Well, it depends! All accounting and finance qualifications emphasise that you have put in extra time and effort to expand your knowledge and skills. Increasingly, commerce students seek professional qualifications such as ACCA, CFA, CIMA, CPA, or MBA to distinguish themselves from their peers.

This would mean better job prospects, higher salaries, access to a global network, and much more!

ACCA (Association of Chartered Certified Accountants) and CFA (Chartered Financial Analyst) are two of the most renowned qualifications for commerce stream students. A question often asked is – which one of the two is better? And why so? Which course is better to pursue in India, or one that matches global standards? Let’s get started by understanding what these qualifications are.

Introduction

Choosing the right qualification in the field of finance and accounting can be a pivotal decision in your career. The credentials of the ACCA (Association of Chartered Certified Accountants) and the CFA course (Chartered Financial Analyst) are highly respected. They can open numerous doors to rewarding career opportunities across the globe. Let us learn about ACCA vs CFA, helping you decide which qualification best aligns with your career aspirations and personal goals.

In today’s competitive finance landscape, gaining professional qualifications has become essential for career growth. Commerce students increasingly opt for ACCA, CFA, CIMA, CPA, or an MBA to boost employability, earning potential, and global mobility. Despite these advantages, many aspirants still struggle to determine whether ACCA or CFA is the better option.

Understanding ACCA vs CFA

ACCA (Association of Chartered Certified Accountants) and CFA (Chartered Financial Analyst) are two of the most renowned qualifications for commerce stream students. A question often asked is, which is ACCA vs CFA better? And why so? Which course is better to pursue in India or that matches global standards? Let’s get started by understanding what these qualifications are:

ACCA (Association of Chartered Certified Accountants)

Association of Chartered Certified Accountants, with 115+ years of experience, is a global professional accounting body headquartered in the UK, offering the Chartered Certified Accountant qualification. It is a globally accepted qualification for successful careers in every sector, including finance, accounting, banking, consulting, business management, audits, and accounts. ACCA course enjoys global recognition with employers across the industry, with more than 2,50,000 fully qualified members and 5,44,000 students from 179+ countries.

To learn everything about ACCA exams, watch the video below:

CFA (Chartered Financial Analyst)

The CFA (Chartered Financial Analyst) Program is a global professional credential offered by the American Chartered Financial Analyst Institute, a premier global association of investment management professionals headquartered in the USA. It is one of the most reputed financial credentials that enjoys high trust and dependence among peers. The CFA Institute, with more than 70+ years of experience, is setting global standards with rigorous focus, integrity, and advanced skills in the finance and investment industry. This set of skills and knowledge will serve you well throughout your career in the finance/investment and capital markets.

ACCA Vs CFA: Which Is Better?

When deciding between ACCA and CFA, it’s important to consider your career goals. ACCA is ideal for those pursuing accounting, auditing, and financial management roles, while CFA focuses on investment analysis and portfolio management. Both qualifications are globally recognized, but ACCA vs CFA depends on your interest in accounting versus finance. Ultimately, ACCA may offer a broader scope for accounting professionals, whereas CFA is better suited for those passionate about investment and financial markets. Now let us help you clear some more doubts with an in-depth analysis of both worlds in the ultimate guide on ACCA vs CFA:

| ACCA | CFA | |

| Organizing Body | Association of Chartered Certified Accountants (ACCA), UK | CFA Institute, USA |

| Recognition | Recognised by employers and students across 179+ countries | Charter Holders in 165+ countries & territories worldwide |

| Eligibility | Must have completed 10+2 from commerce stream or students pursuing graduation in commerce or those who have completed BA or B.Sc. with Foundation in Accountancy | You may begin your preparation in your first year of graduation and take the Level 1 exam in your second year. |

