills and ethical standards necessary to excel in high-level investment roles. With the rise of digital learning platforms, the CFA course has become more accessible than ever, especially through CFA online coaching and CFA online classes.

The CFA course equips you with the analytical skills and ethical standards necessary to excel in high-level investment roles. Let us explore everything you need to know about the CFA course in India, from the course structure and preparation strategies to the benefits of studying with Synthesis Learning. Read our complete guide on CFA program and plan your CFA journey.

What is the CFA Course?

The Chartered Financial Analyst or CFA courseis the gold standard in investment management certification, administered by the CFA Institute. This globally recognized CFA course is designed to develop professionals with a strong understanding of advanced investment analysis and real-world portfolio management skills. TheCFA course provides a thorough education in finance, making it an essential certification for those seeking to advance their careers in finance. For those considering the CFA course in India, numerous options are available, including highly-rated CFA online coaching programs and CFA course classroom and online classes.

CFA Course Duration

The (Chartered Financial Analyst) CFA course duration is typically completed over a Maximum duration of three years*. This includes passing three levels of exams. and meeting a requirement of 4,000 hours of professional work experience, which can be accrued before, during, or after completing the exams (CFA Institute). The CFA course is structured to accommodate both full-time professionals and students, providing flexibility in managing study and work commitments. For those interested in the CFA course in India, many find that CFA online coaching provides the flexibility needed to balance their studies with professional responsibilities.

Scope Of CFA Course

The scope of the CFA course (Chartered Financial Analyst) program is vast and prepares professionals for various career paths in the investment industry. As a CFA charter holder, you will be equipped with expertise in investment analysis, portfolio management, and wealth planning. The CFA course program is recognised globally and is designed to provide the skills and knowledge necessary to excel in roles such as portfolio management, research analysis, consulting, and risk management (CFA Institute). With the rise of digital learning platforms, including CFA online classes, more students are able to access high-quality education from the best CFA institute in India.

Overview of CFA Course Syllabus

The CFA course syllabus is structured across three levels, each focusing on different aspects of finance and investment. Each level of the CFA course builds on the previous one, ensuring a comprehensive understanding of financial concepts and practices.

Level 1

Multiple Choice Questions (MCQs)

Attempts: Feb, May, Aug, Nov

Pass Rate: 40% (10 year avg pass rate 2015-2024)

Exam Topic Area Weight

- Ethical & Professional Standards: 15-20%

- Quantitative Methods: 6-9%

- Economics: 6-9%

- Financial Statement Analysis: 11-14%

- Corporate Issuers: 6-9%

- Equity investments: 11-14%

- Fixed Income: 11-14%

- Derivatives: 5-8%

- Alternative Investments: 7-10%

- Portfolio Management and Wealth Planning: 12-18%

Level 2

Case Studies with MCQs

Attempts: May, Aug, Nov

Pass Rate:45% (10 year avg pass rate 2015-2024)

Exam Topic Area Weight

- Ethical & Professional Standards: 10-15%

- Quantitative Methods: 5-10%

- Economics: 5-10%

- Financial Statement Analysis: 10-15%

- Corporate Issuers: 5-10%

- Equity investments: 10-15%

- Fixed Income: 10-15%

- Derivatives: 5-10%

- Alternative Investments: 5-10%

- Portfolio Management and Wealth Planning: 10-15%

Level 3

Essay and MCQs

Attempts: Feb, Aug

Pass Rate: 52% (10 year avg pass rate 2015-2024)

Exam Topic Area Weight

- Ethical & Professional Standards: 10-15%

- Quantitative Methods: 0%

- Economics: 5-10%

- Financial Statement Analysis: 0%

- Corporate Issuers: 0%

- Equity investments: 10-15%

- Fixed Income: 15-20%

- Derivatives: 5-10%

- Alternative Investments: 5-10%

- Portfolio Management and Wealth Planning: 35-40%

- Specialized Pathways:(Any one)

- Portfolio Management: 25-35%

- Private Markets: 25-35%

- Private Wealth: 25-35%

Eligibility for the CFA Course

Understanding the CFA course eligibility criteria is essential for prospective students. For a 3-year graduate program, you can register for Level I during your first year and appear for Level 1 exam in your second year, register for Level II in your second year and sit for it in your third year, and finally, appear for Level III after graduation. Here’s a breakdown of the CFA course eligibility:

CFA course Eligibility Criteria (earliest possible attempt for a 3-year graduate program)

Level I: Register in Year 1 & Appear in Year 2

Level II: Register in Year 2 & Appear in Year 3.

Level III: Appear after Graduation.

Preparing for the CFA Course Exam

Excelling in the CFA exam requires a strategic approach to preparation. Here are some practical tips:

- Study Guide: Utilize a comprehensive study guide covering all aspects of theCFA course syllabus. Many students find that CFA online coaching provides valuable resources and structured study plans.

