ACCA vs US CMA

Choosing between the Association of Chartered Certified Accountants (ACCA) and the Certified Management Accountant (US CMA) can be pivotal for your finance career. Let’s delve into a detailed comparison to help you make an informed decision.

Table Of Contents

CFA vs US CMA full comparison!

1. Professional Bodies & Global Recognition

ACCA (UK)

- Established: 1904

- Headquarters: London, UK

- Global Presence: Recognised in over 180 countries

- Members & Students: Over 250,000 members and 526,000 students worldwide

- Focus: Comprehensive accounting, finance, and business management

US CMA

- Established: 1972 by the Institute of Management Accountants (IMA)

- Headquarters: USA

- Global Presence: Recognised in over 150 countries

- Members: Over 140,000 members globally

- Focus: Management accounting, financial planning, analysis, and decision-making

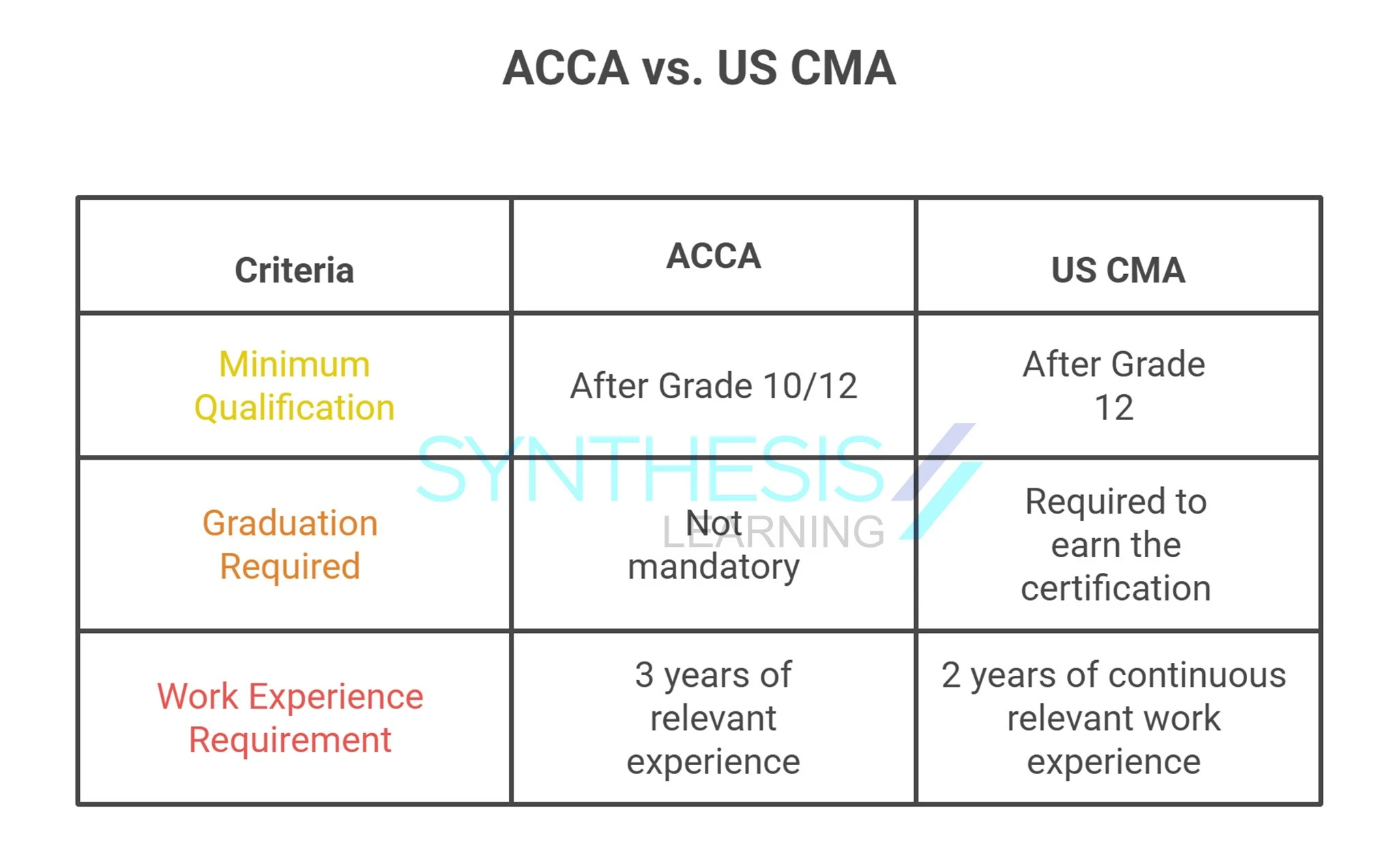

2. Eligibility Criteria

Note: ACCA offers exemptions based on prior qualifications, potentially reducing the number of exams. It’s recommended to start ACCA after grade 12.

