US CMA vs. CMA India: Key Differences and Similarities

For Indian students who are thinking of a career in accounting and finance, making a choice between US CMA vs Indian CMA may be challenging. Both certifications have high value in the professional marketplace, but they serve different career objectives and industry demands.

Here in this blog, we shall thoroughly compare two elite qualifications to enable you to make an informed choice depending on your situation, long-term career objectives, and the benefits each one possesses.

Also, Watch our video to know which is better for you US CMA vs Indian CMA :

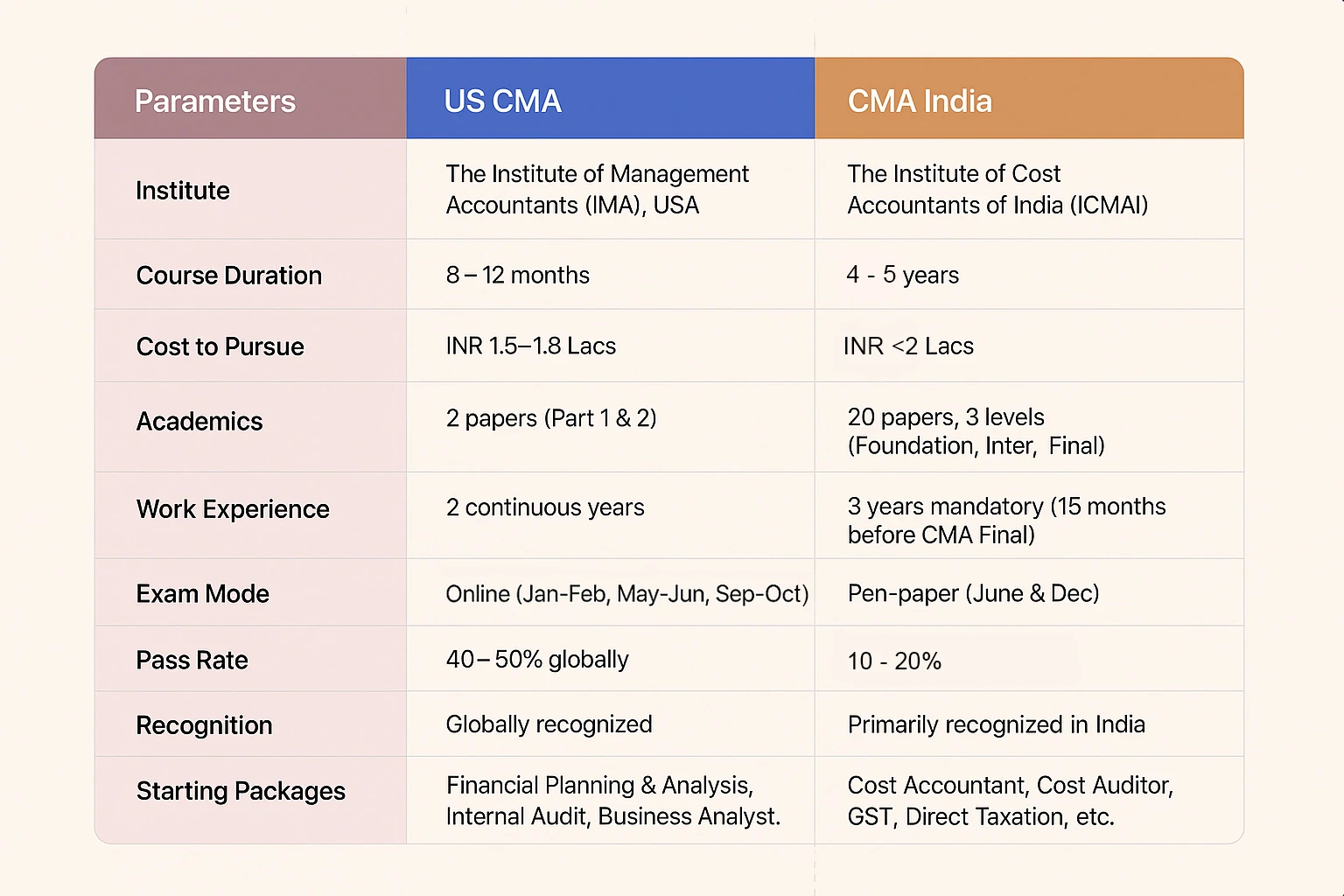

Parent Body

US CMA:

- The US Certified Management Accountant (CMA) designation is governed by the Institute of Management Accountants (IMA), USA.

- Established in 1919, IMA has a widespread global presence with more than 140,000+ members across 150+ countries.

- IMA offers worldwide professional networking, research, continuing education, and career support for management accountants.

Indian CMA:

- The Indian counterpart is governed by the Institute of Cost Accountants of India (ICMAI).

- Established in 1944, ICMAI is a statutory body under the Ministry of Corporate Affairs, Government of India.

- It has over 90,000+ members and 500,000+ students enrolled in the CMA India program, as the pass rate of CMA India is just 10% to 20%.

Course Duration

US CMA:

- Can be completed within 8 – 12 months.

- Since there are only 2 exam parts, the qualification can be done by students in a short span of time as compared to CMA India

CMA India:

- Requires 4 – 5 years to complete due to its three-level structure.

- Includes Foundation (6 months), Intermediate (12 – 18 months), and Final (18 – 24 months) exams, followed by mandatory work experience.

Job Opportunities and Recognition

US CMA:

- Exam fees, registration, and tuition cost around INR 1.5 – 1.8 Lacs.

