CFA® Course Classes in India – Trusted, Structured & Career-Focused

Build Real-world Skills in Investment Analysis & Portfolio Management

- 200K+ Charter Holders

- Students in 162+ Countries

- CFA Charter Holder Start Salary 10-15 LPA (INR)

CFA Program made simple, your free handbook awaits!

What is the CFA Program Course?

Become a stalwart in Investment Analysis and Portfolio Management

The Chartered Financial Analyst (CFA®) designation is the gold standard in investment management, recognized worldwide. With 200,000+ active Charterholders across 162+ countries, Ideal for investment professionals, portfolio managers, analysts, and financial advisors, the CFA charter also adds value to corporate finance, investment banking, and wealth management.

India has emerged as the largest market for Level 1 CFA Program candidates across the world. Checkout CFA Program Levels ->

📍Key Highlights: CFA Program

- Recognized in 162+ Countries - valued by employers in the USA, UK, Canada, India, Singapore & more.

- Master Core Finance Skills - Investment Analysis, Equity Research & Portfolio Management & more.

- Work at Top Companies - Big 4s & Fortune 500 firms like JP Morgan, UBS, BofA hire CFAs.

- Study with College or Work - pursue the CFA program with college or a full-time job.

- Smart Investment, High ROI - Spend ₹4.5-5L, earn upwards of ₹9-12LPA as a CFA Charterholder in India

📍Why become a CFA Charterholder?

- Global Finance Identity – It’s the gold standard in investment management.

- Doors Open, Globally – From investment banking to consulting - opportunities worldwide.

- Future-Proof Your Career – Gain skills that stay relevant in a fast-changing financial world.

- Showcase Your Edge – Earn a digital badge to boost your CV & stand out to employers.

- Serious Career Growth - CFA program isn't just a course—it’s a career accelerator.

CFA Program Paper Pattern

If you’re considering CFA Course classes in India, here’s how the exam structure progresses across all three levels, each with a computer-based exam.

Level 1

Multiple Choice Questions (MCQs)

Attempts: Feb, May, Aug, Nov

Pass Rate (10-year Avg.): 41%

Exam Topic Area Weight

Ethical & Professional Standards : 15-20%

Quantitative Methods : 6-9%

Economics : 6-9%

Financial Statement Analysis : 11-14%

Corporate Issuers : 6-9%

Equity investments : 11-14%

Fixed Income : 11-14%

Derivatives : 5-8%

Alternative Investments : 7-10%

Portfolio Management : 8-12%

Level 2

Vignette Supported with MCQs

Attempts: May, Aug, Nov

Pass Rate (10-year Avg.): 45%

Exam Topic Area Weight

Ethical & Professional Standards : 10-15%

Quantitative Methods : 5-10%

Economics : 5-10%

Financial Statement Analysis : 10-15%

Corporate Issuers : 5-10%

Equity investments : 10-15%

Fixed Income : 10-15%

Derivatives : 5-10%

Alternative Investments : 5-10%

Portfolio Management : 10-15%

Level 3

Vignette Supported Essay & MCQs

Attempts: Feb, Aug

Pass Rate (10-year Avg.): 52%

Exam Topic Area Weight

Ethical & Professional Standards : 10-15%

Derivatives & Risk Management: 10-15%

Portfolio Construction : 15-20%

Asset Allocation : 15-20%

Performance Measurement : 5-10%

Pathway A – Portfolio Management : 30-35%

Pathway B – Private Wealth : 30-35%

Pathway C – Private Markets : 30-35%

Exam Policy: Candidates can take each exam a maximum of twice per calendar year, with a minimum of six months between attempts.

Eligibility for the CFA Program Course

Here’s what drives thousands of Indian students to invest in their future!

- CFA Program Eligibility Criteria (earliest possible attempt for a 3 year graduate program)

- Level I: Register in Year 1 & Appear in Year 2

- Level II: Register in Year 2 & Appear in Year 3.

- Level III: Appear after Graduation.

