ACCA PER GUIDE :

Ready to unlock the next level in your accounting career? Completing your Practical Experience Requirement (PER) is the final step to ACCA membership. Here’s how you can meet this critical milestone and fast-track your journey towards becoming a Chartered Certified Accountant.

Also, check out our video on PER :

Key Information at a glance:

To become an ACCA member, you need to fulfil the following:

- Pass all ACCA exams

- Complete the Ethics and Professional Skills module

- Meet the Practical Experience Requirement (PER)

The Practical Experience Requirement (PER) is a pivotal milestone in the journey towards becoming a full-fledged ACCA member. Beyond mastering the 13 papers and the EPSM, completing PER solidifies your ability to apply theoretical knowledge to real-world scenarios.

This blog aims to provide a comprehensive understanding of ACCA PER. We will guide you through the process of fulfilling this requirement and address frequently asked questions along the way.

By delving deeper into the intricacies of PER, we hope to equip you with the knowledge and confidence needed to successfully complete this crucial stepping stone on your path to ACCA membership.

What is the minimum duration for the ACCA practical experience requirement?

The minimum duration for the ACCA practical experience requirement is three years. This period allows candidates to gain hands-on experience in key areas such as financial reporting, management accounting, auditing, and taxation, all within a professional accounting environment.

The practical experience can be accumulated before or during the ACCA qualification journey and is a critical component for ensuring that ACCA members are well-equipped for the challenges of the global accounting industry. To meet ACCA standards, this experience must be verified and signed off by a qualified supervisor.

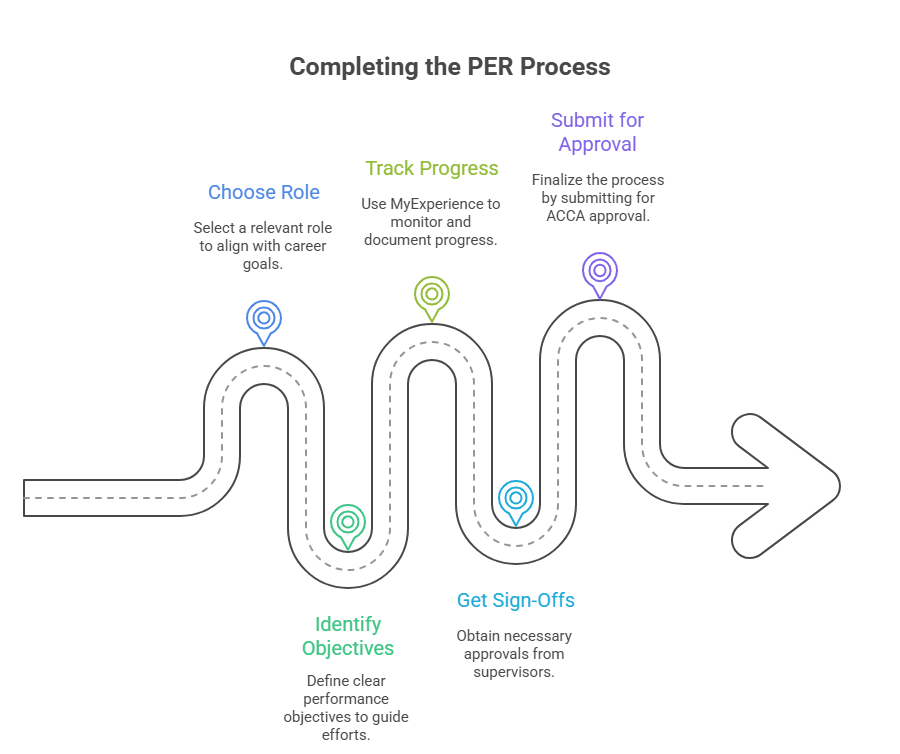

Navigating the PER Maze: Key Steps to Fulfilment

Here’s a Roadmap to Guide You:

To fulfil the practical experience requirement (PER), students must attain certain performance objectives. These objectives and the exams are closely interconnected. Performance objectives serve as benchmarks for effective performance.

You’ll need to achieve nine performance objectives:

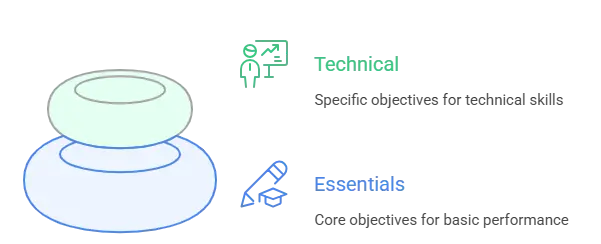

Performance Objectives Explained:

Five Essentials objectives –

These are essential, fundamental business skills that all professional accountants need, so you must achieve all five.

