DECODING THE SUBJECT

The ACCA Taxation or ACCA TX course helps you develop the knowledge and skills relating to the tax system as applicable to individuals, single companies and groups of companies. It is the statutory duty of all individuals and companies to pay associated tax liabilities to the government, i.e., the HMRC (Her Majesty’s Revenue and Customs) in the United Kingdom.

It is designed to ensure it cover various aspects related to Taxation, i.e.

- What is the scope of the tax system?

- What are the obligations of the tax payers?

- How to calculate Income Tax liabilities?

- How to calculate National Insurance Contributions (NIC) for employees, employers and self-employed?

- What are chargeable gains and how do we calculate these gains? Explain Corporation Tax.

- How to calculate Corporation Tax?

- Explain and compute the effects of Valued Added Tax.

Being an exam in the skills level, ACCA TX can be attempted during any of the four exam sessions throughout the year – March, June, September, or December.

Table Of Contents

ACCA TX (UK) SYLLABUS

ACCA TX (UK) PAPER PATTERN

ACCA TX (UK) PASSING TRENDS

SOURCES OF CONTENT

STUDYING METHODOLOGY

HOW TO PLAN ACCA TX (UK) MOCK EXAMS

THINGS TO REMEMBER WHILE WRITING THE EXAM

EXAMINER’S EXPECTATIONS

ACCA TX (UK) SYLLABUS

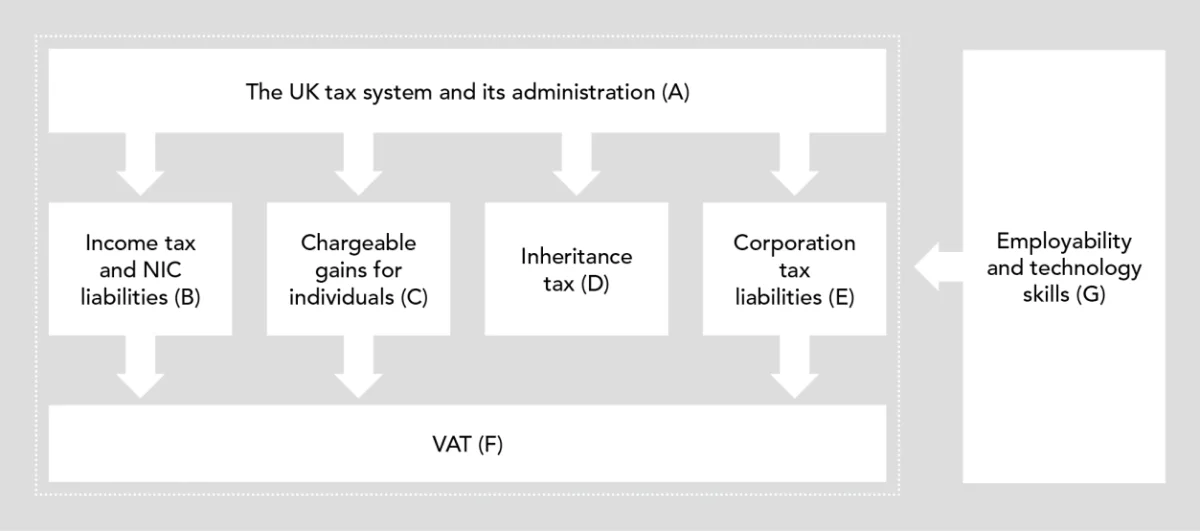

The Syllabus covers the two broad categories of Tax namely Direct Tax (E.g., Income tax, Corporation Tax, Inheritance Tax, Capital Gains Tax) and Indirect Tax (E.g., Value Added Tax). The syllabus can be broken down into the following categories:

A. The UK tax system and its administration

A. The UK tax system and its administration

- The overall function and purpose of taxation in a modern economy

- Principal sources of revenue law and practice

- The systems for self-assessment and the making of returns

- The time limits for the submission of information, claims and payment of tax, including payments on account

- The procedures relating to compliance checks, appeals and disputes

- Penalties for non-compliance

/>B. Income tax and NIC liabilities

/>B. Income tax and NIC liabilities

- The scope of income tax

- Income from employment

- Income from self-employment

- Property and investment income

- The comprehensive computation of taxable income and income tax liability

- National insurance contributions for employed and self-employed persons

- The use of exemptions and reliefs in deferring and minimising income tax liabilities

C. Chargeable gains for individuals

C. Chargeable gains for individuals

- The scope of the taxation of capital gains

- The basic principles of computing gains and losses

- Gains and losses on the disposal of movable and immovable property

- Gains and losses on the disposal of shares and securities

- The computation of capital gains tax

- The use of exemptions and reliefs in deferring and minimising tax liabilities arising on the disposal of capital assets

D. Inheritance tax

D. Inheritance tax

- The basic principles of computing transfers of value

- The liabilities arising on chargeable lifetime transfers and on the death of an individual