📹Planning CFA in 2026? Start here.🔥

We are Synthesis Learning - Best CFA Course Classes In India

We're a House of Global Courses - trusted in 25+ cities in India

Why Students 💙 Us?

- 25+ Years of Legacy - Trusted by 20,000+ students across 25+ Indian cities and 10+ countries.

- End-to-End Support - From expert-led coaching to mentoring and 100% job assistance.

- Learn Your Way - Classroom & Live Online Sessions, choose what suits your schedule.

- Exam-Focused Training - Mock tests, personalized study plans & expert mentors to help you pass faster.

- Smart Learning with eCampus - Access lectures, notes, and tests anytime, anywhere.

Modes of Learning

CFA Classroom Coaching. Redefined.

- World Class Infrastructure

- Expert Tutors

- Hands on Learning

- Rigorous Assessments

- One on One Mentoring

- Revision & Doubt Solving Bootcamps

- Synthesis eCampus

- Systematic Student Progression

- 100% Placement Assistance

CFA Live Online Courses. Redefined.

- Live Study Lectures

- Expert Tutors

- Rigorous Assessments

- Regular Mentoring

- Revision & Doubt Solving Bootcamps

- Synthesis eCampus

- Revision Video Lectures

- 100% Placement Assistance

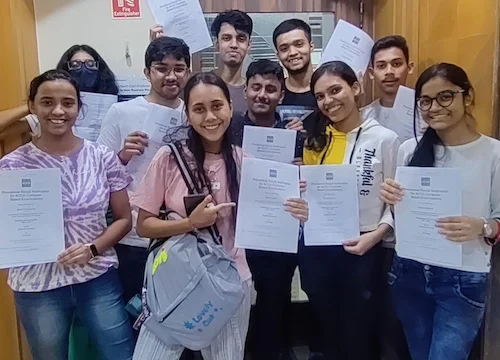

CFA Program Student Reviews at Synthesis Learning

Real CFA journeys. Real progress. Real outcomes.

Everything About the CFA Program, In One Place!

Curated video insights. No confusion. Just clarity.

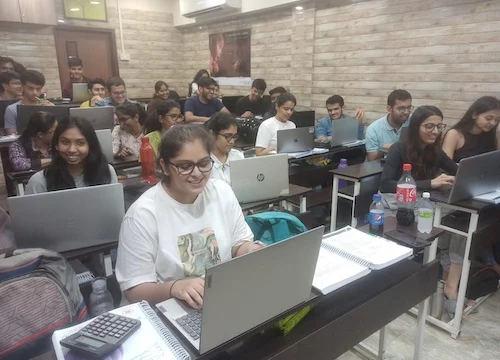

We're generally having Fun (while Learning)

Checkout some quick glimpses of all the memories we're creating at our offices and learning centres

CFA Program Jobs and Global Employers

Many leading financial institutions actively recruit CFA charter holders. These typically include Commercial Banks, NBFCs, Investment Banks, Private Equity Firms, Insurance Companies, Hedge Funds, Consulting Firms, Financial Advisory Firms, Corporate Finance Departments, Regulatory Agencies, Asset Management Companies, Wealth Management Firms and so on.

These companies trust CFAs with their future, do you?

Frequently Asked Questions

1. What is the CFA course duration?

The CFA course duration typically ranges from 2.5 to 3 years, depending on individual preparation and exam schedules.

2. What are the CFA course fees in India?

The CFA course fees in India range from ₹4.5 lakh to ₹5 lacs, including enrollment and exam registration fees.

3. What is included in the CFA course syllabus?

The CFA course syllabus covers ethical standards, investment tools, portfolio management, and advanced financial concepts across three levels.

4. Is there a CFA Level 1 online course available?

Yes, platforms like Synthesis Learning offer a comprehensive CFA Level 1 online course for flexible and effective preparation.

5. What are the career prospects after completing the CFA certification course?

The CFA certification course prepares candidates for roles like Portfolio Manager, Equity Analyst, and Investment Banker, offering global career opportunities.

