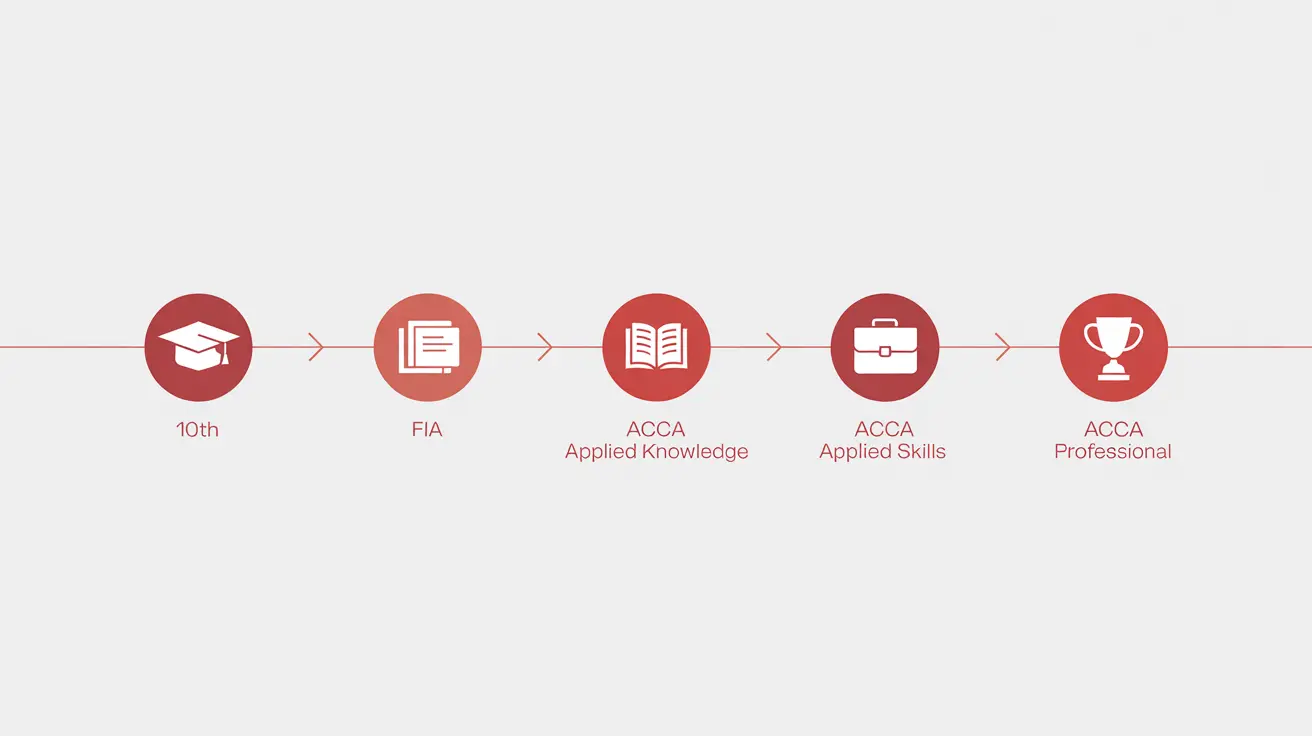

Can You Do ACCA After 10th? A Complete Guide to Eligibility, FIA Route & Career Path

If you’re exploring ACCA after 10th, you’re already thinking ahead—and that’s a good thing. Many students today start researching global career options early, especially in finance, accounting, and business. ACCA often comes up in these conversations because of its international recognition and flexible structure.

The key thing to understand is this: ACCA is a structured qualification with multiple entry points, and students after 10th can begin aligning themselves with the ACCA pathway through the right foundation and planning. When approached correctly, this early awareness can give students clarity, confidence, and a smoother transition into professional education later on.

This guide explains how ACCA fits into a student’s journey after 10th, what pathways exist, and how Indian students can plan their next steps realistically.

What Is ACCA?

Association of Chartered Certified Accountants (ACCA) is a globally recognised professional accounting body founded in the UK. The ACCA Course is designed to develop well-rounded finance professionals with strong grounding in accounting, audit, taxation, financial management, and business strategy.

Some important features of ACCA:

- Recognised across 170+ countries

- Curriculum aligned with International Financial Reporting Standards (IFRS)

- Computer-based exams with flexible exam windows

- Strong focus on practical application and professional skills

The full ACCA qualification consists of 13 exams, an ethics module, and relevant practical experience. Because it is a professional qualification, entry depends on a student’s academic stage this is where students after 10th need clarity.

Why ACCA After 10th Is a Smart Career Move

Thinking about ACCA after 10th doesn’t mean starting everything immediately. It means starting with awareness and preparation.

Here’s why many students explore ACCA after 10th:

Early career clarity:

Students understand whether finance and accounting genuinely interest them. This awareness helps learners avoid unsuitable paths and make informed academic decisions sooner. Choosing ACCA after 10th gives early exposure and supports purposeful planning during crucial education years.

Skill-oriented mindset:

ACCA encourages analytical thinking and business understanding early on. Students begin developing problem-solving abilities that align closely with real-world professional demands. This structured learning builds practical competence alongside theory, preparing learners for workplace expectations.

Global perspective:

Exposure to international accounting frameworks from a young age. Students become familiar with global standards, improving adaptability across diverse professional environments. Opting for ACCA after 10th strengthens cross-border career prospects and supports international mobility ambitions.

Flexible structure:

ACCA allows students to progress step-by-step rather than through rigid group systems. Learners advance at their own pace, balancing studies effectively with school or college commitments. This flexibility reduces academic pressure and supports consistent progress without unnecessary time constraints.

