US CMA Syllabus Part 1: Financial Planning, Performance, and Analytics

The Certified Management Accountant qualification, offered by the Institute of Management Accountants (IMA) is globally recognized for its focus on Financial Planning & Analysis, Strategic Management & Decision Making. CMAs are trained to see beyond the data, translating numbers into high-level strategic insights. The CMA qualification is divided into two parts: Part 1 and Part 2.

In this blog, we will explore the exam format and the detailed syllabus for CMA (US) Part 1: Financial planning, performance, and analytics.

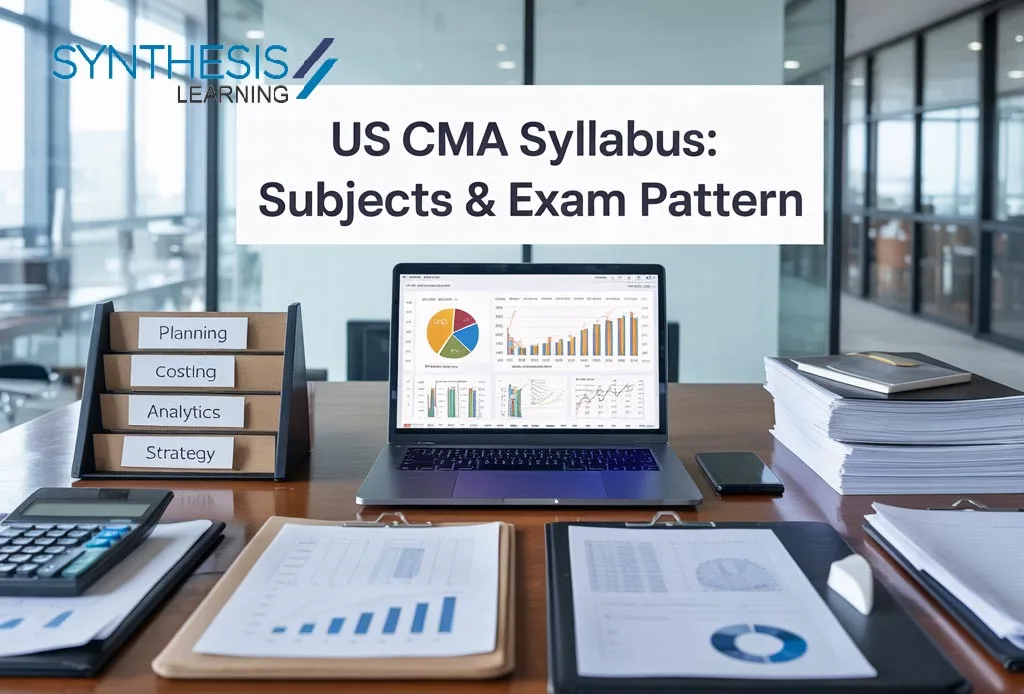

The US CMA Part 1 covers 5 major topics, which are:

- External Financial Reporting Decisions (15%)

- Planning, Budgeting, and Forecasting (20%)

- Performance Management (20%)

- Cost Management (15%)

- Internal Controls (15%)

- Technology and Analytics (15%)

The Exam Format for Part 1 :

Duration: 4 hours per exam

Sections:

Multiple-Choice Questions (MCQs) – 100 questions

Essay Questions – 2 scenario-based essay questions

Total Score: 500 points

Passing Score: 360 points

Question Type:

MCQs – Single correct answer

Essay – Includes problem-solving and calculations.

Overview of the US CMA Syllabus Part 1 Exam

A. External Financial Reporting Decisions (15%)

This section focuses on the financial statements, with an in-depth coverage of:

1. Statement of Financial Position: Acquire the knowledge to understand the financial position of the entity as on a particular date.

2. Income Statement: A Detailed statement regarding the Income & expenses of an entity during a particular period.

3. Statement of Changes in Equity: Tracks changes in shareholders’ equity, answering the essential question of “Who owned how much at the start of the period and what is the status at the end of the period?”.