6. What is the CFA course eligibility for Indian candidates?

3-year degree students can begin their preparation in the first year and appear for the CFA Program Level 1 exam in the second year.

7. How much time is required to prepare for each CFA level?

Candidates should dedicate approximately 300 hours per level to prepare effectively for the exams.

8. Are there additional costs involved in the CFA course fees and duration?

Yes, apart from the standard fees, candidates may incur costs for study materials, coaching classes, and rescheduling exams, which can influence the overall investment and timeline.

9. How is the CFA course structured?

10. Which certification is better: CFA or FRM?

11. How does the CFA course compare to an MBA in terms of career opportunities?

12. Can I pursue the CFA course and FRM certification simultaneously?

13. Which certification has a better global reach: CFA or MBA?

Read More

Advance Your Finance Career with CFA Course

The CFA course (Chartered Financial Analyst) is one of the most prestigious certifications in the world of finance, offered by the CFA Institute. Designed for professionals aspiring to excel in investment management, portfolio analysis, and financial strategy, the CFA certification course sets a global benchmark for expertise in finance.

This comprehensive program covers core financial concepts and emphasises ethical standards and real-world applications, ensuring candidates are equipped to meet the demands of the ever-evolving financial industry.

What is the CFA Course?

The CFA course is a globally recognised certification program that develops skills in investment analysis, wealth management, risk assessment, and portfolio optimisation. Offered by the CFA Institute, it is structured across three levels, each delving deeper into financial theories and practices.

The CFA certification course is particularly popular among those aiming to secure roles in investment banking, equity research, asset management, and corporate finance. If they are wondering what is CFA course, it’s your gateway to becoming a trusted finance professional.

Why Pursue the CFA Course Certification?

The CFA certification course has various benefits that make it a preferred choice for finance professionals globally. The CFA course in India has gained immense traction among finance professionals and students owing to several unique advantages:

Affordable Cost of Education

Compared to pursuing the CFA certification course from other countries, India offers a cost-effective route. Candidates save on ancillary expenses like relocation or higher tuition fees with access to coaching centers and online preparatory platforms. Finally the relative affordability of the CFA course fees in India makes it a viable option for aspirants.

Vibrant Financial Ecosystem

India hosts a thriving financial sector with numerous investment firms, banks, and consultancy firms. Pursuing the CFA course places candidates at the heart of India’s financial hub, offering internship and networking opportunities.

Entrance Exam Centers

Candidates can take the CFA exams in major Indian cities, ensuring convenience and reducing the need for international travel. Diverse preparatory resources, such as localized guides and online lectures tailored to Indian candidates, further simplify the process.

Growing Demand for CFA Charterholders

With the rise of investment advisory services, mutual funds, and fintech innovations, the demand for CFA-certified professionals is booming in India. The CFA certification course equips candidates to excel in such roles.

Who Should Pursue the CFA Course?

The Chartered Financial Analyst (CFA) programme isn’t for everyone, but if any of the profiles below sound familiar, it could be the ideal path for you.

Students Aiming to Enter Core Finance

Are you a B.Com or BBA student fascinated by financial markets but unsure how to start? The CFA programme builds a strong foundation in finance and opens doors to careers in investment banking, equity research, and portfolio management.

Professionals Seeking a Career Shift

If you’re currently in a sales or non-analytical role and wish to move into areas like risk management, asset management, or financial analysis. In that case, the CFA designation can help you make that transition confidently.

Graduates Looking to Enhance Their Existing Degrees

Already hold a degree in finance, economics, or engineering? The CFA qualification adds global recognition and technical depth, making your profile stand out in a competitive job market.

Professionals Aspiring to Join Top Finance Firms

Dream of working with firms like J.P. Morgan, Morgan Stanley, or BlackRock? These institutions value the CFA credential for its rigour and global credibility, often considering it a strong differentiator for high-level roles.

Professionals Who Want to Stay Financially Relevant

Finance evolves constantly. The CFA curriculum keeps you updated with the latest tools, valuation techniques, and industry trends—helping you remain relevant in a fast-changing landscape.