- The use of exemptions in deferring and minimising inheritance tax liabilities

- Payment of inheritance tax

E. Corporation tax liabilities

E. Corporation tax liabilities

- The scope of corporation tax

- Taxable total profits

- Chargeable gains for companies

- The comprehensive computation of corporation tax liability

- The effect of a group corporate structure for corporation tax purposes

- The use of exemptions and reliefs in deferring and minimising corporation tax liabilities

F. Value added tax (VAT)

F. Value added tax (VAT)

- The VAT registration requirements

- The computation of VAT liabilities

- The effect of special schemes

G. Employability and technology skills

G. Employability and technology skills

- Use computer technology to efficiently access and manipulate relevant information

- Work on relevant response options, using available functions and technology, as would be required in the workplace

- Navigate windows and computer screens to create and amend responses to exam requirements, using the appropriate tools

- Present data and information effectively using the appropriate tools

Hack: The UK Tax Syllabus is very vast in comparison to the other Skill Level papers & hence it is challenging to complete the syllabus in the given time period. Therefore, it’s truly important to plan and organize your studies in a systematic manner.

It was advisable to start with Part A: The UK Tax System, this is only an introduction to the subject.

Follow with Part B: Income tax and NIC liabilities it is very time-consuming and is almost 50% of your tax syllabus. Make sure you do this part well from the study text and solve all related questions from the Practise Kit.

Part E: Corporation Tax shall become relatively easier to continue with as there are many related concepts in Part B and Part E. This should take comparatively less time.

After Part B and Part E, you may proceed with Part C: Chargeable gains for Individuals and Companies.

With this, a sizable portion of your syllabus would have been covered. Thereafter you can complete the remaining 2 parts – Part D and Part F

Part D and Part F are both independent areas of the syllabus. They can be chosen in any order.

Choose Part D: Inheritance tax, this is a small concept & questions on this part are usually seen in Section A & B of the paper

Lastly complete Part F: Value Added Tax.

ACCA TX (UK) PAPER PATTERN

The 100-marks ACCA TX (UK) exam paper has been designed to ensure that all the different areas of the syllabus are covered adequately. Following are the various sections and question types that you can expect-

| ACCA Taxation (UK) (100 Marks) | ||

|---|---|---|

| Section A (30 marks) | Section B (30 marks) | Section C (40 marks) |

| 15 OTQ’s * 2 marks each | 3 case studies * 5 OTQ’s in each case study * 2 marks each | 3 Constructed response questions 1 question * 10 marks 2 questions * 15 marks each |

Kindly note the paper pattern is slightly different from the other Applied Skills level papers.

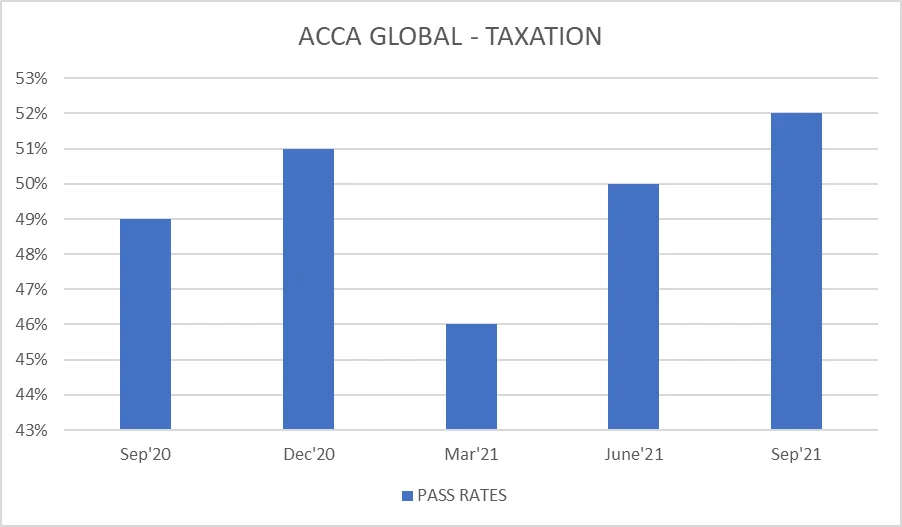

ACCA TX (UK) PASSING TRENDS

You are expected to score 50/100 to pass this examination. This is easily manageable with a clear understanding of the concepts, good practice of the questions, and a positive attitude. The pass rates of ACCA TX (UK) paper across the globe are roughly between 45%-55% for most attempts.

SOURCES OF CONTENT

You need to primarily refer to these two content sources for your preparations –

- The Study Text – for conceptual understanding

- The Practice/Exam Kit – for practice questions

Note: Please refer to the latest material that is valid for your examination, as Taxation rules may change every year.

Kindly avoid using old study material especially for taxation, rules are updated each year. If you are not aware of the updated rules you may lose easy marks.

There are only two ACCA-approved content providers that you should consider, namely, Kaplan Publishing and BPP Learning Media. Apart from this, you can also refer to the technical articles published by ACCA on different topics.

