ACCA Syllabus 2025: A Complete Study Guide

Are you ready to hop on the bandwagon and join one of the highest-paying qualifications globally: ACCA? The Synthesis Learning team congratulates you on this great decision. The ACCA has developed a robust framework to cultivate strategic thinking, and ethically minded, and knowledgeable financial professionals worldwide. But we have a comprehensive guide if you are wondering where to start with the ACCA course subjects and what the ACCA syllabus will be in 2025.

To know the ACCA Qualification updates, check out the video below:

Table of Contents

Introduction To ACCA

The first thing you should be aware of at this stage is, what is ACCA? To briefly describe it, established in 1904, the Association of Chartered Certified Accountants (ACCA) is a global leader in professional accounting. The ACCA offers the prestigious Chartered Certified Accountant qualification to 240,952 current members and 541,930 aspiring members worldwide. Thus, the joining criteria for such an outstanding course need to be understood deeply, and accordingly, you can opt for the best options to take the ACCA Qualification course.

ACCA Course Details

The ACCA course details provide a pathway to one of the world’s most prestigious qualifications in accounting and finance. With the ACCA course details, candidates will learn essential skills, build financial expertise, and develop strategic insight required to succeed globally. This guide highlights critical ACCA course details, ensuring that aspirants are prepared for a fulfilling career.

ACCA Eligibility Criteria

The first step to joining the ACCA course is, of course, registration! To register for the ACCA qualification, you must have:

Standard Entry:

- Complete your 10+2 examinations.

- Achieve at least 65% in Mathematics/Accounts and English.

- Secure a minimum of 50% in other subjects.

Alternative Entry via Foundation in Accountancy (FIA):

- Applicable if you have completed class 10 or must meet the standard entry requirements.

- It allows you to start with the FIA route to progress towards the ACCA qualification.

ACCA Course Structure

The ACCA course structure is carefully designed to promote comprehensive skill-building in finance, ethics, and business management. With three distinct levels, the ACCA course structure allows students to progressively develop expertise, preparing them for complex financial roles. The ACCA course structure equips candidates with a deep understanding of theory and practical applications.

ACCA Courses List

The ACCA courses list is a comprehensive guide to all modules within the ACCA qualification, helping candidates understand each area of focus. By following the ACCA courses list, students can plan their studies and prepare efficiently for their exams.

ACCA Exam Syllabus

The ACCA exam syllabus outlines the topics assessed at each stage of the ACCA qualification. Covering a blend of theory and practical knowledge, the ACCA exam syllabus prepares students for both the foundational and advanced requirements of a finance career.