Ambitious Professionals Without an MBA

Not keen on investing two years and a hefty fee in an MBA? The CFA programme offers a respected, cost-effective, and flexible route to advance your career in finance.

Detailed Breakdown of the CFA Course Details

The CFA course details encompass everything from the program structure to its focus areas. The CFA course details outline a comprehensive framework that is divided into three levels:

|

CFA Level |

CFA Course Details |

|

CFA Level 1 |

Introduces the basics of investment tools, ethical standards, and foundational financial concepts. |

|

CFA Level 2 |

Builds on Level I by focusing on asset valuation, with a strong emphasis on application and analysis. |

|

CFA Level 3 |

Integrates all concepts, focusing on portfolio management and wealth planning in practical scenarios. |

Each level increases in complexity, requiring candidates to dedicate significant time and effort to master the curriculum. The CFA course details also highlight the significance of the rigorous exam process, ensuring candidates are well-prepared for high-level finance roles. With increasing demand for CFA charterholders in India, these CFA course details in India are crucial for understanding the commitment required to succeed.

CFA Course Syllabus

The CFA course syllabus is rigorous and comprehensive, ensuring candidates gain expertise across key financial domains. The CFA course syllabus covers the following topics:

Syllabus Of CFA Level 1

Focus: Lays the groundwork in financial tools, ethics, and quantitative analysis.

|

Subject |

Weightage |

|

Ethical and Professional Standards |

15% to 20% |

|

Quantitative Methods |

6% to 9% |

|

Economics |

6% to 9% |

|

Financial Statement Analysis |

11–14% |

|

Corporate Issuers |

6–9% |

|

Equity Investments |

11–14% |

|

Fixed Income |

11% to 14% |

|

Derivatives |

5–8% |

|

Alternative Investments |

7–10% |

|

Portfolio Management |

8–12%

|

Syllabus Of CFA Level 2

Focus: Application of concepts to real-world scenarios.

|

Topic |

Weightage |

|

Quantitative Methods |

5–10% |

|

Economics |

5–10% |

|

Financial Statement Analysis |

10–15% |

|

Corporate Issuers |

5–10% |

|

Equity Investments |

10–15% |

|

Fixed Income |

10–15% |

|

Derivatives |

5–10% |

|

Alternative Investments |

5–10% |

|

Portfolio Management |

10–15% |

|

Ethical and Professional Standards |

10–15% |

Syllabus Of CFA Level 3

Focus: Advanced portfolio management and wealth planning.

|

Topic |

Exam weight |

|

Asset Allocation |

15–20% |

|

Portfolio Construction |

15–20% |

|

Performance Measurement |

5–10% |

|

Derivatives and Risk Management |

10–15% |

|

Ethical and Professional Standards |

10–15% |

|

Pathways (Portfolio Management or Private Markets or Private Wealth) |

30–35% |

Each topic in the CFA course syllabus is weighted differently across the three levels, with Level 3 focusing heavily on portfolio management. The CFA course syllabus is designed to provide both theoretical knowledge and practical applications, making it relevant for real-world financial decision-making. Understanding the CFA course syllabus in India is crucial for students to tailor their study approach and excel at each level of the program.

CFA Course Eligibility

The CFA course eligibility requirements are simple, ensuring candidates have the academic and professional background to excel. These CFA course eligibility criteria help ensure that individuals are well-prepared to succeed in the demanding CFA program. Understanding the CFA course eligibility is essential for anyone looking to pursue the certification, as it sets clear expectations for potential candidates. Here is the CFA course eligibility criteria:

- Candidates must have a bachelor’s (or equivalent) degree, or their exam window must fall within 23 months of their graduation month.