Download our curated express notes for ACCA TX (UK) here

STUDYING METHODOLOGY

- Commence preparations with the Study Text go through all the concepts, tax rules, applicable rates, and allowances. Thereafter, attempt all questions from the Practice Kit to get more clarity and a deeper understanding of how to approach each part of the syllabus. Yes, of course, there is a lot to remember! However, ACCA has made your job easy, they will provide you with a list of rules (Tax Rates And Allowances) during the examination.

- It is difficult to point out important topics here, you need to be well prepared with all the content provided in your study text. You should gain good practice on knowing how to calculate income tax, NIC, corporation tax, capital gains tax, VAT, and Inheritance tax.

- As compared with the other Applied Skills level papers, the syllabus of taxation is vast. However, the questions asked are relatively straightforward and calculative. So, if you prepare well, you can assure yourself a good score.

- While number-driven questions dominate, there is little theory that needs to be studied. You must also be prepared to answer questions relating to administration such as the date of filing various returns, the due date of associated tax payments, the due date for making various claims, etc.

- When solving the constructed response questions from the practice kit, it is useful to go through the key answer tips, tutor’s top tips, tutorial notes, and examiner’s comments to understand what the common mistakes made by students are and how you can deliver a better answer.

- As Taxation is a numerical paper, clearly the focus here should be on solving as many questions as possible.

- You must use the constructed response ‘blank workspace’ provided by the ACCA after logging in to the Practice Platform to get a hold of the CBE environment. You can follow through this link(Practice Questions)

HOW TO PLAN ACCA TX (UK) MOCK EXAMS

Attempting enough mock exams are a must! Going without solving mocks is like a soldier without a weapon.

The examination is now conducted using the CBE platform, it is truly important to write at least 2-3 mocks to get a good idea of how the final examination would be and to get used to the CBE environment.

You can log in to the ACCA ‘Practice Platform’ for solving mocks using the following link.`

Hack: One day before the examination, invest all your time in revising what you have studied so far. Do not try to study any new concept or solve any new problem. Skim through the study text and practice kit to focus on memorizing the important concepts, theory topics, and formulas if required.

THINGS TO REMEMBER WHILE WRITING THE EXAM

After months of all the effort and hard work you would’ve put into the preparation for this exam, it is equally important to ace your exam. Here are some things to remember-

- Time Management: It is important to complete the paper on time. Remember, time management is a key to success! Here is how you can allocate your time-

| PAPER | TX | TOTAL |

|---|---|---|

| Section A | 15 OTQ’s * 2.67 mins | 40 minutes |

| Section B | 15 case study OTQ’s * 2.67 mins | 40 minutes |

| Section C | 1 question (10 marks) * 22 mins each | 22 minutes |

| Section C | 2 question (15 marks) * 34 mins each | 68 minutes |

| Final check | 10 minutes | |

| TOTAL | 180 minutes |

- Do not stress or panic during the exam, stay calm write all you know. If you freak out, it is possible that you mess with other straightforward, manageable, and scoring questions.

- Do not leave any question unattempted

- For your OTQ’s there is always a 25% probability to get the answer right, place your bet and mark the option you believe is the closest to the answer.

- For constructed response questions there is no negative marking. So, based on your understanding of the concepts make sure you form an answer to every question asked.

- Be prepared to find different and new styles of questions, with patience and linking to the concepts of your syllabus you should be able to tackle them well.

- Better to start with Section A first, then Section B, and lastly Section C, i.e. FOLLOW THE ORDER! Do not spend too much time finding answers to questions you are not able to crack. Section C: make sure for the numerical questions you show the workings along with the solution wherever needed For theoretical questions write enough to earn marks. One healthy and valid point is worth 1 mark.

EXAMINER’S EXPECTATIONS

The ACCA publishes an Examiner’s Report for every attempt which gives an insight into the marking process, the common mistakes that students make during the exams, and other useful techniques to do well in your examination. You must go through the Examiner’s Reports to understand what the examiner is expecting from you. It will help you understand how students have failed to tackle different questions and how they could have performed better. It’s like learning from someone else’s mistakes. You can follow through this link(TX examiner Reports) to refer to a few of the examiner’s reports published by the ACCA.

All the best 😊

Our expert tutors for ACCA Taxation (ACCA TX) have successfully coached thousands of ACCA aspirants with a phenomenal passing rate. Over 92% of our students that completed our full eLearning program passed their exams (92% was an average of all our qualification courses over the last 2 years at the time of writing). Join their club with our Platinum Rated ACCA Online Courses today! Book a demo.

Summary of all links

Technical articles published by ACCA

A. The UK tax system and its administration

A. The UK tax system and its administration />B. Income tax and NIC liabilities

/>B. Income tax and NIC liabilities C. Chargeable gains for individuals

C. Chargeable gains for individuals D. Inheritance tax

D. Inheritance tax E. Corporation tax liabilities

E. Corporation tax liabilities F. Value added tax (VAT)

F. Value added tax (VAT)