Unveiling the ACCA Syllabus: A Detailed Guide

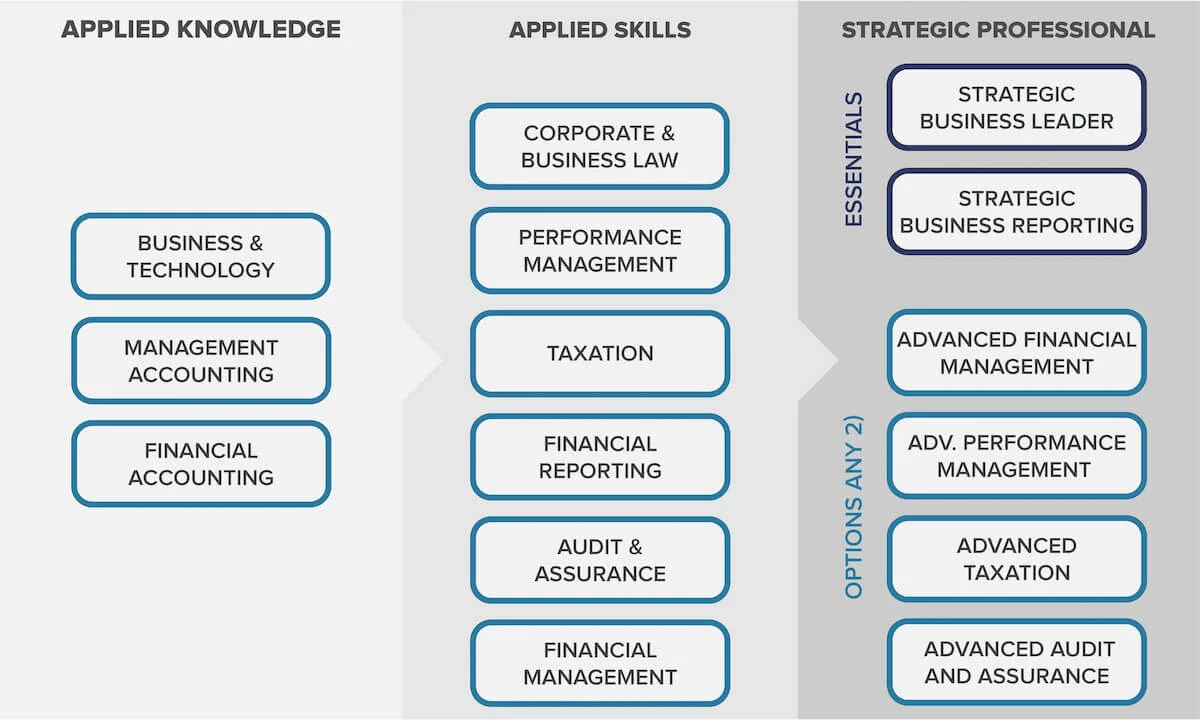

The ACCA syllabus consists of three levels: the Knowledge level, Skills level, and professional level. You will grasp accounting, business, and ethics principles through these thorough levels. These Levels comprise two sections with nine exam modules, which you can read below :

ACCA Syllabus Structure

The ACCA syllabus structure is organised into three levels—Knowledge, Skills, and Professional—each building on the last to provide a well-rounded education in accounting, finance, and business management.

Knowledge Level

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

Skill Level includes

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit and Assurance (AA)

- Financial Management (FM)

Please Note: According to the latest updates in ACCA qualification, if you are an undergraduate or graduate, you can enrol in an accredited BCom program or its variants from a state or central university and can get up to 5 exemptions (BT, MA, FA, LW & TX) after submitting your 1st Semester Marksheet.

Knowledge Level

If you are curious to know what exactly is included in the knowledge level, the Applied Knowledge Level exams provide a comprehensive introduction to accounting and finance. The ACCA syllabus helps you develop a fundamental understanding of accounting practices and methods. The foundational knowledge you gain at this stage will prepare you for more advanced subjects.

This level of Applied Knowledge examination contains 100% obligatory questions that help you cover the full spectrum of each ACCA course syllabus. During this phase, you will prepare for the intricacies of finance, from corporate and business law to performance management.

ACCA Subjects List

The ACCA subjects list provides candidates with a structured roadmap through foundational and advanced topics. At each level, candidates encounter a mix of subjects designed to develop core competencies. The ACCA subjects list helps students understand each topic’s relevance, preparing them to meet the demands of finance roles globally.

ACCA Subjects List Under Knowledge Level

The ACCA subjects provide essential knowledge and skills across key areas in finance, accounting, and business. With modules like Business and Technology, Management Accounting, and Financial Reporting, ACCA subjects build a foundation in business operations, while advanced topics such as Taxation, Financial Management, and Audit offer specialized expertise, preparing candidates for a successful career in global finance.

Please read the ACCA papers list here:

Business and Technology (BT)

Business and Technology teach how businesses operate effectively, efficiently, and ethically, showcasing finance professionals’ critical role. You’ll understand business in the context of its environment with the economic, legal, and regulatory influences on aspects like governance, employment, health and safety, data protection, and security.

Management Accounting (MA)

Acquire skills in management accounting to effectively support businesses in planning, controlling, and monitoring performance. Here, you will explore diverse financial management strategies to optimise business performance.

Financial Accounting (FA)

Learn the underlying principles and concepts of financial accounting, accounting techniques, and the preparation of basic financial statements. Demonstrate technical proficiency in double-entry techniques. This will include preparing and interpreting basic financial statements for sole traders, partnerships, companies, and simple groups of companies.

Skills Level

Skills Level exam modules or papers build upon the knowledge gained during the previous level. They help you understand applications, develop a solid financial understanding, and develop the ability to be a business and finance professional across industries or sectors globally.

ACCA Subject List Under Skill Level:

Please read the ACCA papers list here:

Corporate and Business Law (LW)

You will gain proficiency in understanding general legal frameworks and specific business-related legal areas. You will also master the importance of seeking specialised legal advice as needed.

Performance Management (PM)

With this exam, you will master management accounting techniques, seamlessly integrating quantitative and qualitative information. These will help you plan better, enhance your decision-making skills, build more robust performance evaluations, and take control whenever required.

Taxation (TX)

You’ll develop knowledge and skills related to the tax system as it applies to individuals, single companies, and groups of companies.