- Candidates must agree to adhere to the CFA Institute’s Code of Ethics and Professional Standards.

|

Eligibility Criteria |

Details |

|

Educational Qualification |

Candidates must have a bachelor’s (or equivalent) degree, or their exam window must fall within 23 months of their graduation month. |

|

Work Experience |

At least 4,000 hours of relevant experience, completed in a minimum of 36 months. |

|

Ethical Standards |

Candidates must agree to adhere to the CFA Institute’s Code of Ethics and Professional Standards. |

The CFA course eligibility in India aligns with these global standards, making it accessible for Indian candidates.

CFA Exam Pattern & Important Details

The CFA exam is designed to challenge even the most determined finance professionals. It tests not only your technical knowledge but also your ability to apply concepts in real-world scenarios. Understanding the exam structure and key details beforehand can help you plan your preparation more strategically and improve your chances of success.

CFA Exam Pattern of Each Level

|

Level |

CFA Exam Focus |

CFA Exam Format |

CFA Exam Duration |

Our Advise |

|

CFA Level 1 |

Basics of finance and investment |

180 Multiple-Choice Questions |

Two sessions of 2 hours, 15 mins each |

The students are recommended to take the help of the CFA Institute Learning Ecosystem (LES) and take online mock tests. All questions are, by default, based on the International Financial Reporting Standards (IFRS). However, the students should still learn about US GAAP. When the questions are based on US GAAP, they will be mentioned specifically. |

|

CFA Level 2 |

Application of concepts |

88 Item Set Questions (mini case studies) |

Two sessions of 2 hours, 12 mins each |

Here too, the students are recommended to take mock tests to get familiar with the exam’s format. Students who have cleared this exam have reported studying for at least 300 hours. |

|

CFA Level 3 |

Portfolio and wealth management |

11 Essay Questions & 11 Item Set Questions |

Two sessions of 2 hours, 12 mins |

The number of item sets and essay questions will be 5 or 6. It has a vignette form of questions along with MCQs. A word of caution for future exam takers, ensure to be mindful of the time you allocate to the exams in this level. |

Important Dates for the CFA Exam

The CFA exams are held multiple times a year, giving candidates flexibility in planning their attempt. Level 1 exams are conducted four times annually, while Levels 2 are conducted 3 times and Level 3 are offered twice a year.

Exam Schedule:

Level I: February, May, August, and November

Level II: May, August, November

Level III: Feb and August

Our Tip: Register early to take advantage of lower exam fees and to secure your preferred exam centre.

CFA Course Fees

The CFA course fees include several components, making it essential for candidates to plan their budget effectively:

|

2025 CFA Program pricing |

2026 CFA Program pricing |

|

|

New Level I enrollment fee |

USD 350 |

USD 0 |

|

Level I early-bird Level I standard |

USD 990 USD 1,290 |

USD 1,140 USD 1,490 |

|

Level II early-bird Level II standard |

USD 990 USD 1,290 |

USD 1,140 USD 1,490 |

|

Level III early-bird Level III standard |

USD 1,090 USD 1,390 |

USD 1,240 USD 1,590 |

The total CFA course fees in India vary depending on exchange rates and registration periods. Candidates are encouraged to register early to save on costs.

CFA Course Duration

The CFA course duration is flexible, allowing candidates to progress at their own pace. On average, completing all three levels takes about 2.5 to 4 years.

Each level requires approximately 300 hours of dedicated study, making time management crucial for success. Candidates should consider their professional and personal commitments while planning their study schedule.

Candidates should carefully consider their professional and personal commitments while planning their study schedule to make the most of the CFA course duration. It’s essential to maintain a consistent study routine, as the CFA course duration can vary depending on the time allocated for each level.

Duration to Complete the CFA Course

The CFA course demands consistent effort and preparation across all three levels. Here’s a breakdown of the average time required for each stage:

|

CFA Level |

Average Preparation Time |

Exam Frequency |

Approximate Completion Time |

|

Level 1 |

~300 hours |

4 times a year (Feb, May, Aug, Nov) |

8-10 months |

|

Level 2 |

~350 hours |

3 times a year (May, Aug, Nov) |

8-10 months |

|

Level 3 |

~400 hours |

2 times a year (Feb, Aug) |

8-10 months |

Strategies to Excel in CFA Exams

Succeeding in the CFA course requires meticulous planning. Here’s how to ensure your success:

Time Management

With the average candidate dedicating 300+ hours to each level, creating a structured study plan is essential. Allocate sufficient time for challenging topics like derivatives, fixed income and portfolio management.