Confidence advantage:

Students who plan early often feel more in control of their academic choices. Clear direction builds self-belief and reduces anxiety during key educational decision-making stages. This confidence positively influences performance, motivation, and long-term career commitment.

Can You Start ACCA After 10th? Eligibility Explained

ACCA is designed to be entered at different academic stages. For students who have completed Class 10, the ACCA journey typically begins through a foundation-level pathway rather than the main qualification itself.

In practical terms:

- Students usually enter the core ACCA qualification after completing Class 12

- Students after 10th can start through ACCA’s Foundation in Accountancy (FIA) route, which builds the required base before moving ahead

This structure ensures that students develop the right academic foundation before progressing into advanced professional subjects—making the journey more manageable and meaningful.

ACCA Foundation Diploma (FIA): An Entry Path After 10th

The Foundation in Accountancy (FIA) is an official ACCA-designed programme for students who are not yet eligible for the main ACCA qualification.

What is FIA?

- A foundation-level qualification

- Suitable for students after 10th, including those without a commerce background

- Acts as a bridge into the ACCA Course

FIA Structure at a Glance

|

Level |

Focus Areas |

Outcome |

| Introductory | Business basics & accounting fundamentals | Conceptual clarity |

| Intermediate | Financial & management accounting | Core technical skills |

| Diploma Level | Applied accounting & business concepts | Progression to ACCA |

Once students complete the relevant FIA components, they can move into ACCA Applied Knowledge, aligning them with the main ACCA pathway.

For students considering ACCA after 10th, FIA provides structure but timing and pacing should be planned alongside school studies.

Steps to Start ACCA After 10th (India-Specific Path)

Here’s how most Indian students approach acca after 10th in a balanced and sustainable way:

Build Awareness

Understand ACCA’s structure, subjects, and career outcomes. This stage is about clarity, not pressure.

Choose the Right Stream in 11th–12th

Commerce with Accounts is helpful. Advanced Maths is not mandatory, but basic numerical comfort is important.

Decide on Foundation Timing

Some students start FIA during school years; others focus on boards first and begin later. Both approaches are valid.

Balance Academics and Professional Prep

School performance still matters. ACCA success depends on consistency, not speed.

Progress into ACCA After 12th

Once eligible, students formally register and begin ACCA Applied Knowledge and Skills papers.

This step-by-step progression allows students to stay ahead without feeling overwhelmed.

Check our detailed blog on ACCA after 12th for more info

Career Opportunities After ACCA

ACCA opens doors to a wide range of finance and accounting roles in India and internationally.

Common roles include:

- Financial Accountant

- Management Accountant

- Audit & Assurance Associate

- Tax Consultant

- FP&A Analyst

- Finance Manager

In the Indian context, earning potential typically progresses with qualification status and experience:

- ACCA Affiliate (early career): approximately ₹6–8 LPA

- ACCA Member (post experience): approximately ₹8–10 LPA

These are average industry ranges, and actual compensation depends on role, organisation, location, and individual skill sets. ACCA’s strength lies in its long-term global mobility and career flexibility.

Synthesis Learning: A Long-Term Partner for Your ACCA Journey

Synthesis Learning has spent over 25 years shaping global finance professionals, and that long-term view reflects strongly in how students are guided especially those who start exploring ACCA early, even after 10th.

What sets Synthesis Learning apart is not just exam coaching, but how early-stage students are prepared for the full professional journey from understanding ACCA as a qualification to eventually entering the corporate world with confidence.

A few aspects that matter particularly for students planning ACCA early:

Platinum Approved Learning Partner status

This is ACCA’s highest recognition for quality, outcomes, and student success earned through consistent performance and strong academic systems.

Real-world exposure through an in-house ACCA Approved Employer

Students benefit from first preference for internships and job opportunities at InCorp Advisory (Ascentium Group), giving them an edge that goes beyond classroom learning.

Mentorship-led preparation, not just teaching

With 1-on-1 mentoring, paper planning, and structured doubt-solving, students are guided on when and how to attempt exams—an important advantage for those starting young.

Faculty with global results

Tutors at Synthesis Learning have coached multiple global and India rankers, including World Rank 1, bringing exam insight and practical clarity into everyday learning.

Career readiness through the Campus-to-Corporate approach

Alongside ACCA preparation, students are gradually equipped with workplace skills, interview readiness, and professional exposure bridging the gap between qualification and career.

For students exploring ACCA after 10th, this ecosystem ensures that decisions are well-timed, well-informed, and aligned with long-term career outcomes, rather than driven by pressure or incomplete information.

Conclusion

Exploring ACCA after 10th is less about starting everything immediately and more about making thoughtful, well-informed choices. ACCA offers a clear structure that helps students build strong foundations early, gain clarity before committing fully, and progress steadily into a globally respected qualification. A student may begin through a foundation pathway or plan ACCA after 12th, but the real advantage comes from informed planning rather than rushed decisions. With the right guidance and balanced pacing, ACCA can become a strong pillar in a student’s long-term career journey.

At Synthesis Learning, students also have the option to explore structured coaching for the following:

FAQs:

1. Can students after 10th begin the ACCA pathway?

Yes, students can begin ACCA after 10th through the foundation-level route. This allows them to plan a structured progression into the main ACCA qualification.

2. Is FIA mandatory for students after 10th?

FIA is the recognised entry route for students choosing ACCA after 10th without completing Class 12. It helps build foundational knowledge before moving to higher ACCA levels.

3. Is ACCA suitable for all students after 10th?

ACCA suits students interested in accounting, finance, and business careers. Career interest and aptitude matter more than simply starting ACCA after 10th.

4. Does starting early make ACCA easier?

Starting ACCA after 10th with clear planning helps students adapt better to professional-level studies. Early exposure also builds confidence and academic discipline over time.