Is US CMA Worth It? A Detailed Cost-Benefit Analysis

The US CMA qualification, offered by the Institute of Management Accountants (IMA) is globally recognized for its focus on Financial Planning & Analysis, Strategic Management & Decision Making. CMAs are trained to see beyond the data, translating numbers into high-level strategic insights.

Valued by top employers worldwide, this qualification equips professionals with rich expertise in finance, management accounting, decision-making & other key business skills. Founded in 1919, the IMA has a strong global presence with over 140,000 members across 150+ countries. The CMA (US) can open doors to prestigious positions in multinational corporations (MNCs) and even the Big 4 accounting firms. However, many aspiring professionals wonder: is it worth the investment of time, effort, and money?

In this blog, we will delve into the costs, benefits, and long-term value of becoming a US CMA, helping you decide whether this certification aligns with your career goals.

Summary

When evaluating whether to pursue the US CMA certification, consider these factors:

Investments required to become a US CMA

1. Time Commitment – Completing the CMA certification typically requires a preparation of 6 to 9 months, depending on how much time you can dedicate to studying.

2. Relevant Work Experience– To qualify as a US CMA, candidates must complete two years of relevant work experience as a Financial Analyst, Management Accountant, Budget Analyst, Internal Auditor, Risk Analyst

or any other relevant roles in management accounting or financial management

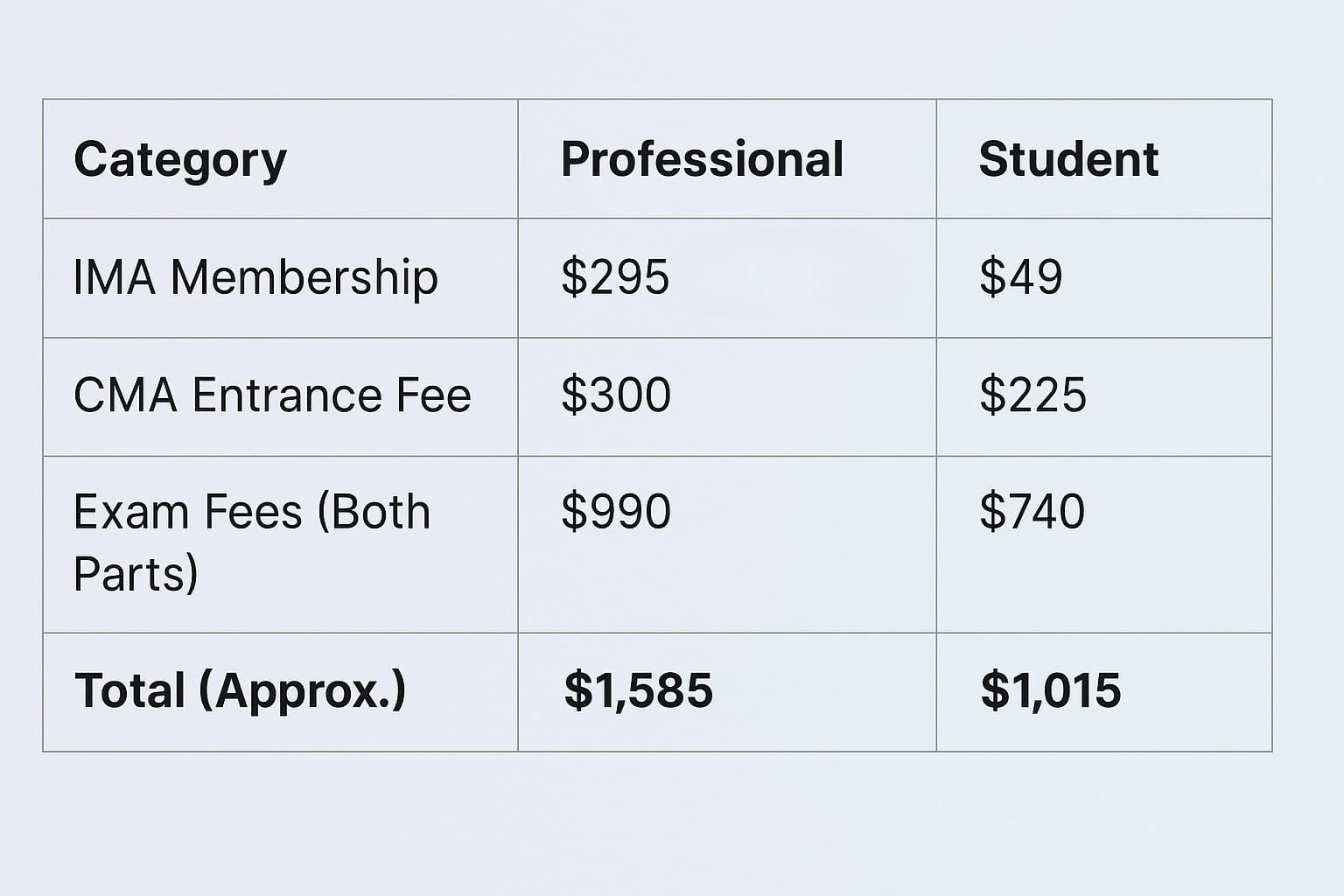

3. Financial investments -The financial investment for US CMA includes IMA fees (registration, membership, and exam fees), which range from $1015 to $1585 and coaching investments for CMA (US), which range from ₹85k to ₹100k. With a high ROI, candidates typically recover their complete investment of doing CMA within first six months of employment.

Key Benefits of Becoming a US CMA

1. Career Advancement & Recognition – The US CMA is globally recognized, accelerating your career into leadership roles like CFO, Controller, and Finance Manager.