Understanding the Curriculum

Focus on the CFA course structure, understanding the emphasis on ethics, quantitative methods, and portfolio management. The curriculum builds cumulatively, so mastering concepts at CFA Level I is critical.

Mock Exams and Feedback

Practice with mock tests tailored to CFA exam formats. Analyze your performance to identify weak areas and focus on improving them.

Stay Updated with Financial Trends

The CFA certification course emphasizes real-world application. Staying informed about global market trends enhances your ability to answer questions rooted in practical scenarios.

Leverage Online Resources

The CFA Level 1 online course offers tools like video tutorials, digital guides, and interactive quizzes. Utilize these resources for accessible and efficient learning.

CFA Online Course

The CFA online course offers unparalleled flexibility for professionals balancing work and studies. These courses provide:

Comprehensive Study Materials: Covering the entire CFA course syllabus.

Interactive Sessions: Engaging video lectures and live Q&A sessions.

Mock Tests: To simulate the exam environment and identify areas for improvement.

Synthesis Learning offers a robust CFA Level 1 online course, ensuring candidates are well-prepared for their certification journey.

CFA Course in India

The CFA course in India is increasingly popular due to its global recognition and the growing demand for skilled finance professionals. Major cities host exam centres, making it convenient for candidates. The CFA course details in India benefit students with a wide range of prep resources and coaching options tailored to help them succeed.

Career Opportunities with the CFA Course Certification

The CFA certification course opens doors to prestigious roles, including:

– Portfolio Manager

– Equity Research Analyst

– Investment Banker

– Risk Consultant

– Wealth Manager

These roles are in high demand across global financial hubs, ensuring lucrative career opportunities for CFA charterholders.

Emerging Trends Impacting CFA Career Opportunities

The CFA certification course adapts to evolving financial landscapes, preparing candidates for emerging trends such as:

Fintech Innovations

Roles integrating blockchain, AI in trading, and robo-advisory services are in demand. The CFA course syllabus now includes fintech applications, ensuring candidates remain relevant.

Sustainability and ESG Investing

With increased focus on environmental, social, and governance (ESG) factors, CFA charterholders are uniquely positioned to lead sustainable investing strategies.

Globalization of Financial Markets

The CFA course structure trains professionals to manage international portfolios, addressing cross-border investment challenges.

Data-Driven Decision Making

Emphasis on quantitative methods ensures charterholders can interpret big data for strategic financial decisions.

Cost of CFA at Each Level

Pursuing the CFA designation involves several expenses beyond just the exam fees. In addition to the fees paid to the CFA Institute, candidates should also account for costs related to coaching, study materials, and approved calculators. Having a clear understanding of these expenses helps in effective financial planning for the entire journey.

|

2025 CFA Program pricing |

2026 CFA Program pricing |

|

|

New Level I enrollment fee |

USD 350 |

USD 0 |

|

Level I early-bird Level I standard |

USD 990 USD 1,290 |

USD 1,140 USD 1,490 |

|

Level II early-bird Level II standard |

USD 990 USD 1,290 |

USD 1,140 USD 1,490 |

|

Level III early-bird Level III standard |

USD 1,090 USD 1,390 |

USD 1,240 USD 1,590 |

Comparative Analysis: CFA Course vs. Other Certifications

When evaluating different paths in finance, understanding the distinction between the CFA course, MBA in Finance, and FRM certification is crucial for aspirants to make informed decisions.

Focus

The CFA course primarily centers on investment management and upholds high ethical standards. It equips candidates for roles like portfolio management and equity research.

In contrast, an MBA in Finance takes a broader approach, covering general management and corporate finance, preparing candidates for leadership roles across industries.