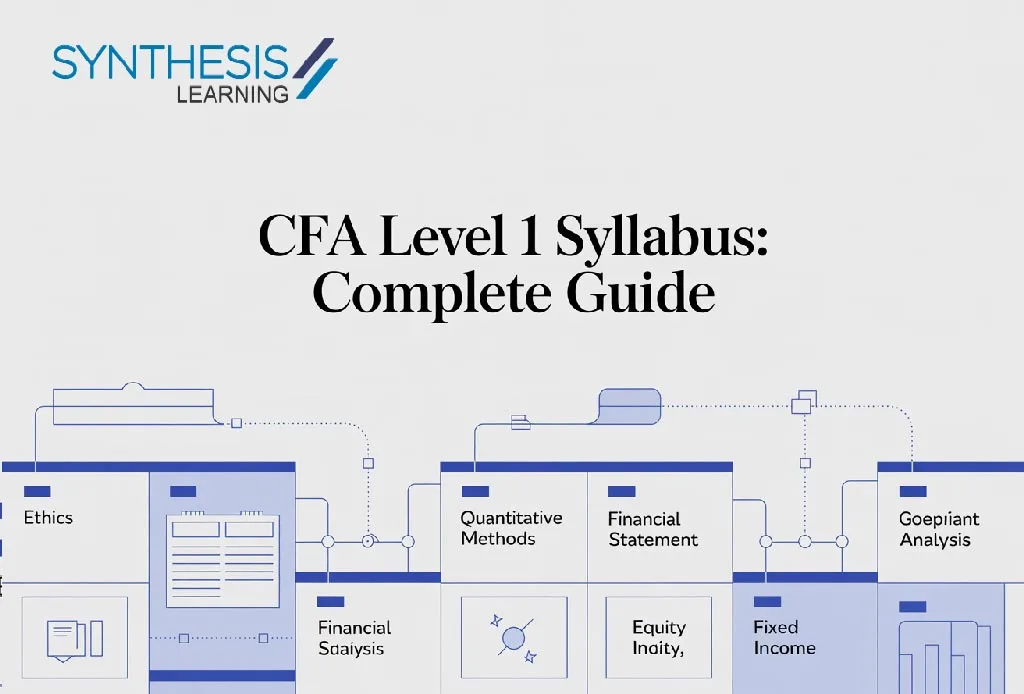

| Focus Areas | 1. Business & Technology 2. Financial Accounting 3. Management Accounting 4. Corporate & Business Law 5. Performance Management 6. Taxation 7. Financial Reporting 8. Audit & Assurance 9. Financial Management 10. Strategic Business Leader 11. Strategic Business Reporting 12. & 13. (Any 2) Advanced Financial Management Advanced Performance Management Advanced Taxation Advanced Audit & Assurance | 1. Quantitative Methods 2. Economics 3. Financial Statement & Analysis 4. Corporate Issuers 5. Equity Investments 6. Fixed Income 7. Derivatives 8. Alternative Investments 9. Asset Allocation 10. Performance Measurement 9. Portfolio Management, Private Markets, Private Wealth 10. Ethical & Professional Standards |

Key Differences between ACCA and CFA

When considering your career options, understanding the key difference between ACCA and CFA can be crucial. The ACCA vs CFA debate often comes down to your career goals. Let’s explore the ACCA vs CFA distinctions in detail.

Focus:

ACCA emphasises accounting, financial reporting, and management accounting. CFA centres on investment analysis and portfolio management.

Scope:

ACCA broadly covers accounting, finance, and business management. CFA specialises in investment management.

Exam Format:

ACCA features multiple exams per level, which are computer-based year-round. CFA has three computer-based levels.

Difficulty:

CFA is generally more challenging, demanding more study time. CFA’s pass rates are lower than ACCA’s.

Time Required / Duration:

CFA typically takes 1.5 years to qualify. ACCA usually takes 3-4 years for 13 exams.

Salary:

ACCA professionals in India earn about 6- 8 lakhs annually. CFA charter holders in India earn 6-8 lakhs per year.

Membership:

The CFA has a membership association (CFA Institute), and ACCA is a professional body offering networking and development resources.

Cost / Fees:

CFA costs between 3.5 lakhs and 4 lakhs, and ACCA also costs around 3.5 lakhs and 4 lakhs.

Career Prospects:

ACCA opens diverse accounting and finance roles. CFA focuses on investment management opportunities.

Eligibility:

The ACCA requires completion of 12th-grade or foundation courses, while the CFA necessitates a bachelor’s degree or final-year study.

Study Material:

ACCA provides textbooks and online resources. CFA offers more comprehensive study materials designed for self-study.

Recognition:

CFA enjoys global recognition in investment management. ACCA is widely acknowledged in finance and accounting.

Regional Differences:

ACCA is popular in the UK, Europe, Asia, and Africa. CFA is favoured in the US, Canada, and Australia.

Career Path:

ACCA leads to finance and accounting roles, such as Financial Analyst, while CFA opens pathways to investment management as an analyst.

Specialisations:

ACCA offers specialisations in audit, tax, and financial reporting. CFA specialises in portfolio management and risk management.