Financial Reporting (FR)

Gain proficiency in understanding accounting standards and theoretical frameworks. Learn how to effectively prepare financial statements for entities, including groups, and master the analysis and interpretation of these statements.

Audit and Assurance (AA)

You’ll develop knowledge and understanding of the assurance engagement process and its application in the professional regulatory framework.

Financial Management (FM)

Develop the knowledge and skills expected of a finance manager with investment, financing, and dividend policy decisions.

Professional Level

Now, let us understand what’s in store for you at the Professional Level of the ACCA course structure! The professional level in the ACCA course syllabus includes two main categories: Essentials and Options. This module closely mirrors the structure of post-graduation degrees and focuses on augmenting your technical skills. It also provides exposure to advanced professional skills, values, and techniques by professional accountants with advisory roles at a senior executive level.

To excel in leadership roles, you need more than the foundational knowledge provided by the Knowledge & Skill Level modules. With a well-designed curriculum, the Strategic Professional Level exams prepare you for future leadership positions by enhancing your technical, ethical, and professional skills. This level in the ACCA course structure includes six papers, two being compulsory and four optional. Students select specialisations from FM, PM, TX, and AA that align with their career goals.

Essential Papers

Strategic Business Leader (SBL)

You will demonstrate your technical, ethical, and professional skills in evaluating, synthesising, and presenting a case study.

Strategic Business Reporting (SBR)

This program elevates reporting to a new level. You will gain the skills needed to confidently speak the language of business and explain reports to various stakeholders.

Optional Papers (any 2)

Advanced Financial Management (AFM):

Develops advanced skills in financial management, including investment decision-making, risk management, and strategic financing options.

Advanced Performance Management (APM):

It focuses on advanced performance management techniques and strategies, making it ideal for management accounting, performance optimisation, and consultancy roles.

Advanced Taxation (ATX):

It covers complex taxation issues, corporate tax planning, international taxation, and the tax implications of business decisions. It is suitable for roles in tax advisory and senior compliance.

Advanced Audit and Assurance (AAA):

Deals with high-level auditing practices, including strategic analysis and critical auditing standards within a global framework.

EPSM Module

After clearing modules at both levels, you must dedicate 20 hours to the Ethics and Professional Skills Module (EPSM). This module in the ACCA course syllabus, featuring case studies and exposure to real-world business situations, aims to enhance the trustworthiness and credibility of ACCA candidates.

Sequentially attempt the exam modules, starting with Applied Knowledge, progressing to Applied Skills, and concluding with the Strategic Professional modules. The Ethics and Professional Skills Module becomes available after completing the Applied Knowledge exams.

ACCA Exam Pattern

The ACCA exam pattern is structured to assess both theoretical knowledge and practical skills through three progressive levels. This ACCA exam pattern ensures that candidates receive comprehensive preparation for a global finance and accounting career. By following the ACCA exam pattern, students can build a solid foundation and advance effectively in their professional journey.

Three Levels of Exams:

The ACCA course syllabus is structured into three levels: Knowledge, Skills, and Professional. Each level must be completed sequentially, building your knowledge progressively.

Computer-Based

All ACCA exams are conducted in a computer-based format. This applies to every level, including Knowledge, Skills, and Professional levels, ensuring a consistent and modern approach to assessment across the entire qualification spectrum.

Objective and Subjective Questions:

The exams include a mix of multiple-choice questions (MCQs), objective test questions (OTQs), and longer, written questions that require detailed answers, particularly at the Professional level.

Four Exam Sessions Per Year:

ACCA offers four exam sessions annually—March, June, September, and December—allowing students to plan their studies and exams flexibly.

Pass Marks:

A minimum score of 50% is required to pass each exam. This consistent pass mark applies across all levels and exams within the ACCA course.

Strategic Professional Level Exams:

At the Strategic Professional level, students must complete two compulsory exams—Strategic Business Leader (SBL) and Strategic Business Reporting (SBR)—along with two optional exams from a choice of four, such as Advanced Financial Management (AFM) and Advanced Audit & Assurance (AAA).

Ethics and Professional Skills Module (EPSM):

Before attempting the Strategic Professional exams, students must complete the Ethics and Professional Skills Module (EPSM), which is crucial for developing the skills required at this advanced level.