Meanwhile, the FRM (Financial Risk Manager) certification specializes in risk management, focusing on market, credit, and operational risks.

Global Recognition

The CFA certification course enjoys high global recognition, particularly in investment management and financial analysis, with employers worldwide valuing its credibility.

An MBA’s global reputation varies depending on the institution; top-tier B-schools enjoy international prestige, while others may not.

The FRM certification is niche but well-regarded in risk management and sought after by financial institutions.

Duration

Completing the CFA course typically requires 2.5 to 3 years, depending on how quickly candidates clear the three levels. An MBA in Finance is shorter, usually 1 to 2 years for full-time programs, but securing admission to the best colleges can be challenging. It often takes another year to prepare for the CAT exam, a key entrance requirement.

The FRM certification has a comparable timeline of around 1 to 2 years, depending on the candidate’s pace and exam success.

CFA Coaching in India to Elevate Your Success

Finding the right CFA coaching is key to mastering the CFA curriculum and achieving certification. With structured training, expert guidance, and strategic study plans, well-established CFA coaching in India helps candidates build a strong foundation in investment management.

At Synthesis Learning, we provide one of the best CFA coaching in India, offering industry-aligned training, expert faculty, and flexible learning options. As one of the best coaching institutes for CFA in India, we ensure comprehensive study support with high-quality resources and mentorship. Whether through classroom sessions or online learning, our programs cater to students and professionals, making us a trusted choice for the best coaching for CFA in India.

How to Select the Best CFA Course Prep Provider?

Choosing the right CFA course preparation platform is crucial for success. Here are key factors to consider:

Comprehensive Syllabus Coverage

Ensure the coaching provider covers all aspects of the CFA course syllabus, emphasizing practical applications and exam patterns. CFA classes will also guide students in aligning study efforts with CFA Institute guidelines.

Flexible Learning Formats

Professionals balancing jobs benefit from a CFA online course that provides flexibility without compromising the quality of learning. Look for providers of CFA online classes offering recorded lectures, live Q&A sessions, and mobile-friendly materials.

Reputation and Results

Opt for CFA classes with a proven track record of high pass rates in the CFA exams. Reviews and testimonials from former students can provide insight into teaching quality.

Mock Tests and Assessment Tools

Regular practice is key to mastering the CFA certification course. Choose platforms offering multiple mock tests that simulate the exam environment and detailed feedback.

Support for Career Development

Some providers, like Synthesis Learning, prepare candidates for exams and assist with placement in high-demand roles, ensuring a smooth transition into the workforce.

How Your CFA Prep Provider Should Measure Up

While the selection criteria are key, seeing how a provider delivers on them is what matters. Choosing the right CFA prep partner can make a significant difference in your exam performance and career growth. The right provider not only teaches concepts but also ensures you gain confidence through practice, support, and real-world insights. Here’s a checklist to compare your options:

|

Key Selection Factor |

What to Look For |

How Synthesis Learning Delivers |

|

Syllabus Coverage |

A complete CFA online course that mirrors the official CFA Institute curriculum and exam format. |

Our CFA Level 1, 2, and 3 online classes are meticulously structured for 100% syllabus coverage with a focus on practical application. |

|

Learning Flexibility |

CFA online classes that offer live sessions, recorded lectures, and mobile access for studying on-the-go. |

We provide flexible formats: live CFA online coaching, self-paced courses, and accessible materials for every level. |

|

Proven Track Record |

Consistently high pass rates and positive testimonials from alumni of all CFA level online course programs. |

We are proud of our industry-leading pass rates and the success stories from our CFA Level 1, 2, and 3 online coaching students. |

|

Practice & Assessment |

An extensive bank of mock exams and performance analytics, crucial for any CFA certification course. |

Our platform includes mock tests for each level, providing a real-time simulation of the exam environment. |

|

Career Support |

A provider that goes beyond the exam to offer placement assistance and career guidance. |

Our unique value includes dedicated placement support to help you transition into high-demand finance roles. |

Why Synthesis Learning is Your Partner to Ace the CFA Course

Synthesis Learning is a trusted name for CFA preparation, offering tailored solutions to help aspirants succeed. Here’s why we are your ideal partner:

Expert Tutors: Our faculty comprises experienced finance professionals who simplify complex topics and provide practical insights.