- IMA offers student discounts and scholarships to ease financial burden.

Indian CMA:

- Total cost exceeds INR 2 Lacs, including tuition, registration, and exam fees.

- Coaching classes and self-study resources add to the total expense.

- Exam re-attempts and late registration fees may further increase costs.

Academics & Exam Structure

US CMA:

- The exam consists of 2 parts:

Part 1: Financial Planning, Performance, and Analytics.

Part 2: Strategic Financial Management. - Each part consists of 100 multiple-choice questions (MCQs) and two essay questions.

- Topics include cost management, risk management, financial statement analysis, corporate finance, decision analysis, performance management, and internal controls.

- The exams emphasize practical application, decision-making, and financial analysis.

Indian CMA:

- The program consists of 20 papers across three levels:

- Foundation Level (4 papers): Covers basic subjects like Economics, Accounting, Business Laws, and Mathematics.

- Intermediate Level (8 papers): Includes Cost Accounting, Financial Management, Direct and Indirect Taxation, and Company Law.

- Final Level (8 papers): Focuses on Advanced Financial Management, Corporate Laws, Strategic Cost Management, and Indirect Tax Laws.

- Exams are offline descriptive, requiring detailed answers, calculations, and case-study analysis

Work Experience Requirement

US CMA:

- Requires 2 years of continuous work experience in management accounting or financial management.

- Experience can be gained before or within seven years of passing the exam.

- Roles such as financial analyst, cost accountant, and internal auditor qualify for experience.

Indian CMA:

- Requires 3 years of mandatory work experience.

- Includes a 15-month internship requirement before appearing for the CMA Final exams.

- Internships must be under a practising CMA or in an industrial setup.

Exam Mode

US CMA:

- Conducted online at Prometric centres globally.

- Exams are available in January-February, May-June, and September-October.

- Results are typically available within six weeks.

Indian CMA:

- Conducted in pen-and-paper mode.

- Exams are held twice a year (June and December).

- Results are released after two months.

Pass Rate

US CMA:

- Global pass rate of 40 – 50%, making it relatively achievable.

- Part 1 has a lower pass rate than Part 2 due to the difficulty of cost management concepts.

Indian CMA:

- Pass rate of 10 – 20%, making it one of India’s toughest accounting qualifications.

- The Final Level has the lowest pass rate due to its complexity.

Global Recognition

US CMA:

- Recognized in 150+ countries, including the US, Canada, Europe, the Middle East, and Asia.

- Valued by MNCs and global consulting firms.

Indian CMA:

- Primarily recognized in India but also holds value in the UAE, Canada, the UK, and some other countries.

- More relevant for professionals working in the Indian taxation and regulatory environment.

Starting Salary Packages

US CMA:

- India: starts from INR 5 – 6 Lacs per annum.

- Salary varies based on experience, location, and industry.

Indian CMA:

- India: starts from INR 6 – 8 Lacs per annum.

- Public sector roles may offer structured pay scales.

Career Roles and Opportunities

US CMA:

- Popular in multinational corporations, consulting firms, investment banking, and corporate finance.

- Common roles include:

- Financial Planning & Analysis (FP&A) Manager

- Internal Auditor

- Business Analyst

- Risk Manager

- Corporate Finance Specialist

Indian CMA:

- Focuses more on cost management, taxation, and regulatory compliance.

- Common roles include:

- Cost Accountant

- Cost Auditor

- GST Consultant

- Direct & Indirect Taxation Expert

- Corporate Law Consultant

Industry Demand & Job Prospects

US CMA:

- High demand in sectors like financial services, technology, healthcare, and manufacturing.

- Preferred by companies like Big 4 firms (Deloitte, PwC, EY, KPMG), Amazon, IBM, Accenture, and Goldman Sachs.

Indian CMA:

- High demand in Indian PSU (Public Sector Undertakings), manufacturing, and taxation firms.

- Preferred by companies like BHEL, SAIL, Indian Railways, Larsen & Toubro, and TATA Group.

Which One Should You Choose?

• If you are looking for a globally recognized certification, faster completion time, and high flexibility, then US CMA is the ideal choice.

• If you want a structured Indian certification that provides deep expertise in cost accounting and taxation, Indian CMA is the better option.

Both certifications hold immense value in the finance and accounting domain. Your choice should depend on your career aspirations, geographical preferences, time commitment, and financial investment. Either way, earning a CMA certification will significantly enhance your career and professional growth.

FAQs

1. What is the key difference between CMA India and CMA USA?

The main difference between CMA India and CMA USA lies in their scope and recognition. CMA India is ideal for professionals seeking opportunities within India, while US CMA vs Indian CMA gives global exposure, especially with multinational corporations.

2. Can I pursue CMA USA if I have a CMA India qualification?

Yes, many professionals choose to pursue US CMA after CMA India to expand their career opportunities internationally. However, you’ll need to meet the eligibility criteria for the CMA US vs CMA India pathway.

3. What are the salary expectations after completing US CMA vs Indian CMA?

After completing US CMA vs CMA India, you can expect a higher salary potential with US CMA due to its international recognition. While both certifications offer competitive salaries, US CMA holds an edge in multinational companies, with salaries ranging from ₹4 to ₹5 lakhs in India.

4. Which certification is more globally recognised, CMA India or US CMA?

US CMA is globally recognised and offers more international career opportunities than CMA India, which focuses more on the Indian market. If global career prospects are your goal, US CMA vs Indian CMA could significantly influence your decision.