Table of Content

ACCA vs MBA :

Pursuing professional accomplishment often leads us to a critical juncture: ACCA vs MBA. Both hold immense prestige, opening doors to lucrative and fulfilling careers. However, their landscapes and inhabitants differ markedly. A strategic and introspective approach is essential to navigate this pivotal decision effectively. To know more, check out the video below:What is ACCA?

ACCA stands for the Association of Chartered Certified Accountants. It’s a globally recognized professional qualification, transforming individuals into financial alchemists. But unlike the rigid structure of many qualifications, ACCA course offers unmatched flexibility.Flexible Entry Points:

– After Grade 10/ 12: Start your journey early with foundation-level courses. – Graduation (B.Com/M.Com): Build upon your existing knowledge with exemptions based on your degree (up to 5 Exemptions) – CA Inter/Final: Leverage your CA studies for even more exemptions (up to 9 Exemptions) – After CMA: Up to 9 ExemptionsCost

Exam fees and study materials typically cost around 3 to 4.5 Lacs.What does this mean for you?

You can tailor your ACCA journey to fit your timeline and aspirations. Whether you’re a college graduate or a seasoned CA professional, ACCA welcomes you with open arms – and exemptions!ACCA: Jobs & Scope

For individuals with a natural affinity for numbers and a meticulous attention to detail, the ACCA beckons. This globally recognized qualification delves into the intricacies of accounting, auditing, financial reporting, performance management, taxation and many more, transforming candidates into financial alchemists. Structured learning modules and rigorous professional exams build a robust foundation of business and finance knowledge, preparing graduates for success in high-demand fields like ERP, ESG reporting, investment banking, auditing, consulting, risk and many more.ACCA may be the ideal stepping stone for those who:

– Possess a natural aptitude for quantitative analysis and find joy in the intricacies of ACCA-specific financial reporting. – Aspire to careers in high-demand fields like accounting, auditing, investment banking, consulting, ERP, ESG reporting, taxation and many more, leveraging their ACCA expertise. – Thrive in structured learning environments and appreciate the guidance of clearly defined milestones within the ACCA program.What is an MBA?

An MBA is a Master of Business Administration. It is a postgraduate degree that business schools around the world offer. MBAs are typically generalists with a broad knowledge of business. They can work in various roles, including marketing manager, human resources manager, and consultant. Quality of Bschool plays a very important role in your journey.Entry Points

Typically requires a bachelor’s degree and often entrance exams like CAT/CET. It takes around 18 to 24 months to complete an MBA.Cost

Tuition fees and living expenses for MBA programs can cost approx 15 – 20 Lacs.MBA: Jobs and Scope

Those driven by the allure of leadership and a holistic understanding of business operations might find their compass pointing towards the MBA. This esteemed course equips individuals with the essential tools to navigate the dynamic landscape of the corporate world. From deciphering the intricate charts of marketing to orchestrating the gears of operations, the MBA curriculum provides a panoramic view of the entire business ecosystem. This coveted credential paves the way for executive positions, entrepreneurial ventures, and consulting gigs, empowering graduates to lead and manage within complex organizational structures.MBA may be the optimal path for individuals who:

– Demonstrate strong leadership potential and excel at communication and interpersonal skills, seeking to utilize these strengths in diverse organizational settings. – Harbor ambitions for executive positions or entrepreneurial ventures within an MBA-driven career path. – Seek a comprehensive understanding of business functions, encompassing marketing, finance, operations, and more, as offered by the MBA curriculum. Now that you know the details of MBA and ACCA, let us move on to the key differences between ACCA and MBA.|

