US CMA vs MBA: What to Choose for Career Growth?

Choosing between the Certified Management Accountant (CMA US) and the Master of Business Administration (MBA) is a big decision—one that can shape your career trajectory in the finance and business world. Both are powerful qualifications, but they serve different purposes. Let’s break it down and help you decide what fits your goals best.

1️. Recognition & Focus Areas

CMA (US)

Offered by the Institute of Management Accountants (IMA), USA, the CMA credential is recognized in 150+ countries and is focused on management accounting, cost control, performance analysis, and financial planning. It’s a specialist credential that builds deep financial and analytical acumen needed in corporate decision-making roles.

MBA

The MBA is a broad-based postgraduate degree with domestic recognition depending on the institution. It covers multiple areas such as marketing, finance, HR, strategy, operations, and is tailored toward building future business leaders and entrepreneurs. It’s designed for those who want to move into general management, consulting, or leadership roles.

2️. Eligibility & When You Can Start

CMA (US) can be started right after Class 12. You can begin studying and even appear for exams during your graduation. The candidates just have to clear two parts of their exam. The only condition is that to earn the CMA certification, you must be a graduate and have 2 years of relevant work experience. This makes it an excellent head-start option for students who want to become job-ready before graduation ends.

MBA requires you to be a graduate and top an entrance exam (like CAT, GMAT, etc.) also have clear the group discussion and personal interview to get admission a reputed business school. Most MBA programs are postgraduate-level, and students usually pursue them after 1–3 years of work experience.

A few of the top B schools in India are

IIM Ahmedabad, FMS Delhi, IIM Bangalore, IIM Calcutta,IIM Lucknow, IIM Indore, XLRI Jamshedpur, ISB Hyderabad, SPJIMR Mumbai, and IIM Kozhikode

3️. Course Structure, Duration & Curriculum

CMA (US): Fast-Track & Focused (2 Parts)

Can be completed in 6 to 12 months.

Part 1: Financial Planning, Performance & Analytics

- External Financial Reporting Decisions

- Planning, Budgeting & Forecasting

- Performance Management

- Cost Management

- Internal Controls

- Technology & Analytics

Part 2: Strategic Financial Management

- Financial Statement Analysis

- Corporate Finance

- Decision Analysis

- Risk Management

- Investment Decisions

- Professional Ethics

Built for decision-making, financial planning, and analytics in corporates.

MBA: Broad, Multi-Domain (Full-Time: 1–2 Years)

Core MBA subjects usually include:

- Finance & Accounting

- Marketing Management

- Organisational Behaviour

- Operations & Supply Chain

- Human Resources

- Business Strategy

- Economics

- Business Law & Ethics

Many programs offer electives, industry projects, and internships.