To make the comparison easier, here’s a side-by-side overview highlighting the key differences between ACCA and CFA:

| Criteria | ACCA | CFA |

| Focus | Accounting, financial reporting, management accounting | Investment analysis, portfolio management |

| Scope | Broad coverage of accounting, finance, and business | Specialised in investment management |

| Exam Format | Multiple computer-based exams, year-round | 3 computer-based levels |

| Difficulty | Moderate to high | Generally higher with lower pass rates |

| Duration | 3–4 years (13 exams) | Around 1.5–4 years |

| Average Salary (India) | ₹6–8 lakhs per annum | ₹8–12 lakhs per annum |

| Eligibility | 10+2 or foundation route | Bachelor’s degree or final-year students |

| Career Prospects | Accounting, audit, taxation, finance roles | Investment banking, asset & portfolio management |

| Recognition | Globally recognised in accounting & finance | Highly respected in investment management |

| Specialisations | Audit, tax, financial reporting | Investment Analysis & Portfolio Management |

Choosing Between ACCA vs CFA

When deciding between ACCA and CFA, consider your career goals and interests. ACCA focuses on accounting and finance skills essential for roles in auditing and taxation, while CFA emphasises investment management and financial analysis. Both qualifications require significant time and financial investment. Check out the details below to understand the differences better.

ACCA | CFA | |

| Typical Course Completion | 3 years (less with applicable exemptions) | 1.5 years to qualify |

| Paper Exemptions | Depending on any existing qualifications you may hold, certain paper exemptions are awarded (Applicable to B.com Graduates, CA Inter cleared, CA Final cleared, CMA, etc.) | Usually, no exemptions are awarded. |

| Course Flexibility | Minimum 1 and maximum 4 papers per attempt every quarter | None |

| Total Investment | 3.5 – 4 lakhs | 3.5 – 4 lakhs |

| Expected Salary | 6 – 8 lakhs per annum | 6 – 8 lakhs per annum |

| Job Roles/Areas |

|

|

Cfa Vs Acca Difficulty

When comparing CFA vs ACCA difficulty, both qualifications present unique challenges depending on your career focus. The CFA is often seen as more difficult due to its in-depth coverage of investment analysis, portfolio management, and financial theory, requiring strong analytical skills and a deep understanding of financial markets.

On the other hand, the ACCA focuses on accounting, taxation, auditing, and financial management, making it more suited for those pursuing a career in accounting or finance.

While the ACCA syllabus covers a broad range of topics, CFA exams tend to be more complex and require a higher level of financial and quantitative expertise, particularly in later levels. Ultimately, the perceived difficulty depends on personal interests and career goals.

CFA vs ACCA Salary: Which Pays More?

When comparing CFA vs ACCA salary in India, both qualifications offer similar earning potential, with professionals earning ₹6-8 lakhs annually on average, depending on experience and industry.

ACCA Salary in India

ACCA professionals in India typically earn ₹6-8 lakhs annually. CFA vs ACCA salary differences are minimal, though ACCA professionals often work in accounting or auditing roles, with salaries varying by experience and employer.

CFA Salary in India

CFA charterholders in India also earn ₹6-8 lakhs per year on average. While the CFA salary vs ACCA salary range is similar, CFA professionals usually work in investment and financial analysis, which can lead to higher earnings with experience.

ACCA vs. CFA: Career Opportunities

ACCA and CFA qualifications offer various career opportunities for aspiring finance and accounting professionals. Let’s look at the job prospects associated with each qualification, particularly in the context of CFA vs ACCA.

Job Prospects with ACCA

ACCA provides diverse career options, including positions such as financial accountant, management accountant, auditor, tax advisor, and financial analyst. With an ACCA qualification, you can pursue opportunities across various sectors, including banking, insurance, public practice, and corporate finance.

Job Prospects with CFA

CFA certification is highly regarded in the investment industry. It paves the way for roles such as financial analyst, portfolio manager, research analyst, risk manager, and investment banker. CFA charter holders typically find positions in investment banks, asset management firms, hedge funds, and private equity companies.

ACCA vs CFA Cost Implications

Examination and Registration Fees:

Both qualifications require an initial registration fee plus exam fees. CFA typically has higher exam fees per level compared to ACCA.

Study Materials and Resources:

Both require investment in study materials, though CFA often involves additional costs for preparatory classes.

Total Investment:

Depending on the resources and coaching chosen, both qualifications may cost between 3.5 and 4 lakhs on average.

Return on Investment:

Considering the potential earnings and career progression, both qualifications offer good ROI, especially in their respective specialized fields.

Synthesis Learning: Your Best Partner To Ace ACCA Exams

When comparing the benefits of ACCA vs CFA, the choice of your learning partner can significantly influence your success. Here’s why Synthesis Learning is your ideal ally in conquering the ACCA exams and how it compares to your preparations for other qualifications like CFA.