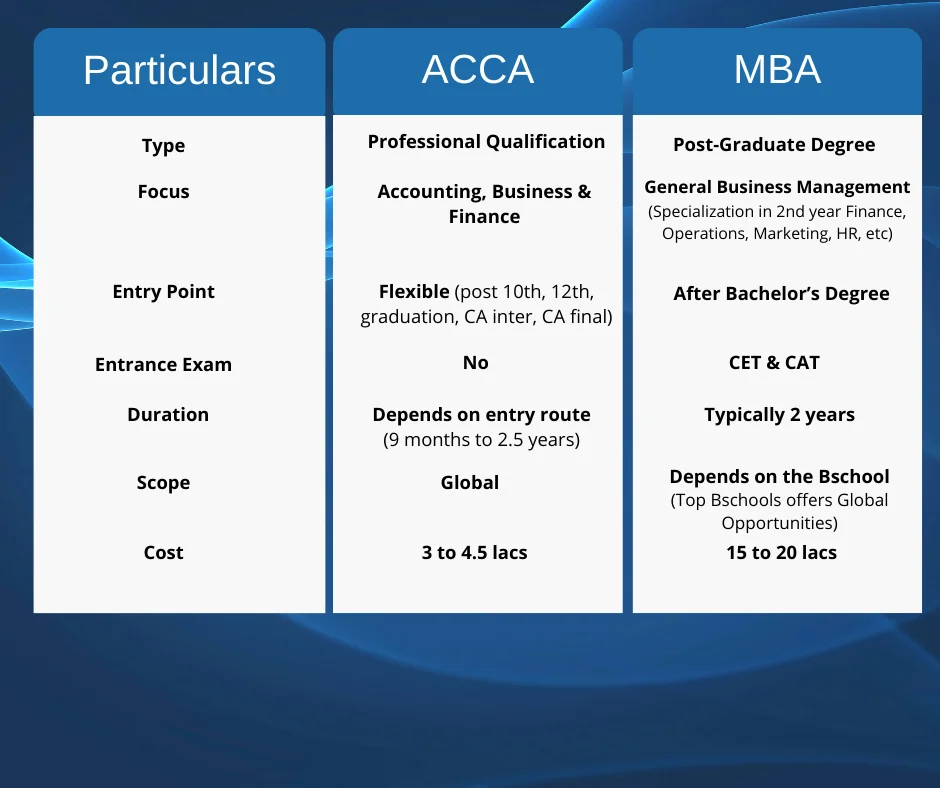

Parameter |

ACCA |

MBA |

| Definition | ACCA is for those aiming for a career in business & finance. | MBA is a post-graduate course focusing on business and management. |

| Awarded by | The Association of Chartered Certified Accountants (ACCA). | Universities (private or government-recognized). |

| Duration | Requires passing 13 exams and 3 years of work experience. | Typically takes 1 to 2 years to complete. |

|

Job Opportunities |

Roles like Accountant, Tax Manager, Finance Manager, Financial Consultant, Investment Banker and more. | Jobs include Financial Planner, Investment Banker, Insurance Specialist, HR Manager, and more. |

ACCA might be better if you:

– Want to specialize in accounting, business and finance – Aim to work globally in roles like an Accountant, Internal Auditor, Investment Banker, Financial Planner, or financial consultant. – Prefer a practical global professional qualification. – Are interested in positions that require technical skills and expertise in finance.MBA might be better if you:

– Want a broader understanding of business and management. – Are aiming for leadership or strategic roles, such as financial planner, investment banker, or HR manager. – Seek career advancement in general management. – Prefer a more diverse range of business opportunities and career paths. Ultimately, the decision depends on your career goals and the type of skills you want to develop.ACCA vs MBA: Which qualification is right for you?

It is important to note that the timelines for ACCA and MBA qualifications do not necessarily conflict. ACCA can often be pursued concurrently with undergraduate studies, while an MBA typically requires prior completion of a bachelor’s degree. This distinction allows individuals to choose the qualification that best aligns with their current stage in their academic and professional trajectory. Furthermore, ACCA and MBA differ significantly in their focus and global reach. ACCA is a globally recognized qualification with a specialized curriculum in accounting, business, and finance. It prepares individuals for a variety of finance-related roles within multinational organizations. In contrast, MBA programs often have a more localized focus, offering specializations in diverse areas like finance, human resources, marketing, operations, logistics, etc. This flexibility allows individuals to tailor their education to their specific career aspirations. Consequently, the time commitment and investment required for each qualification vary. ACCA typically demands a shorter timeframe and lower financial cost compared to an MBA. However, the specialized nature of ACCA may limit its applicability outside the field of finance. Conversely, an MBA’s broader scope and prestigious reputation often command a higher price tag and time commitment, but also open doors to a wider range of career opportunities. While both ACCA and MBA offer promising career pathways, the ideal choice ultimately depends on your individual aspirations and priorities. If your heart lies in the intricate world of accounting and finance, and you seek specialized expertise, then ACCA might be the perfect stepping stone. Conversely, if you yearn for a broader business perspective and leadership skills for a diverse career journey, an MBA could unlock your full potential. Ultimately, the key lies in aligning your unique goals and resources with the specific strengths of each program. Take the time to delve deeper, explore specific options, and make a well-informed decision that paves the path to a fulfilling and successful career.