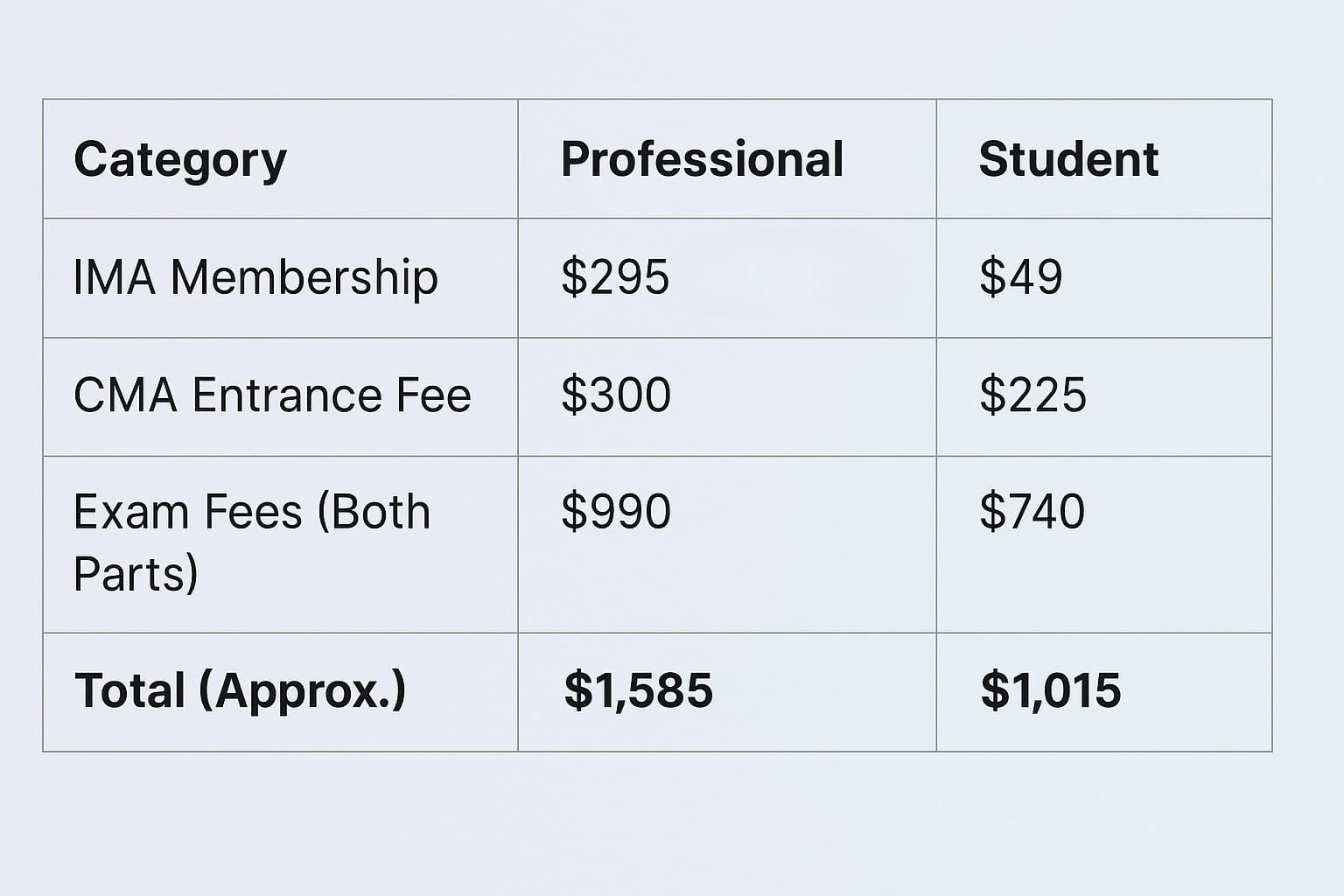

4️. Cost of the Program

CMA (US) is among the most cost-effective global finance qualifications. The total investment, including exam fees, IMA membership, study material, and professional coaching, typically falls between ₹1.5 to ₹2 lakhs. That’s a fraction of what you’d spend on most postgraduate programs.

In contrast, pursuing an MBA, especially from a reputed Indian B-school or a global university, can cost anywhere from ₹9 lakhs to ₹25 lakhs (or more). This includes tuition, exam fees, hostel, and other expenses. So if you’re planning to pursue an MBA, think of it as a bigger investment that may or may not yield proportional returns depending on the institute’s brand and placements.

5️. Career Pathways, Job Roles & Salaries

CMA (US) Career Path

- Financial Analyst

- FP&A Manager

- Cost Accountant

- Business Controller

- Internal Auditor

- Finance Manager

- Budgeting & Planning Analyst

Sectors:

MNCs, Shared Services, IT/ITES, Manufacturing, Consulting, FMCG. Average Salary in India

Entry-Level: ₹5–8 LPA

Mid-Level: ₹9–12 LPA

Senior Roles: ₹15–20+ LPA

MBA Career Path

Roles (depending on specialization):

- Marketing/Brand Manager

- Strategy Consultant

- Product Manager

- Finance/Investment Analyst

- Operations Head

- HRBP/People Strategy Lead

- Management Trainee (MT) Programs

Sectors:

BFSI, Tech, FMCG, Startups, Consulting, E-commerce, Retail, Education, Healthcare

Average Salary in India

- Top B-Schools: ₹12–18+ LPA

- Tier 2/3 B-Schools: ₹6–8 LPA

CMA salaries are skill-driven; MBA salaries are brand-driven.

6️. Return on Investment (ROI)

The CMA (US) offers a quick ROI. With just 2 exams and a short duration, many candidates start earning within a year, often even before completing their degree. This makes it ideal for early career acceleration and landing roles in core finance.

An MBA’s ROI is variable. From a top B-school, it can open six-figure salary doors and even international opportunities. But from mid- or low-tier institutes, the returns may not justify the time and financial investment. Hence, the brand of the MBA institute plays a massive role in determining your success.

Final Verdict: Start with CMA, Then Do an MBA

If you’re still in college or recently passed Class 12, you’re not yet eligible for an MBA—but you can start CMA (US) right away.

And that’s exactly what makes CMA a smart first step

- You can pursue CMA alongside your graduation, build a solid technical foundation in finance, costing, and analytics, and become job-ready even before your degree ends.

- Once you’ve gained some work experience, you’ll be in a much stronger position—professionally, financially, and mentally—to pursue an MBA from a top B-school and move into management and leadership roles.

So the ideal roadmap is:

Step 1: Start CMA (US) during graduation →

Step 2: Get a job in core finance or a business role →

Step 3: Pursue an MBA to scale into leadership

This route gives you the best of both worlds: technical expertise early on, and strategic breadth later on.

You don’t have to choose between CMA and MBA—you can time them right for maximum career impact.