3. Course Structure & Duration

4. Syllabus & Focus Areas

ACCA Curriculum:

Knowledge Level:

- Business and Technology,

- Management Accounting

- Financial Accounting

Skill Level:

- Corporate and Business Law

- Performance Management

- Taxation

- Financial Reporting

- Audit and Assurance

- Financial Management

Professional Level:

Compulsory Papers

- Strategic Business Leader

- Strategic Business Reporting

Optional Papers (Any 2)

- Advanced Financial Management

- Advanced Performance Management

- Advanced Taxation

- Advanced Audit and Assurance

US CMA Curriculum:

Part 1:

- Financial Planning, Performance, and Analytics.

- External Financial Reporting Decisions

- Planning, Budgeting, and Forecasting

- Performance Management

- Cost Management

- Internal Controls

- Technology and Analytics

Focuses on analysing financial performance and making data-driven decisions.

Part 2:

- Strategic Financial Management.

- Financial Statement Analysis

- Corporate Finance

- Decision Analysis

- Risk Management

- Investment Decisions

- Professional Ethics

Emphasizes strategic decision-making and long-term financial planning.

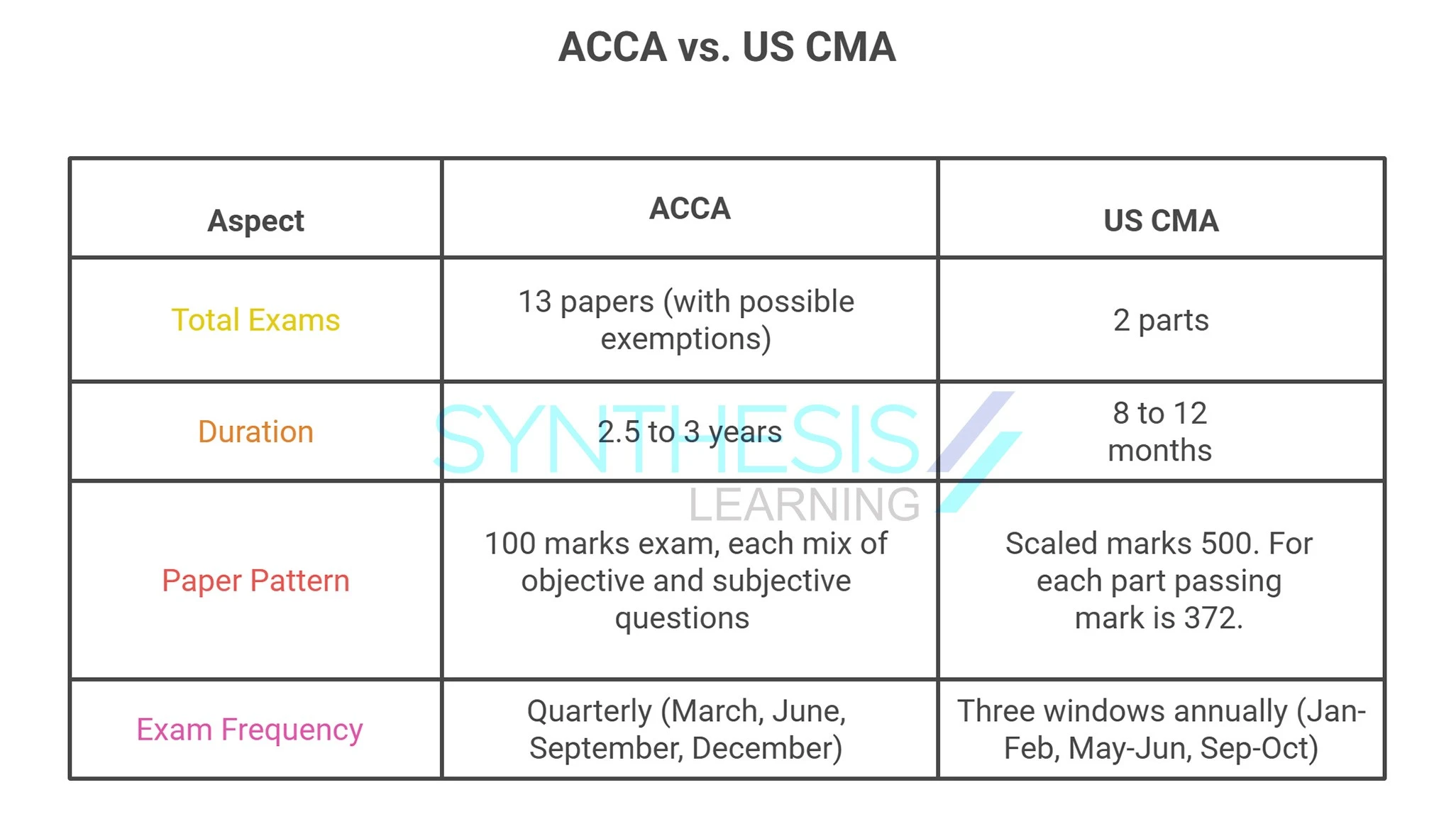

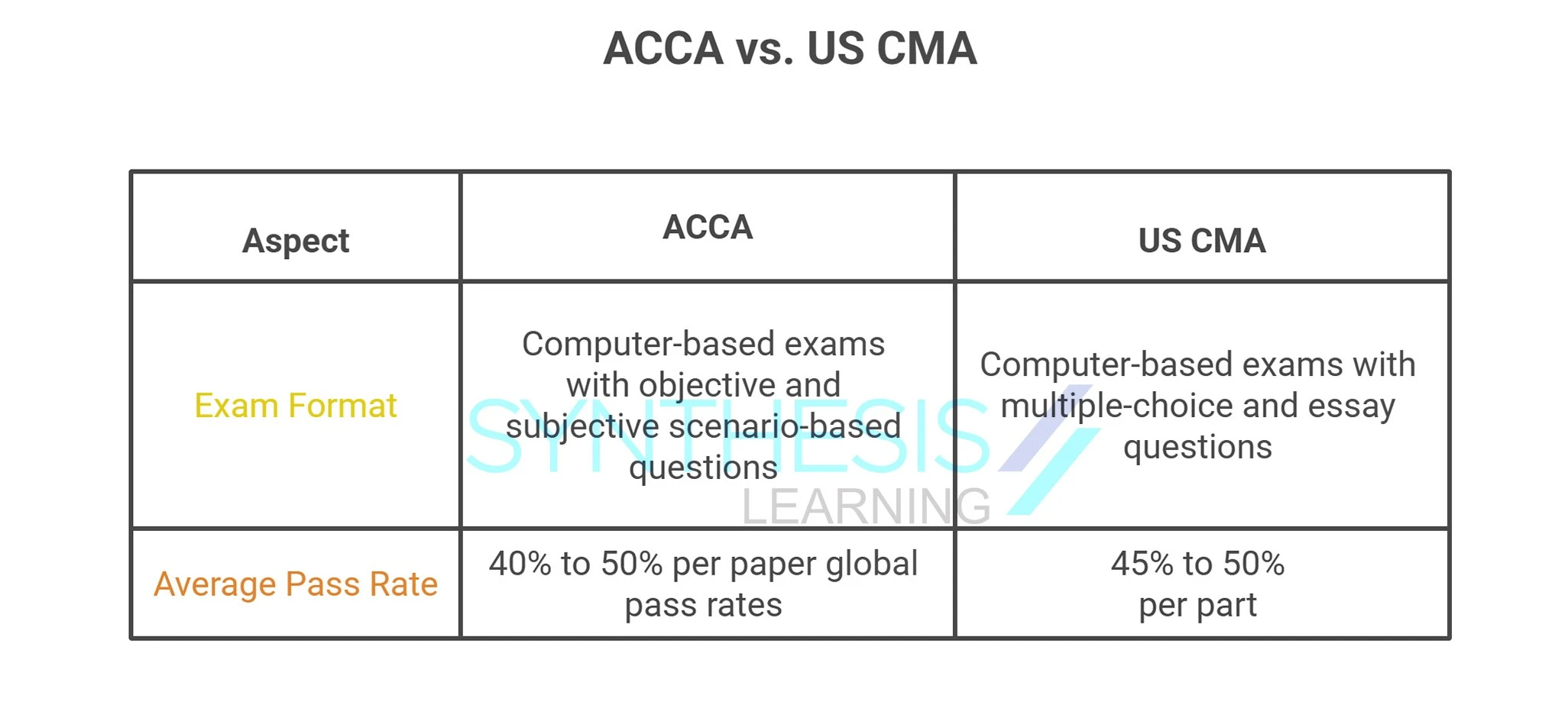

Exam Pattern & Pass Rates

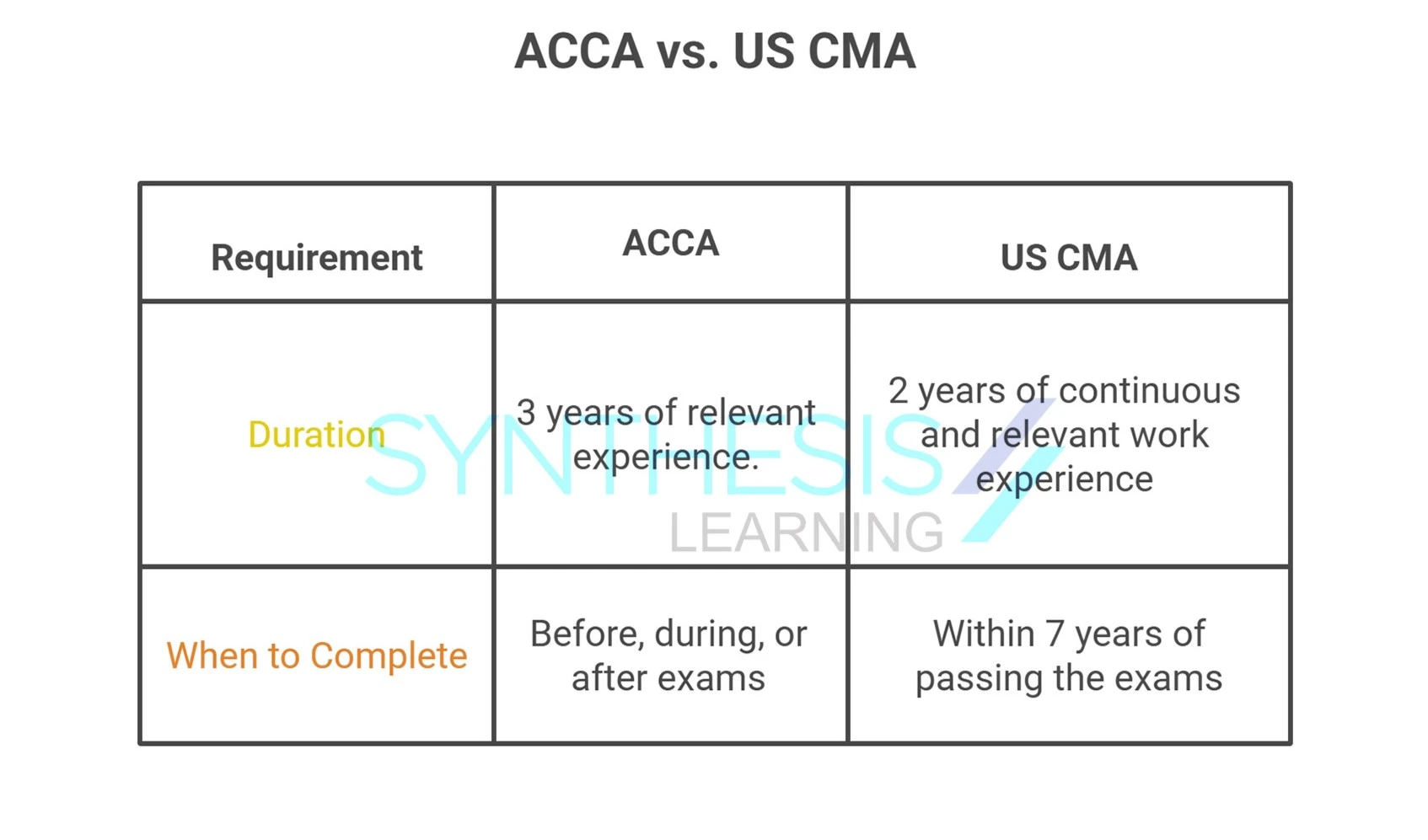

Work Experience Requirements

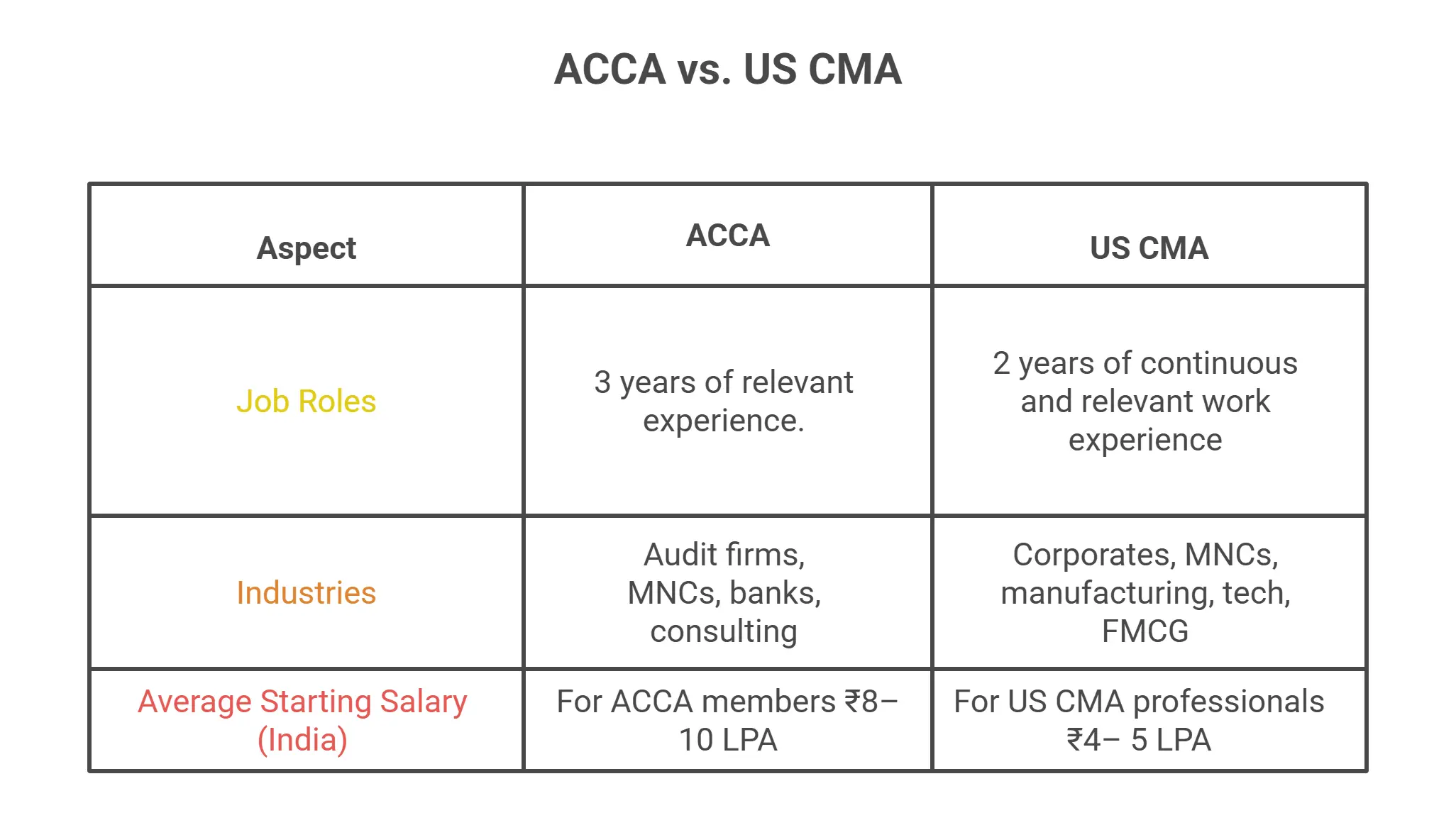

Career Opportunities & Salary

Investments For the Qualifications

Pursuing the ACCA qualification involves a total estimated investment of ₹4 to ₹4.5 lakhs. This includes all essential components – registration, annual subscriptions, exam-related