2. Enhanced Financial & Analytical Skills – Gain strategic financial expertise to drive business decisions and stand out in the job market.

3. Global Opportunities – Work in top global companies and across industries with a certification respected worldwide.

4. Higher Earning Potential – US CMAs earn up to 21% more than non-certified peers, offering a strong ROI on certification costs.

5. Professional Network & Resources – Join IMA’s global network, access career growth opportunities, and stay updated with industry trends.

6. Job Security & Market Demand – High demand for US CMAs ensures better job security and strong career advancement potential.

7. Ethical Standards & Professionalism – CMAs uphold strong ethical standards, boosting credibility and trust in the industry.

Cost Breakdown of the US CMA Qualification

1. Preparation time: 6 to 9 months

Students typically require a preparation period of 6 to 9 months to successfully complete the US CMA qualification. This timeframe allows for thorough coverage of the syllabus, adequate practice with exam-style questions, and effective revision. The duration may vary depending on prior knowledge, study pace, and availability of study resources

The CMA exam consists of two parts:

- Part 1: Financial Planning, Performance, and Analytics

- Part 2: Strategic Financial Management

- The paper pattern for both parts is as follows: Total Questions: 100 Multiple-Choice Questions (MCQs) + 2 Essay Questions

- Exam Duration: 4 hours

- Exam Mode: Computer-based at Exams

2. Relevant work experience

To qualify as a US CMA, one needs candidates must complete two years of relevant work experience as Financial Analyst, Management Accountant, Budget Analyst, Internal Auditor, or Risk Analyst

OR any other relevant roles in management accounting or financial management This experience can be gained before or after 7 years of completing the qualification.

3. Financial Investment required to do the US CMA

The financial Investments required to pursue the US CMA can primarily be divided into 2 parts. One is the fees payable to IMA & the second part is the coaching fees payable to the Learning Provider.

Fees Payable to IMA

Note that the Institute of Management Accountants (IMA) offers exclusive discounts to candidates on both components, which can range from a 20% to a 50% discount, therefore, students can benefit from significant cost reductions on IMA membership, CMA entrance fees, and exam fees, making the certification more affordable

Additionally, CMA coaching investments typically range between ₹85k to ₹100k, depending on the mode, place, & other factors.

Due to the high ROI provided by the US CMA, the candidates generally recover the complete cost of doing the CMA in the first 6 months of employment.

Career Benefits of the US CMA

1. Career Advancement and Global Recognition

The US CMA is considered the gold standard in management accounting. It’s not only recognized globally but also highly respected across various industries.

Earning this credential can accelerate your career, pushing you into mid-manager and senior roles such as CFO, Controller, and Finance Manager. In a crowded job market, a US CMA helps you stand out and makes you a top choice for leadership roles in finance.

The profiles CMAs usually work in are:

- Corporate Finance

- Financial Planning & Analysis

- Cost Manager

- Financial Manager

- Management Accounting

- Financial Risk Manager

- Internal Audit

- Business Development

2. Enhanced Financial and Analytical Skills

The CMA curriculum is designed to sharpen your financial management skills and analytical abilities, preparing you for real-world challenges.

US CMAs are trained to not only know the what but also the why behind the numbers and strategic insights that drive organizational performance. If you’re looking to move into decision-making roles, these skills are adding immense value to your resume and professional career.

3. Global Opportunities

The US CMA certification is recognized worldwide, providing opportunities to work in different countries and industries. Whether you’re aiming for a career in the Indian sub-continent, the United States, Europe, or other global business cities, the US CMA credential is respected across borders.

Companies like Accenture, Capgemini, Oracle, and Uber actively seek US CMAs for roles in financial planning and analysis, cost management, and strategy development. Along with Big 4 (PWC, EY, KPMG, Deloitte) being the major employer of US CMAs worldwide.

4. Higher Earning Potential

One of the key reasons professionals pursue the US CMA certification is the higher earning potential it provides. According to the IMA 2023 Global Salary Survey report, US CMAs certification holders earn up to 21% more than their non-certified counterparts.

In India, the average starting salary for a US CMA is between ₹5 to ₹6 lakhs per annum, which you can start earning whilst you’re in college.

5. Professional Network and Resources

As a CMA, you become part of the IMA’s vast network of professionals, offering endless opportunities for mentorship, career growth, and professional development.

Networking with other CMAs can help you stay updated with the latest trends in the industry and open doors to new job opportunities. Along with this, IMA provides opportunities for continuous career growth through the mandatory requirement of 30 hrs. of Continuous professional education every year.

6. Job Security and Market Demand

The demand for skilled financial professionals, especially those with management accounting expertise, continues to grow. In industries like finance, technology, and manufacturing, companies seek CMAs for their ability to contribute to strategic business decisions.

The demand for US CMA professionals is increasing at a pace that is much greater than the rate at which the supply is increasing, which means with a US CMA, you’ll enjoy better job security and increased chances of career advancement.

7. Ethical Standards and Professionalism

The CMA program places a strong emphasis on professional ethics and member conduct. US CMAs are bound by a strict code of conduct, which ensures they maintain the highest standards of integrity and professionalism.

This not only adds to your credibility but also helps build trust with employers and clients. Resulting in high trust placed by the market on US CMA professionals.

Conclusion

The US CMA is a High-value Investment as the certification equips candidates with valuable skills like financial analysis, strategic decision making, budgeting, leadership skills and many more career-defining skills. These skills provide long-term benefits to the candidates throughout their professional careers

US CMA helps candidates in career acceleration, provides them with better job opportunities and global recognition. All these benefits, when compared to the investments required to become a US CMA, make it a very lucrative investment for the candidates.