CFA vs US CMA

If you’re exploring global finance careers, you’ve probably heard of both the American courses – Chartered Financial Analyst (CFA) and Certified Management Accountant (US CMA) qualifications. Each opens different doors in the finance world. CFA is known for its deep dive into investment management, while US CMA focuses on internal finance functions like planning, costing, and decision-making.

But which one should you pursue?

Let’s break it down: eligibility, course structure, syllabus, job prospects, costs, and more, so you can make an informed career decision.

Table Of Contents

1. Professional Bodies & Global Recognition

2. Eligibility & Entry Requirements

3. Course Structure & Duration

4. Syllabus & Key Focus Areas

5. Pass Rates & Exam Difficulty

6. Career Opportunities & Salaries

7. Investment for the Qualifications

Final Verdict: CFA or US CMA?

Want a quick overview? Watch our YouTube video on CFA vs US CMA

1. Professional Bodies & Global Recognition

CFA® Program (USA)

- Established by: CFA Institute, USA, in 1962

- Global Reach: Recognised in 165+ countries

- Members & Candidates: Over 190,000+ charterholders globally

- Focus: Investment analysis, portfolio management, and ethics

US CMA

- Established: 1972 by the Institute of Management Accountants (IMA)

- Headquarters: USA

- Global Presence: Recognized in over 150 countries

- Members: Over 140,000 members globally

- Focus: Management accounting, financial planning, analysis, and decision-making

2. Eligibility & Entry Requirements

| Criteria | CFA | US CMA |

|---|---|---|

| Minimum Education | 23 months before graduation | Can appear after 12th |

| Work Experience | 4000 hours in 36 months | 2 years continuous relevant experience |

| Who It’s For | Investment roles or equity research | FP&A, costing, internal finance |

Note: ACCA offers exemptions based on prior qualifications, potentially reducing the number of exams. Its recommended to start ACCA after grade 12.