- Practice Scenarios: Regularly practice past exam scenarios to familiarize yourself with the format. ManyCFA course online classes offer practice exams and mock tests.

- Training Programs: Enroll in specialized CFA course online classes that offer expert guidance and support.Synthesis Learning’s CFA classroom & online coaching is designed to help you navigate the complexities of the CFA course with expert assistance.

- Develop Analytical Skills: Focus on enhancing your analytical and ethical decision-making abilities, which are essential for success in the CFA exams.

Advantages of Pursuing a CFA Online Course with Synthesis Learning

Opting for a CFA online course with Synthesis Learning offers numerous benefits tailored to your needs:

- Flexibility: Our CFA classroom and online classes fit seamlessly into your busy schedule, allowing you to study from anywhere at your convenience. This flexibility is ideal for balancing professional and personal commitments.

- Comprehensive Resources: With our CFA online course, you gain access to extensive digital resources, including interactive materials, practice exams, and live webinars.

- Expert Instruction: Benefit from our CFA online coachingdelivered by seasoned professionals who provide personalized support and real-world insights, helping you excel in your CFA exams.

- Cost-Effectiveness: Save on commuting and accommodation costs with our affordableCFA online classes. We offer flexible pricing and payment plans to fit various budgets.

Career Opportunities with CFA Certification

Completing the CFA course opens up numerous career opportunities in leading financial institutions, including roles such as:

- Investment Analyst: Conduct detailed financial analyses and valuations.

- Portfolio Manager: Manage investment portfolios and make strategic investment decisions.

- Risk Manager: Identify and manage financial risks.

- Financial Advisor: Provide strategic financial advice to clients.

TheCFA course in India provides a robust foundation that prepares you for these high-demand roles by equipping you with advanced skills and knowledge in finance and investment management.

CFA Course Fees

Understanding the CFA course fees is crucial for planning your investment. The fees can vary based on the registration period and location. For specific information on CFA course fees in India, please refer to the CFA Institute’s official website and reach out to Synthesis Learning for complete CFA course support.

Studying the CFA Course with Synthesis Learning

At Synthesis Learning, we are acknowledged as AIR Rank 1 & Rank on top globally for our dedication to helping you succeed in the CFA course. Here’s why studying with us can benefit you:

- Platinum Approved Partner: We are recognized for our high standards and exceptional training.

- Flexible Learning Modes: We offer classroom, live online, and self-paced learning options to fit your schedule and style.

- Expert Tutors: Learn from experienced professionals who guide you through every step of the CFA curriculum.

- Proven Methodology: Our 4-step approach—Counseling, Coaching, Mentoring, and Placement—ensures comprehensive support throughout your CFA journey.

For more detailed information about our offerings, visit our CFA Course Details page.

Conclusion

Embarking on the CFA journey with Synthesis Learning will equip you with the analytical and professional skills needed to excel in the finance industry. Whether you’re looking to enhance your current position or explore new opportunities, mastering the CFA course is your key to success.

Frequently Asked Questions (FAQs)

What is the CFA Course?

The CFA (Chartered Financial Analyst) course is a globally recognized certification that equips professionals with advanced investment analysis and portfolio management skills.

What topics is the CFA course covering?

The CFA course covers various topics, including ethics, quantitative methods, economics, financial statement analysis, corporate finance, equity investments, fixed income, derivatives, alternative investments, portfolio management, and wealth planning.

How can I prepare for the CFA exam?

Prepare for the CFA exam using comprehensive study guides, practising past exam scenarios, and enrolling in specialised CFA classes and training programs.

What career opportunities can I pursue with CFA certification?

With CFA certification, you can pursue roles such as Investment Analyst, Portfolio Manager, Risk Manager, and Financial Advisor.

How can Synthesis Learning help me succeed in the CFA course?

Synthesis Learning provides expert coaching, comprehensive study resources, and flexible learning options to help you excel in the CFA course and develop your professional skills.

Why is Synthesis Learning the leading CFA Coaching provider in Mumbai?

Synthesis Learning is the leading CFA institute in Mumbai due to its expert faculty, tailored programs, outstanding student support, and a proven track record of high pass rates and successful candidates.

What Makes Synthesis Learning the best CFA Coaching provider in India?

Synthesis Learning excels as the best CFA institute in India due to its expert faculty, comprehensive curriculum, personalized support, and proven track record of high pass rates and successful candidates.

Why is Synthesis Learning the leading CFA Coaching provider in Mumbai?

Synthesis Learning is the leading CFA Coaching provider in Mumbai due to its expert faculty, tailored programs, outstanding student support, and a proven track record of high pass rates and successful candidates.

For further details and to start your CFA journey with Synthesis Learning, visit our CFA Course Details page.