- Ethics and professionalism

- Stakeholder relationship management

- Strategy, innovation and sustainable value creation

- Governance, risk and control

- Leadership and management

Any four from 17 Technical objectives –

There are 17 Technical performance objectives to choose from – and they fall into different technical areas. You can choose to complete any four of these objectives.

Corporate and business reporting

- Record and process transactions and events

- Prepare external financial reports

- Analyse and interpret financial reports

Financial management

- Evaluate investment and financing decisions

- Manage and control working capital

- Identify and manage financial risk

Management accounting

- Evaluate management accounting systems

- Plan and control performance

- Monitor performance

Taxation

- Tax computations and assessments

- Tax compliance and verification

- Tax planning and advice

Audit and assurance

- Prepare for and plan the audit and assurance process

- Collect and evaluate evidence for an audit or assurance engagement

- Review and report on the findings of an audit or assurance engagement

Advisory and consultancy

- Business advisory

Data, digital and technology

- Data analysis and decision support

Where can I work?

ACCA trainees can work in any sector and size of the organisation. What is important is that your role must focus on any aspect of Accounting & Finance. Further, ACCA has a list of Employers it calls ‘ Approved Employers’ you can check the list here. However, it is not mandatory to work with an ACCA-approved employer.

For the Practical Experience Requirement (PER) in ACCA, you can work in various organisations such as public accounting firms, private companies, government bodies, nonprofits, or as a freelancer. Job roles can include statutory audit, internal audit, forensic audits, tax, financial planning & analysis, management accounting, management consulting, Risk, ESG, Corporate Finance & more.

It’s also important that your work is appropriately supervised and that the time you complete towards your 36 months’ experience is signed off by your practical experience supervisor.

ACCA PER Supervisor

Practical experience supervisors hold a significant position within the PER framework. They are also responsible for signing off on your achievements and supervising your experience.

Who can be your Supervisor?

Generally, your practical experience supervisor is either your line manager or a person you report to for specific projects or activities.

To sign off your performance objectives, your practical experience supervisor should be someone who:

- is a qualified accountant* (CA, ACCA, CPA)

- works closely with you

- knows your work.

* A qualified accountant is a member of an IFAC (International Federation of Accountants) member body and/or recognized by law in your country.

Document Your Journey

Meticulously track your work experience. Note down your job titles, responsibilities, and key achievements. Utilize the My Experience record within your My ACCA, account – a handy tool to streamline this process.

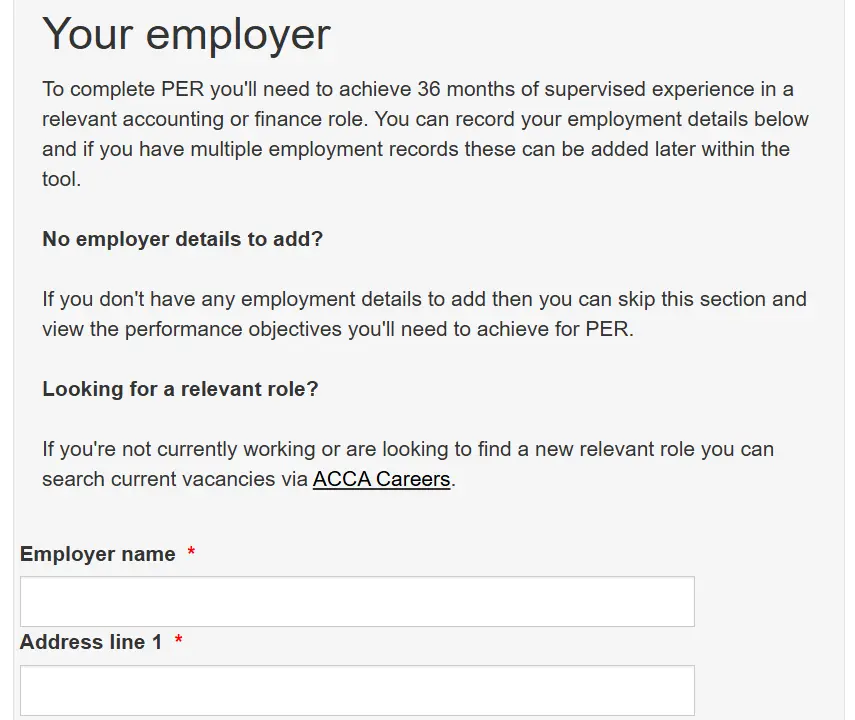

You can use the online MyExperience tool within MyACCA to accomplish the PER requirement. This tool will allow you to plan and record your achievements effectively.

The tool will help you to:

- record your employment, role and supervisor details

- calculate the amount of experience you’re gaining in your role

- plan your development and target performance objectives

- complete the performance objectives

- submit your experience to your practical experience supervisor for approval

- Track your progress towards achieving the PER.