3. Course Structure & Duration

| Criteria | CFA | US CMA |

|---|---|---|

| Levels/Parts | 3 Levels | 2 Parts |

| Approximate Duration | 3 years | 8 to 12 months |

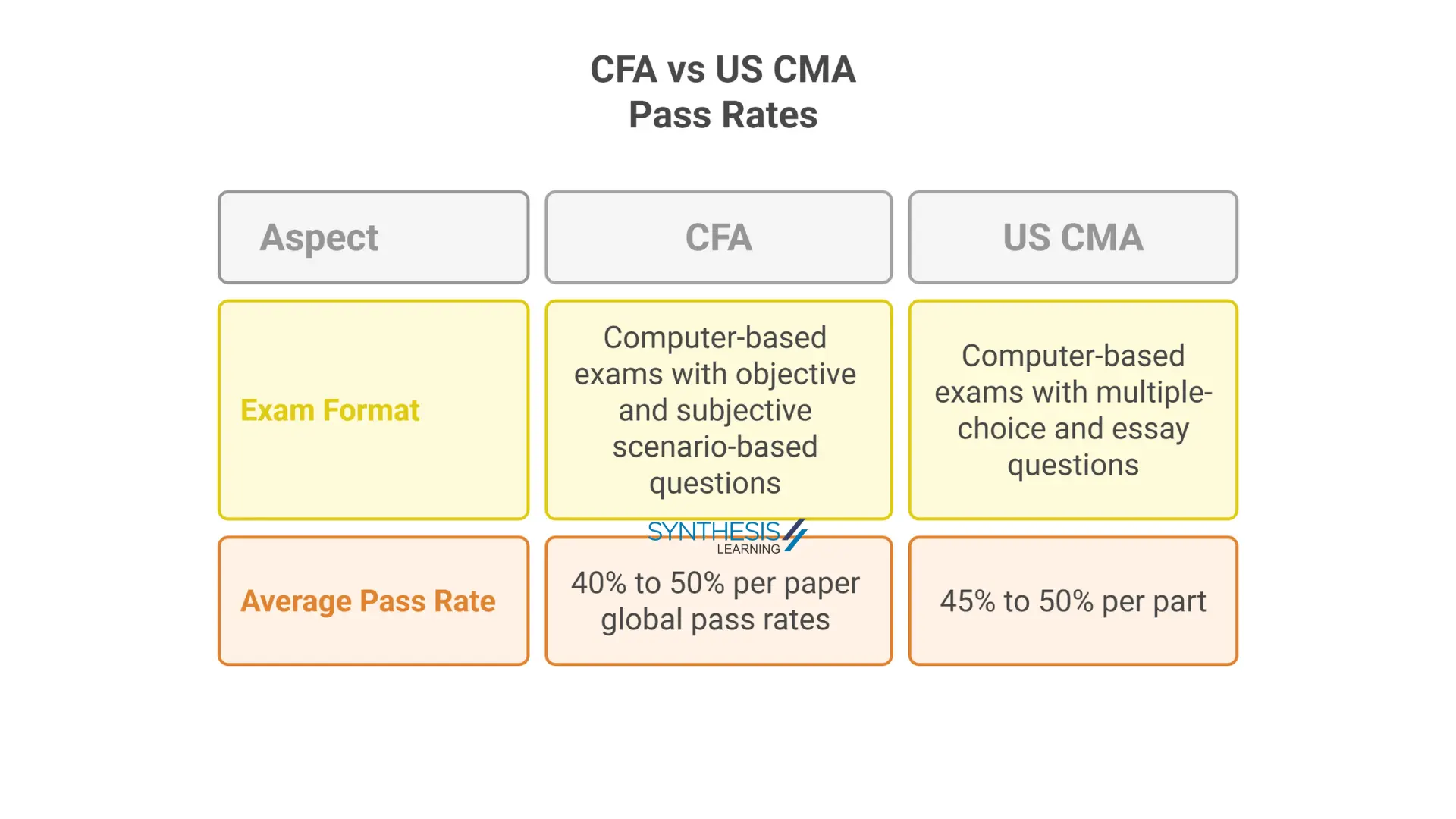

| Exam Format | Computer-based exams with MCQs, case-based & essay-type questions | Computer-based exams with MCQs & essay questions |

| Exam Frequency | Multiple windows per year | Jan–Feb, May–June, Sep–Oct |

CFA is more rigorous and spaced out, while the US CMA is compact and fast-track friendly.

4. Syllabus & Focus Areas

Syllabus & Focus Area

The CFA Program is structured across three levels, each building on the knowledge from the previous one. While the 10 core subjects remain consistent, the depth and complexity increase as you progress.

Level 1 :

- Ethical and Professional Standards

- Quantitative Methods

- Economics

- Financial Statement Analysis

- Corporate Issuers (formerly Corporate Finance)

- Equity Investments

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management and Wealth Planning

Level 2 :

Topics remain the same as level 1, only the depth and weightage change

Level 3: Portfolio Management and Strategy

- Ethical and Professional Standards

- Economics (focused on macro forecasting & capital markets)

- Equity Investments

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management and Wealth Planning

US CMA Curriculum:

Part 1:

- Financial Planning, Performance, and Analytics.

- External Financial Reporting Decisions

- Planning, Budgeting, and Forecasting

- Performance Management

- Cost Management

- Internal Controls

- Technology and Analytics

Focuses on analysing financial performance and making data-driven decisions.

Part 2:

- Strategic Financial Management.

- Financial Statement Analysis

- Corporate Finance

- Decision Analysis

- Risk Management

- Investment Decisions

- Professional Ethics

Emphasizes strategic decision-making and long-term financial planning.

Key Difference: CFA is externally focused (markets, investors). US CMA is internally focused (company decision-making).