costs, and professional coaching. Given its global recognition and comprehensive realtime syllabus, ACCA is a very powerful credential for those aiming to build a long-term global career in various domains of Business, Accounting & Finance.

On the other hand, the US CMA certification offers a more compact and cost-effective pathway, with a total investment typically ranging between ₹1.5 to ₹2 lakhs. The US CMA certification provides immense value with a shorter duration and a focused curriculum in Financial Planning, Analytics & Financial Management.

Please note that discounts are available for the above fees if you register and study through an ALP for ACCA and a Course Provider for US CMA. To know more about the discounts, please contact our counselor at synthesis learning

Final Verdict: Which Should You Choose?

Choose ACCA if you’re aiming for a stunning career in global finance and business. It’s the ideal path if you aspire to work with the Big 4 or land international roles across diverse industries. With a typical duration of 2.5 to 3 years and an overall investment of ₹4.5 to ₹5 lakhs, ACCA is best suited for students who can commit the time and resources to build a strong global finance foundation.

On the other hand, choose US CMA if you’re looking to fast-track your career in financial planning & analysis and management accounting. It’s perfect for those targeting roles in MNCs, shared service centres, or FP&A teams. With a shorter duration of 6 to 12 months and a total investment of ₹1.5 to ₹2 lakhs, US CMA offers a focused and efficient route into high-demand corporate finance roles.