ACCA Subjects After CA

A Chartered Accountant (CA) can claim 9 paper exemptions out of 13 ACCA exams and directly take the professional-level ACCA exams. These include:

Essentials ACCA Subjects:

- Strategic Business Leader (SBL)

- Strategic Business Reporting (SBR)

Optionals ACCA Subjects:

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

To get ACCA certification, CAs need to pass the professional level: 2 Essentials and 2 Optionals.

Excel ACCA Syllabus With Synthesis Learning

At Synthesis Learning, we pride ourselves on the best ACCA coaching to learn the ACCA syllabus with our innovative approach to education. We’ve designed a precise four-step process to ensure that our ACCA students not only master the syllabus but also excel in their professional careers. Here’s how we do it:

Counselling:

We start with personalised sessions to understand your career goals and educational needs.

Mentoring:

You’ll receive guidance from experienced professionals who’ve been where you want to go.

Coaching:

Our targeted coaching methods ensure you grasp complex concepts effectively.

Placements:

We don’t just educate; we also help place you in roles that fit your new qualifications.

How Does Synthesis Learning Help You Study For ACCA Subjects?

As an ACCA Platinum Approved Learning Partner, Synthesis Learning is dedicated to helping students achieve their accounting certification goals. With a track record of success, Synthesis Learning provides a comprehensive ACCA preparation program for understanding the ACCA syllabus, both in-person and through ACCA Online courses, led by experienced tutors who are also distinguished experts in the accounting field. Our approach combines innovative teaching methods with practical training, ensuring students are well-prepared for the certification exams and the professional world.

Highlights of Synthesis Learning’s ACCA Prep Course:

Flexible Learning Options:

Choose between online and offline courses tailored to meet the needs of students nationwide.

Extensive Learning Resources:

Benefit from a variety of resources including practice papers, mock tests, and instructional videos.

Career Advancement:

Gain access to our exclusive placement portal upon program completion, connecting you with top recruiters and career opportunities across leading companies.

Synthesis Learning’s ACCA coaching program is specifically designed to equip students with the knowledge and skills required to excel as full-fledged accounting professionals in today’s competitive industry.

Why Choose Us as Your Learning Partner?

Platinum Approved Learning Partner:

Synthesis Learning is recognised as a Platinum Approved Learning Partner, the highest accreditation by ACCA, signifying our commitment to delivering exceptional education standards.

Highest Accreditation by ACCA:

Being a Platinum Rated partner means we meet the rigorous standards of ACCA for educational excellence.

High Student Outreach:

Our programs are designed to reach many students, ensuring accessibility and inclusivity in learning.

Exceptional Pass Rates With Global Rankers:

We boast impressive pass rates and have a history of our students achieving global ranks, demonstrating the effectiveness of our teaching methods.

Conclusion

The ACCA qualification offers guidance towards becoming a seasoned professional capable of making solid impacts in the finance world. Each step of the ACCA journey builds upon the last, culminating in a robust understanding of finance and business’s technical and ethical aspects. With Synthesis Learning’s support, get equipped to achieve your ACCA qualifications with the best results and make way for a successful and fulfilling career in accounting and finance.

Get In Touch

Looking to accelerate your career in ACCA? Connecting with us is super easy and hardly takes a minute! Call 9320007893/96, and we will help you design a comprehensive ACCA journey. At Synthesis Learning, we offer coaching for the following courses as well:

CFA Course

The course prepares professionals to excel in investment management and portfolio management skills. Synthesis Learning offers a comprehensive program with expert instructors providing practical guidance to build the analytical skills essential for success in finance.

CMA Course

The course focuses on Financial Planning, Performance, and Analytics and strategic financial management. Synthesis Learning delivers a structured program with expert-led training to ensure students are ready to make impactful decisions and drive organizational growth.

What is the EPSM module in the ACCA course syllabus?

The Ethics and Professional Skills Module (EPSM) is a critical component of the ACCA course syllabus. It is designed to enhance your ethical decision-making and professional skills, preparing you for leadership roles in global finance. The EPSM is a mandatory part of the ACCA course and must be completed before attempting the Professional Level exams. This module uses interactive case studies to help you develop the practical skills required to succeed in the finance industry.

What are the eligibility requirements for the ACCA course in India?

To enrol in the ACCA course in India, candidates must have completed their 10+2 examinations with a minimum of 65% in Mathematics/Accounts and English and at least 50% in other subjects. Alternatively, students can start with the Foundation in Accountancy (FIA) route if they have completed class 10 but still need to meet the standard entry requirements. This flexibility ensures that many students can pursue the ACCA course.