5️. Pass Rates & Exam Difficulty

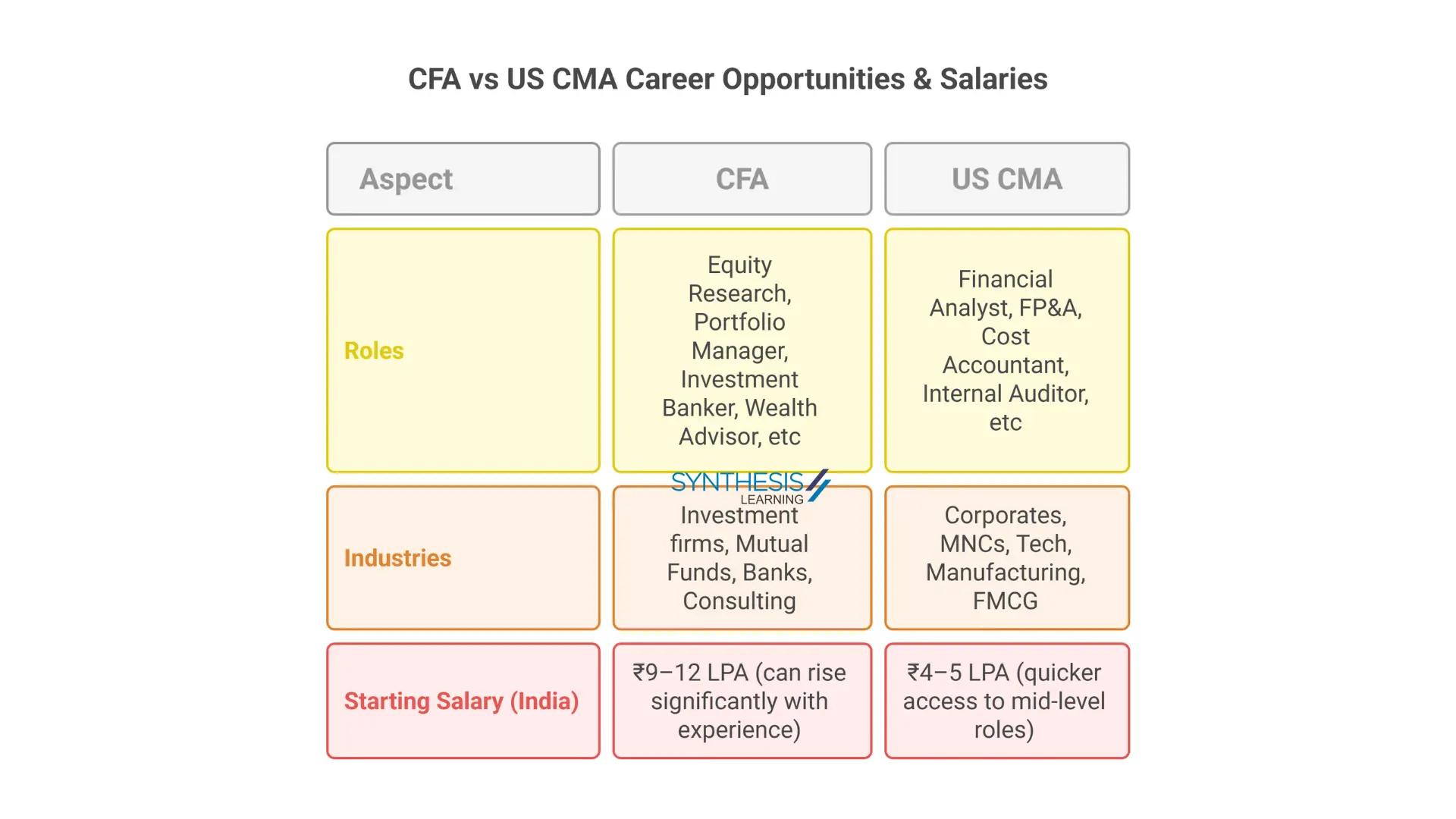

6️. Career Opportunities & Salaries

Location, job role, and company brand matter. CFA roles are often front-office, while US CMA roles are internal corporate.

7. Investments For the Qualifications

Pursuing the CFA Program typically involves a total estimated investment of ₹4.5 to ₹5 lakhs. This includes enrollment fees, exam fees for all three levels, official prep materials, and professional coaching. Given its depth, global recognition, and strong value in investment-related roles, the CFA Charter is a high-return credential for those committed to careers in asset management, investment banking, or equity research.

In contrast, the US CMA certification presents a more compact and cost-effective pathway, with a total investment generally ranging between ₹1.5 to ₹2 lakhs. This covers IMA membership, entrance and exam fees for both parts, study materials, and coaching. Designed for professionals aiming to build expertise in management accounting and corporate finance, the US CMA offers exceptional value within a shorter duration.

Final Verdict: CFA or US CMA?

Choose CFA if you’re aiming for a high-impact career in investment banking, portfolio management, equity research, or global asset management. With a typical duration of 3 to 4 years and an overall investment of ₹4.5 to ₹5 lakhs, the CFA Program is ideal for those ready to commit to a rigorous, globally respected finance qualification that opens doors to top financial institutions worldwide.

On the other hand, choose US CMA if you’re looking to fast-track your career in financial planning & analysis, and management accounting. It’s perfect for those targeting roles in MNCs, shared service centres, or FP&A teams. With a shorter duration of 6 to 12 months and a total investment of ₹1.5 to ₹2 lakhs, US CMA offers a focused and efficient route into high-demand corporate finance roles.