Table of Content

The US Certified Management Accountant (CMA) is a globally recognised professional qualification designed for those who want to move beyond traditional accounting roles and step into financial management and strategic decision-making. Offered by the Institute of Management Accountants (IMA) and recognised in 150+ countries, the CMA program focuses on building strong capabilities in financial planning, performance evaluation, cost management, and risk analysis.

What makes CMA particularly relevant today is its business-first approach. Instead of focusing only on compliance or bookkeeping, the syllabus trains candidates to understand how financial information supports real corporate decisions – exactly where most B.Com graduates and early-career finance professionals aim to work.

This guide breaks down the CMA USA syllabus, subjects, exam pattern, and preparation approach clearly and practically, so you know what to study, how the exam works, and how to plan your preparation with confidence.

Overview of the US CMA Course

The US CMA course syllabus is structured into two exam parts, each designed to build a distinct set of professional skills. Together, they cover the full journey – from operational finance to strategic leadership.

Unlike courses that spread content across many levels or papers, CMA keeps the structure focused and efficient. Each part tests:

- Think like a finance professional inside a real business, not just a student answering questions

- Translate numbers into decisions, insights, and business impact

- Balance accuracy with judgment under time pressure – just like in corporate roles

Because of this structure, candidates often find CMA easier to plan around college or work schedules, while still gaining skills that are directly applicable in corporate finance roles.

US CMA Subjects

The US CMA subjects are aligned with how finance functions actually operate inside organisations. Instead of an isolated theory, the syllabus connects accounting, finance, and strategy into a single learning framework.

At a high level, the subjects focus on:

- Planning and budgeting for business operations

- Measuring and improving organisational performance

- Managing costs, risks, and internal controls

- Supporting strategic and investment decisions

These subject areas are especially valuable for roles such as Management accountant, Financial Planning and Analysis analyst, Business analyst, and Finance manager.

(You can explore the full course overview in detail on the US CMA Course page.)

US CMA Part 1 Syllabus Explained

The US CMA Part 1 syllabus lays the foundation of management accounting and internal financial control. This part focuses on how organisations plan, monitor, and control performance at an operational level.

CMA Part 1: Financial Planning, Performance, and Analytics includes:

- Financial planning, budgeting, and forecasting

- Cost management and cost behaviour analysis

- Performance management and variance analysis

- Internal controls, governance, and enterprise risk

Part 1 is convenient. Candidates learn how budgets are prepared, how performance is evaluated against targets, and how internal controls protect business value.

This makes it especially relevant for students entering corporate finance or accounting roles early in their careers.

US CMA Part 2 Syllabus Explained

The CMA US subjects covered in Part 2 take candidates from operational finance into strategic financial leadership. This section is designed for decision-makers – those involved in evaluating risks, investments, and long-term business strategy.

CMA Part 2: Strategic Financial Management includes:

- Financial statement analysis for decision-making

- Corporate finance and capital investment decisions

- Risk management and financial risk assessment

- Strategic planning and business analysis

Part 2 develops the mindset required for senior finance roles. Instead of asking “How do we record this?”, candidates learn to ask “What decision should the business take based on this information?”

US CMA Exam Format and Structure

Understanding the US CMA exam pattern is crucial before beginning your preparation. Each part of the exam follows a consistent and predictable structure.

For each part:

- 100 multiple-choice questions (MCQs)

- 2 essay-type questions

- Total duration: 4 hours

This format balances speed-based testing (MCQs) with deeper evaluation of analytical thinking (essays).

Question Types, Scoring, and Evaluation

Under the CMA USA exam pattern, MCQs test conceptual clarity and applied understanding, while essay questions assess problem-solving and written communication. Essay questions are typically scenario-based and require structured reasoning rather than lengthy calculations.

Scores are reported on a 0 – 500 scale, with 360 as the passing score. Both MCQs and essays contribute to the final result, reinforcing the need for balanced preparation across concepts and application.

How the CMA Paper Pattern Tests Application (and Industry-Ready Thinking)

The CMA paper pattern is intentionally designed to move candidates away from rote memorisation and traditional pen-and-paper exam habits. Instead, it mirrors how finance professionals actually work in today’s corporate environment – digitally, analytically, and under time-bound conditions.

Since the CMA exam is conducted entirely in an online, computer-based format, candidates get accustomed to reading scenarios on screen, analysing data quickly, and structuring answers in a professional, concise manner.

This closely reflects real-world finance roles, where decisions are made using dashboards, spreadsheets, and reports – not handwritten workings.

Questions are application-driven and often scenario-based, requiring candidates to:

- Interpret financial and operational data digitally

- Apply concepts to business situations rather than recall definitions

- Make judgment-based decisions within a limited time

This online-first approach doesn’t just test knowledge – it builds comfort with modern assessment and decision-making environments, which is especially valuable for students transitioning from college to corporate roles.

In many ways, the CMA exam itself becomes early training for how finance professionals think, analyse, and respond in today’s workplace.