Comprehensive Resources: Access detailed study materials, mock tests, and the latest tools aligned with the CFA course syllabus.

Flexible Learning Modes: We offer classroom coaching, live CFA online classes across India, and self-paced courses for working professionals.

Proven Results: With an impressive track record, our students consistently achieve high pass rates in CFA exams.

Placement Support: We provide career guidance and placement assistance, ensuring you land lucrative roles post-certification.

Conclusion

The CFA course is your gateway to a successful investment management, financial analysis, and portfolio management career. With a comprehensive curriculum, global recognition, and emphasis on ethical practices, the CFA certification course equips you with the expertise needed to excel in the financial industry. Whether you choose the CFA course in India or opt for flexible learning options like the CFA Level 1 online course, this program opens doors to prestigious roles and unparalleled opportunities. With the right preparation and support, such as that offered by Synthesis Learning, you can achieve your goals and advance your career in finance.

FAQ’s

1. Can CFA course be done after 12th?

Candidates must have a bachelor’s (or equivalent) degree, or their exam window must fall within 23 months of their graduation month..

2. Can I do CFA course along with BCom/BBA or other graduation?

Yes, you can pursue the CFA course along with your BCom, BBA, or any other graduation degree. In fact, many students begin Level 1 during their 2nd year to save time and gain an early advantage in their finance careers.

3. Can the CFA course be done with a job?

Yes, working professionals can pursue the CFA course while continuing their job. The program is flexible and self-paced, allowing candidates to balance work and study effectively. Many professionals use CFA to enhance their financial expertise and career growth.

4. Can I do the CFA course along with or after engineering?

Engineering graduates or students can pursue the CFA course either alongside or after completing their degree. The CFA program welcomes candidates from all academic backgrounds, and engineers often perform well due to their strong analytical and quantitative skills.

5. What are the CFA course fees at Synthesis Learning?

At Synthesis Learning, the CFA course fees are structured to be transparent and affordable. The total CFA course fees are approximately 4.5 lakhs.

6. Why choose Synthesis Learning for CFA coaching ?

Synthesis Learning offers one of the most comprehensive programs for CFA coaching, led by experienced CFA charterholders and finance professionals. Their result-driven approach, doubt-solving sessions, and mock tests help students build both confidence and exam readiness.

7. Are there flexible CFA classes for working professionals at Synthesis Learning?

Yes, Synthesis Learning provides weekday, weekend, and online CFA classes to suit diverse schedules. These flexible options are ideal for students and professionals managing work or college alongside CFA preparation.

8. How does the CFA course in India through Synthesis Learning add value?

The CFA course in India offered by Synthesis Learning gives students a globally recognised qualification and practical finance exposure. It opens doors to careers in investment banking, portfolio management, and equity research.

9. What is the total CFA course fee, including coaching and materials?

The overall CFA course fees through Synthesis Learning, including training, mock exams, and study materials, range between INR 4.5 to 5 lakhs for all levels. Candidates also receive end-to-end support for CFA registration and preparation.

10. What makes Synthesis Learning’s CFA coaching stand out?

Synthesis Learning’s CFA coaching focuses on conceptual clarity and exam-oriented training. With small batches, interactive sessions, and experienced mentors, students receive personalised guidance throughout their CFA journey.

11. Does Synthesis Learning offer online CFA classes?

Yes, Synthesis Learning offers both classroom and online CFA classes, providing flexibility for students across different locations. The online platform includes live lectures, recorded sessions, and digital resources for convenient learning.

12. Is the CFA course in India through Synthesis Learning globally recognised?

The CFA course in India through Synthesis Learning follows the same global curriculum approved by the CFA Institute. Earning this qualification enhances your global career prospects and strengthens your profile in the finance industry.