ACCA’s Highest Quality Rating – Platinum Approved Partner for Top-Notch Education

As a Platinum Approved Learning Partner, Synthesis Learning holds the highest badge of honor granted by ACCA. This prestigious recognition is a testament to our unwavering commitment to providing the highest-quality education. When considering “ACCA vs. CFA, which is better?”, the quality of educational support should be a crucial factor.

Rigorous, Stellar Education

Our Platinum Rating consistently meets ACCA’s stringent standards for educational excellence. We maintain a sharp and updated curriculum delivered by top-tier educators to ensure you receive the best possible preparation. This level of rigor is essential whether you’re pursuing ACCA or considering the equally challenging CFA.

Flexible Learning Modes (Classroom, Live Online, Self-Paced)

Synthesis Learning is dedicated to making learning accessible and inclusive, supporting all aspiring accountants regardless of location or background. This approach is vital for those on the ACCA path and valuable for prospective CFA candidates seeking flexible and supportive learning environments. Explore our flexible learning modes here.

Join the High Achievers – Achieve Top Global Ranks

Our commitment to excellence is reflected in our excellent pass rates and the global recognition our students achieve. Many of our learners secure top global ranks, illustrating that Synthesis Learning doesn’t just help you pass; it prepares you to excel internationally. Surround yourself with ambitious peers and join the ranks of global achievers here.

Get inspired by real success stories and career launches. Plan your path to the top by watching our success stories on YouTube.

Our 4-Step Proven Methodology – Counselling, Coaching, Mentoring & Placementa

Our four-step proven methodology of Counselling, Coaching, Mentoring, and Placement consistently delivers success. Trust in our approach to guide you through your ACCA journey.

Choosing the right educational partner like Synthesis Learning can significantly impact your professional journey, whether you opt for ACCA or CFA. With our support, you’re not just preparing for exams; you’re setting the stage for a successful global career in finance and accounting. Also, we have ACCA online programmes that offer flexible, expert-led learning designed to fit your schedule and help you succeed faster.

Get Free Counselling By industry-leading experts Today.

ACCA and CFA will help you land your desired job profiles in the business, finance, and accounting industries. However, each course caters to a specific audience, job profiles, and interests. So, you must choose the right one based on your objectives and aspirations. The career choice should primarily consider your interest and passion, which will eventually take care of your paycheck in the long run.

FAQs

What is the duration to complete each qualification?

ACCA can be completed in 3 years, depending on exemptions, while CFA typically takes about 1.5 to 4 years, depending on the candidate’s progress through the levels.

Can I pursue ACCA or CFA if I have a non-commerce background?

ACCA requires a foundation in accountancy, which can be achieved through various pathways; CFA requires either a bachelor’s degree or professional experience in any field.

Which qualification is better for a career in global finance?

Both are highly respected, but CFA may be preferable for global investment analysis and portfolio management roles.

What are the exam pass rates for ACCA and CFA?

ACCA exams generally have a pass rate of about 40-50%, while CFA levels have varying pass rates, often lower, reflecting their difficulty.

How do employers view ACCA vs CFA?

Employers value both depending on the industry; ACCA is favoured in roles needing broad accounting skills, while CFA is prestigious in investment management and analysis.

ACCA vs CFA: Which offers more job opportunities?

Both have strong career prospects, but ACCA tends to offer broader job opportunities in accounting, audit, and finance roles, whereas CFA is more specific to investment-related careers.

What are the career paths for ACCA vs CFA holders?

ACCA leads to careers in accounting, audit, financial reporting, tax, and management accounting. CFA holders often work in investment banking, asset management, hedge funds, and financial analysis.

Who earns more, ACCA or CFA?

Earnings can vary based on role, industry, and location. Generally, CFA professionals in finance and investment roles may earn more, but ACCA professionals in accounting and finance management can also have competitive salaries.

Which is harder, ACCA or CFA?

Both ACCA and CFA are challenging, but in different ways. ACCA focuses on accounting, auditing, and taxation, while CFA emphasises investment analysis and financial markets. The difficulty depends on your career goals and area of interest.

ACCA vs CFA: Which is better?

There is no one-size-fits-all answer. The better qualification depends on your career goals. ACCA is better suited for careers in accounting, audit, and finance management, while CFA is ideal for investment analysis, portfolio management, and capital markets roles.

What are the CFA exemptions for ACCA?

There are no CFA exemptions for ACCA holders. ACCA qualifications do not provide exemptions from any CFA exam levels. However, ACCA members may meet eligibility requirements and benefit from overlapping concepts when preparing for the CFA Program.