Can I pursue the ACCA course if I have not studied Mathematics in my 10+2?

While Mathematics is a preferred subject for eligibility, students who have yet to study Mathematics but meet the overall 10+2 score requirements can still apply for the ACCA course in India. The course focuses on building the necessary skills from the ground up, so a strong commitment to learning can help overcome this initial gap.

How does the ACCA course structure accommodate working professionals?

The ACCA course structure is highly flexible and ideal for working professionals. Exams can be taken one at a time, with four exam sessions held each year. This allows you to balance your studies with work commitments. The ACCA course syllabus is also available online, allowing you to study at your own pace, wherever you are based, whether in Mumbai or any other location in India.

How difficult is the ACCA course compared to CA or CFA?

The ACCA course is known for its flexibility. It allows students to take one exam at a time, which can make it more manageable than CA or CFA. While CA is considered more rigorous regarding pass rates and exam structure, the ACCA course offers a balanced approach with a global perspective. Compared to CFA, which focuses primarily on investment management, the ACCA course subjects cover a broader range of topics, making it slightly more extensive but equally challenging.

What are the ACCA course subjects included in the ACCA course syllabus?

The ACCA course syllabus is divided into Knowledge, Skills, and professionalism. Each level contains specific ACCA course subjects that build upon the previous one. The ACCA course subjects in Knowledge Level includes subjects like Business and Technology (BT), Management Accounting (MA), and Financial Accounting (FA). The ACCA course subjects in Skills Level cover Corporate and Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Audit and Assurance (AA), and Financial Management (FM). The ACCA course subjects in Professional Level involve advanced subjects such as Strategic Business Leader (SBL), Strategic Business Reporting (SBR), and optional papers like Advanced Financial Management (AFM) and Advanced Audit & Assurance (AAA).

What topics are covered in the ACCA subjects list?

The ACCA subjects list includes topics at each level, such as Business and Technology, Financial Accounting, and Audit and Assurance, giving students the foundational and advanced skills necessary for a career in finance.

Is there any exemption available for graduates in the ACCA course?

Yes, the ACCA course syllabus offers exemptions for graduates depending on their prior qualifications. For instance, students with a BCom degree or CA Inter qualification may receive exemptions from up to five exams, allowing them to fast-track their progression through the ACCA course in India. The number of exemptions is determined based on the relevance of your previous studies to the ACCA course subjects.

What if I fail an exam in the ACCA course?

If you fail an exam, the ACCA course structure allows you to retake the exam at the next available session. With four exam sessions held annually, you have ample opportunities to reattempt and pass the exam without significantly delaying your progress. The ACCA’s flexible exam pattern is designed to support continuous improvement and learning.

Are there any additional costs for the EPSM module in the ACCA course fees?

The EPSM module is a required part of the ACCA course syllabus and is included in the overall ACCA course fees. However, there might be a separate fee for the module, depending on where you are studying. It’s recommended to check with your chosen tuition provider or the ACCA Global website for detailed information on fees related to the EPSM module.

How much does the ACCA course cost in India?

The ACCA course fees in India can vary depending on factors such as the number of exams, exemptions, and the choice of study materials or tuition providers. On average, the total cost of the ACCA course in India ranges from INR 2 to 3.5 lakhs. This includes registration fees, exam fees, and study resources. It’s advisable to check with approved learning partners or the ACCA Global website for the most accurate and up-to-date fee structure.

How does ACCA compare to CA or CFA in terms of global recognition?

The ACCA course is globally recognised in over 179 countries, making it a preferred qualification for those seeking international opportunities. While CA is highly respected within India, ACCA’s global recognition offers a broader scope for career opportunities. CFA, on the other hand, is specifically tailored for careers in investment management, making it more specialised compared to the ACCA course, which covers diverse aspects of finance, accounting, and business management.

Is the ACCA course syllabus updated regularly to reflect industry changes?

Yes, the ACCA syllabus is regularly reviewed and updated to ensure it remains relevant to current industry practices and standards. The syllabus reflects the latest trends and developments in global finance, accounting, and business management, ensuring that ACCA-qualified professionals are equipped with the knowledge and skills required in today’s fast-evolving financial landscape.

How is the ACCA exam pattern structured?

The ACCA exam pattern consists of computer-based exams taken at three levels. Each level has a mix of objective and written questions, with four exam sessions annually. The ACCA exam pattern ensures comprehensive assessment and skill-building across the qualification.