4. Statement of Cash Flows: Displays cash inflows and outflows, giving insights into liquidity.

5. Consolidated Statements: Financial reports combining multiple entities’ data e.g. Consolidated Financial statements for a group of companies.

6. Integrated Reporting: Provides a holistic picture, linking financial performance with other elements like environmental and social governance.

You will also learn the recognition, measurement, and valuation of assets, liabilities, equity transactions, and revenue. This includes a comparison between U.S. GAAP and IFRS, preparing you to work in diverse global environments. This topic accounts for 15% of the total exam marks.

B. Planning, Budgeting, and Forecasting (20%)

Strategic planning is at the core of any successful business. This section covers:

1. Strategic Planning: Learn to analyse internal and external environments affecting business strategy and align tactics with long-term goals.

2. Budgeting Concepts: Understand how to allocate resources and set performance goals using effective budgeting processes.

3. Forecasting Techniques: Master regression analysis, learning curve analysis, probability, and other forecasting methods to predict financial outcomes.

4. Budgeting Methodologies: From activity-based budgeting to zero-based and flexible budgeting, you’ll explore different approaches for various business needs.

5. Annual Profit Plans: Develop operational, financial, and capital budgets for a particular period and forecast the profit projections for a particular period.

6. Top-level Planning and Analysis: Create pro forma income statements and financial projections used by the highest level of Executives in a company.

Budgeting and forecasting are crucial for financial planning and decision-making. This topic accounts for 20% of total exam marks.

C. Performance Management (20%)

Performance management involves analyzing how well a company is doing compared to its goals. This section covers:

1. Cost and Variance Measures: Compare actual results with budgeted ones and analyze variations using standard cost systems to be able to perform corrective measures.

2. Responsibility Centers and Reporting Segments: Learn about different roles and responsibility centers (e.g., profit, cost, investment centers) and how to evaluate their performance.

3. Performance Measures: Explore methods to assess product, business unit, and customer profitability. Delve into advanced metrics like Return on Investment (ROI), Residual Income, and the Balanced Scorecard.

This topic accounts for 20% of the total exam marks.

D. Cost Management (15%)

In this section, you’ll explore various cost allocation methods and costing systems that help businesses make informed financial decisions:

1. Costing Systems: Understand job order costing, activity-based costing, life-cycle costing, and more and where to use which method for accurate cost estimations.

2. Overhead Costs: Learn what overhead costs are and how to allocate overhead costs appropriately to various departments and services.

3. Supply Chain Management: From lean resource management techniques to enterprise resource planning (ERP), these strategies help streamline operations.

4. Business Process Improvement: The focus of this area is on process analysis and quality control concepts, like value-added analysis, benchmarking, and continuous improvement play a vital role in achieving these goals.

Cost management is essential to business efficiency, and with the right training, you can help organizations reduce waste and improve profitability. This topic accounts for 15% of the total exam marks.

E. Internal Controls (15%)

Internal controls ensure that the risks an entity faces are addressed adequately. In this section, you will study:

1. Governance, Risk, and Compliance: Learn about internal corporate governance structures, policies, and risk assessment procedures.

2. System Controls and Security Measures: learn about information management systems controls, technology controls, transaction controls, and business continuity planning.

Understanding internal controls is crucial for safeguarding assets and maintaining the integrity of financial reporting. This topic accounts for 15% of total exam marks.

F. Technology and Analytics (15%)

In today’s digital age, the ability to leverage technology for financial decision-making is critical. This section delves into:

1. Information Systems: Learn about accounting information systems, ERP systems, and performance management systems.

2. Data Governance: Discover how to manage data effectively and safeguard against security breaches.

3. Technology-Enabled Finance Transformation: Explore automation and innovative applications in finance.

4. Data Analytics: Understand business intelligence, data mining, and data visualization to make data-driven decisions.

Technology and analytics are rapidly transforming the financial industry. This topic accounts for 15% of the total exam marks.

Conclusion

The CMA (US) Exam marks are your gateway to a successful career in financial planning, performance management, and analytics. With thorough coverage of external financial reporting, cost management, budgeting, and more, this exam tests your ability to apply real-world financial strategies.