Table of Content

All of us have opportunities to choose between right and wrong every day; we see in the businesses around us how getting it ethically wrong can lead to serious consequences, including corporate failure, loss of reputation, fines or even jail sentences. The recent PNB Nirav Modi scam, YES Bank scam, IL&FS fiasco and PMC Bank scam have all pointed out to the same thing – that finance professionals, accountants and auditors can make or break a company’s fate by highlighting facts at the right time.

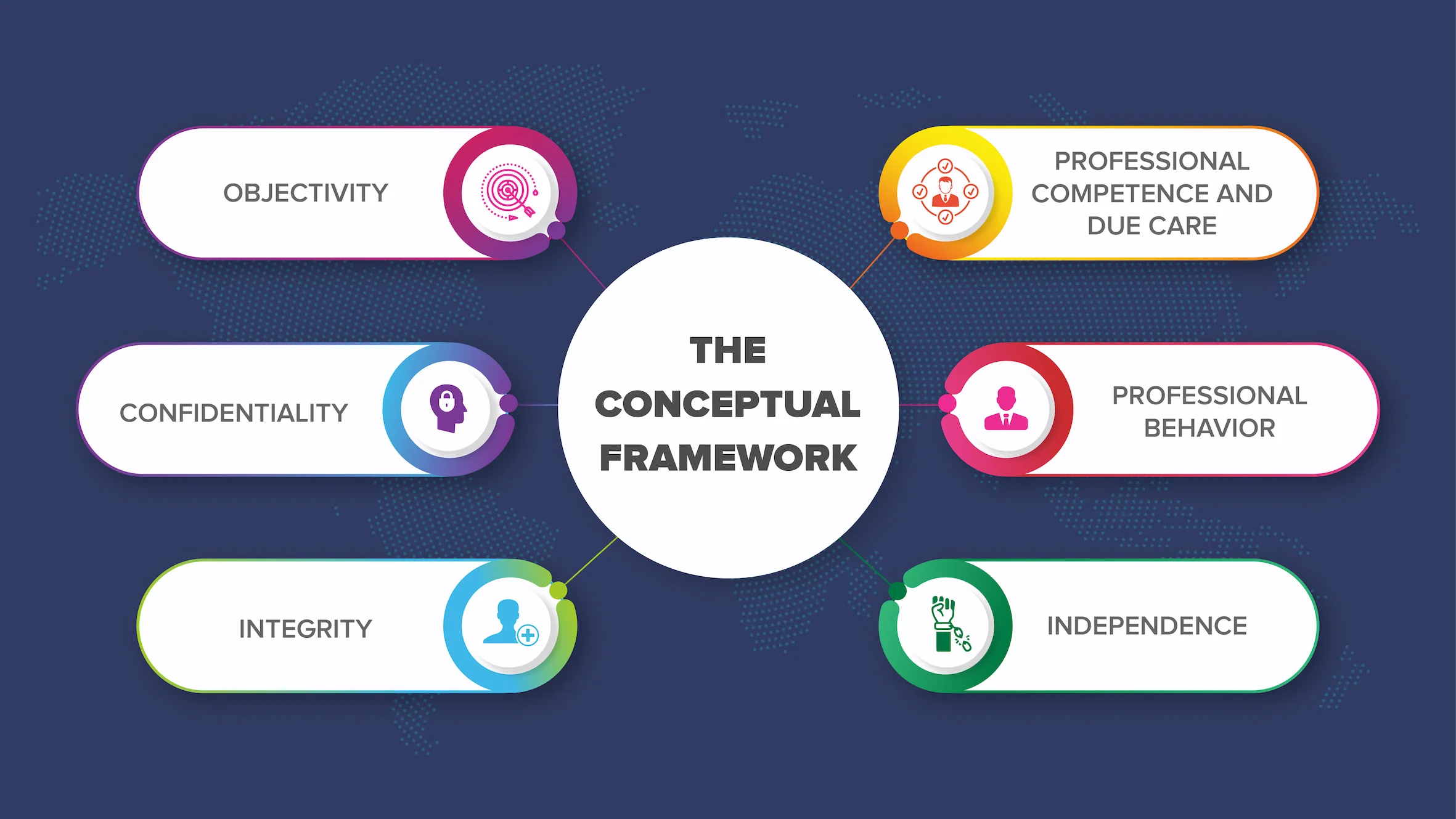

As professionals, one professes to a high standard of ethical behavior. But leaving rules and regulations to one side, who’s to say what’s right and what’s wrong? Members of the public may place their trust in you because you’re a member of a trusted professional body. They aren’t expected to know how to assess either the ability or the ethics of a doctor, lawyer, auditor or accountant. They trust that the professional bodies will do that for them. This means that as a professional you owe the public a certain level of integrity and objectivity – as well as professional competence and due care, confidentiality and professional and independent behavior.

Clearly, the membership of a professional body like the Association of Chartered Certified Accountant (ACCA) requires adherence to a code of ethical conduct. The Ethics and Professional Skills module (EPSM)is an essential part of the ACCA Qualification and helps increase your employability and workplace effectiveness. The module uses realistic business simulations to develop a number of professional skills such as leadership, communication and commercial awareness. The International Code of Ethics for Professional Accountants also sets out key areas of focus and a Conceptual Framework. The five fundamental ethical principles set out in ACCA rulebook are:

- Professional competence and due care – To maintain professional knowledge and skill at a level required to ensure that a client or employer receives competent professional service based on current developments in practice, legislation and techniques, and act diligently and in accordance with applicable technical and professional standards;

- Integrity – Being straightforward and honest in all professional and business relationships;

- Objectivity – Not allowing bias, conflicts of interest or undue influence of others to override professional or business judgments;

- Confidentiality – To respect the confidentiality of information acquired as a result of professional and business relationships and, therefore, not disclose any such information to third parties without proper and specific authority, unless there’s a legal or professional right or duty to disclose, nor use the information for the personal advantage of the professional accountant or third parties; and

- Professional behavior – To comply with relevant laws and regulations and avoid any action that discredits the profession.