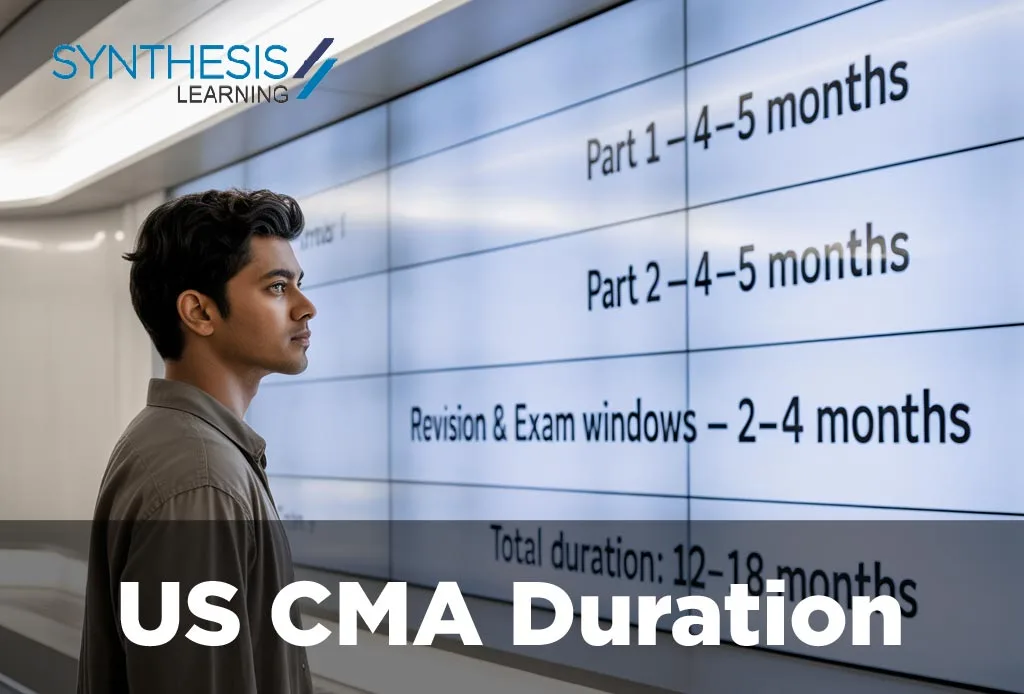

Exam Windows and Attempt Flexibility

As per the CMA US exam pattern, exams are conducted in three testing windows every year:

- January – February

- May – June

- September – October

Candidates can choose when to attempt each part, making the syllabus flexible for college students and working professionals. Most candidates attempt one part at a time to maintain focus and improve pass probability.

Planning Your CMA Preparation the Right Way

Preparing for CMA is less about studying endlessly and more about studying strategically. A well-planned approach typically includes:

- Weekly study targets instead of daily pressure

- Concept learning followed by question practice

- Regular revision cycles to avoid last-minute overload

- Mock exams to build confidence and exam temperament

This is where structured support can make a real difference. With 25+ years of experience in global finance education, Synthesis Learning supports CMA candidates through:

- Being an Approved Course Provider for the US CMA

- 1-on-1 mentorship, paper planning, and doubt-solving sessions

- Early placement exposure through its Campus-to-Corporate program

- A comprehensive US CMA pass-guarantee ecosystem, ensuring candidates successfully clear the paper

- Discounts of upto ₹50 thousand on IMA fees

These elements align well with the CMA syllabus’s application-driven nature, especially for students balancing preparation alongside college or work.

Conclusion

A clear understanding of the US CMA syllabus removes uncertainty and helps candidates prepare with direction and confidence. When you know what subjects are covered, how the exam is structured, and what skills are being tested, your preparation becomes focused and efficient.

Whether you are a student planning ahead or a working professional upgrading your skill set, mastering the syllabus and exam pattern is the first step toward earning the CMA credential successfully.

FAQ’s

1. What does the CMA qualification focus on?

The US CMA course focuses on management accounting, financial planning, performance management, and strategic decision-making rather than traditional bookkeeping or compliance roles.

2. What areas are covered in the first part of the CMA exam?

The US CMA Part 1 syllabus covers financial planning, cost management, performance evaluation, and internal controls, forming the foundation of management accounting.

3. How is the CMA exam conducted?

The US CMA exam pattern consists of two parts, each with 100 MCQs and 2 essay questions, conducted as a 4-hour computer-based exam.

4. What is the structure of the CMA question paper?

As per the CMA paper pattern, the exam blends objective questions with scenario-based essays to test both speed and analytical depth.

5. Which subjects are included in the CMA programme?

The CMA US subjects include financial planning, cost and performance management, internal controls, corporate finance, and strategic analysis.

6. Is the CMA syllabus manageable alongside work or studies?

Yes, the CMA USA syllabus is manageable with a structured study plan and flexible exam windows, making it suitable for students and working professionals a like.

The US CMA course focuses on management accounting, financial planning, performance management, and strategic decision-making rather than traditional bookkeeping or compliance roles.

The US CMA Part 1 syllabus covers financial planning, cost management, performance evaluation, and internal controls, forming the foundation of management accounting.

The US CMA exam pattern consists of two parts, each with 100 MCQs and 2 essay questions, conducted as a 4-hour computer-based exam.

As per the CMA paper pattern, the exam blends objective questions with scenario-based essays to test both speed and analytical depth.

The CMA US subjects include financial planning, cost and performance management, internal controls, corporate finance, and strategic analysis.

Yes, the CMA USA syllabus is manageable with a structured study plan and flexible exam windows, making it suitable for students and working professionals a like.