Working for an ACCA Approved Employer

ACCA Approved Employers are organizations that have been formally recognized by the Association of Chartered Certified Accountants (ACCA) for their commitment to providing high-quality training and development opportunities for ACCA members and trainees.

ACCA’s Approved Employer programme recognises and rewards employers staff training and development.

If your employer is a gold or platinum ACCA-approved employer. they may allow you to record your performance objectives via a simplified route. You would still be required to achieve 36 months’ experience

Simplified Performance Objective Recording

You would not need to write performance objective statements or claim your objectives via My Experience. This is because ACCA recognises that your employer has a training and development programme that gives trainees the required support to achieve professional status.

However, it is important to confirm that your employer has this level of approval and whether they will allow you to complete the Approved Employer PER confirmation form. (Please note that it is your employer – not you – who decides whether you can follow this simplified route.) If you have met the requirements for membership or leave an approved employer, you must complete the Approved employer PER confirmation form which you can download from My Experience.

This will ensure that you have a record of any performance objectives you have achieved while working for them. Please send a copy of your signed-off Approved employer PER confirmation form to ACCA and they will update your records to reflect your

achievement.

Support Beyond Exams: How Synthesis Learning Helps You Achieve ACCA Membership

Synthesis is dedicated to guiding you through your ACCA journey with personalized support and expert guidance. As a trusted partner in your professional development, Synthesis has strong ties with industry-leading employers and ACCA-approved employers, ensuring you gain the relevant practical experience needed to meet the ACCA membership requirements.

Through its comprehensive ecosystem, Synthesis offers access to valuable resources, including its sister organization, Incorp Advisory, which provides specialized advisory services to enhance your career growth. With Synthesis, you not only receive top-tier educational support but also connect with a network of professionals and employers that accelerate your path to ACCA membership.

Achieve ACCA Membership Faster with Synthesis

Synthesis helps you go beyond passing exams — it helps you become a qualified ACCA member faster. With direct connections to ACCA-approved employers and strong industry partnerships, Synthesis ensures you gain the practical experience (PER) you need through real-world opportunities.

Its unique ecosystem, including its sister firm Incorp Advisory, gives you access to professional networks, advisory projects, and mentorship that go far beyond the classroom. Whether you’re starting your ACCA journey or nearing completion, Synthesis offers the tools, support, and connections to accelerate your path to full ACCA membership — and a successful career in finance.

Acca PER FAQs

What happens if I switch employers during my PER?”

Answer: Switching employers is allowed, but you’ll need to ensure you have a continuous record of your work and that your new employer is willing to supervise your progress.

Can I complete PER while working part-time?”

Answer: Yes, as long as your work aligns with the required performance objectives and is supervised by a qualified accountant.

Can I pause my PER journey if I take a career break or switch industries?

Answer: Yes, your PER doesn’t have to be completed in a continuous stretch. If you take a break or change industries, previously approved and signed-off experience still counts. However, ensure that any new experience aligns with ACCA’s PER guidelines. You can return and continue logging experience later.

Do part-time or internship roles count towards the 36-month requirement?

Answer: Yes, but only on a pro-rata basis. For example, if you work 20 hours per week in a part-time finance role, you would accumulate experience at 50% of the full-time rate. ACCA assesses experience based on actual time spent on relevant tasks under supervision.

Can I change my supervisor during my PER journey?

Answer: Yes. You can have multiple supervisors during your PER period. Each one can sign off the objectives and experience relevant to their supervision period. Make sure you get all sign-offs before changing roles or leaving a company, as retrospective sign-offs are difficult.

Is remote or freelance work eligible for PER?

Answer: Yes, as long as the role is relevant to accounting or finance and is supervised by a qualified accountant who can verify your work. Freelancers may need to proactively engage with a supervisor and ensure regular check-ins to validate their experience.

How often should I update MyExperience?

Answer: There’s no official frequency, but it’s best to update every 3–6 months or after completing major tasks/projects. Regular updates help ensure details are fresh and accurate when requesting supervisor sign-off.

What if I can’t find a qualified supervisor at my workplace?

Answer: If your direct manager isn’t a qualified accountant (i.e., not a member of an IFAC body), you can ask another senior colleague or external mentor who fits the criteria and has closely observed your work. If that’s still not possible, consult ACCA’s student support team for guidance.

Can I complete more than 9 performance objectives?

Answer: Yes. While only 9 are required (5 Essential + any 4 Technical), you’re encouraged to complete more if your role allows. This showcases broader competence and can help with future specialization or if you’re unsure which career track you’ll pursue

How do I know if a job is “relevant” for PER?

Answer: A role is relevant if it involves applying accounting, audit, finance, or tax knowledge — even partially. ACCA provides a “Relevance Assessment Tool” and Career Navigator to help identify suitable roles. The key criteria are: does the role contribute to meeting performance objectives, and is it supervised appropriately?

Have more questions about your PER journey? Contact us for more thorough guidance.